Stagecoach XTra Credit SIX - Prudential Annuities

Stagecoach XTra Credit SIX - Prudential Annuities

Stagecoach XTra Credit SIX - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

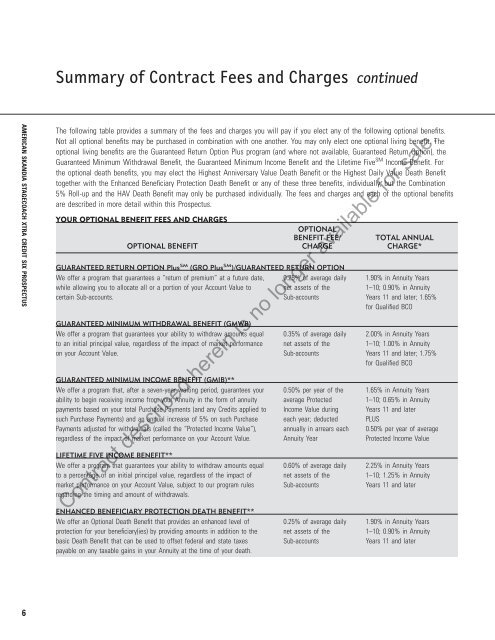

Summary of Contract Fees and Charges continued<br />

AMERICAN SKANDIA STAGECOACH XTRA CREDIT <strong>SIX</strong> PROSPECTUS<br />

The following table provides a summary of the fees and charges you will pay if you elect any of the following optional benefits.<br />

Not all optional benefits may be purchased in combination with one another. You may only elect one optional living benefit. The<br />

optional living benefits are the Guaranteed Return Option Plus program (and where not available, Guaranteed Return Option), the<br />

Guaranteed Minimum Withdrawal Benefit, the Guaranteed Minimum Income Benefit and the Lifetime Five SM Income Benefit. For<br />

the optional death benefits, you may elect the Highest Anniversary Value Death Benefit or the Highest Daily Value Death Benefit<br />

together with the Enhanced Beneficiary Protection Death Benefit or any of these three benefits, individually, but the Combination<br />

5% Roll-up and the HAV Death Benefit may only be purchased individually. The fees and charges and each of the optional benefits<br />

are described in more detail within this Prospectus.<br />

YOUR OPTIONAL BENEFIT FEES AND CHARGES<br />

OPTIONAL BENEFIT<br />

OPTIONAL<br />

BENEFIT FEE/<br />

CHARGE<br />

GUARANTEED RETURN OPTION Plus SM (GRO Plus SM )/GUARANTEED RETURN OPTION<br />

We offer a program that guarantees a “return of premium” at a future date, 0.25% of average daily<br />

while allowing you to allocate all or a portion of your Account Value to net assets of the<br />

certain Sub-accounts.<br />

Sub-accounts<br />

GUARANTEED MINIMUM WITHDRAWAL BENEFIT (GMWB)<br />

We offer a program that guarantees your ability to withdraw amounts equal<br />

to an initial principal value, regardless of the impact of market performance<br />

on your Account Value.<br />

GUARANTEED MINIMUM INCOME BENEFIT (GMIB)**<br />

We offer a program that, after a seven-year waiting period, guarantees your<br />

ability to begin receiving income from your Annuity in the form of annuity<br />

payments based on your total Purchase Payments (and any <strong>Credit</strong>s applied to<br />

such Purchase Payments) and an annual increase of 5% on such Purchase<br />

Payments adjusted for withdrawals (called the “Protected Income Value”),<br />

regardless of the impact of market performance on your Account Value.<br />

LIFETIME FIVE INCOME BENEFIT**<br />

We offer a program that guarantees your ability to withdraw amounts equal<br />

to a percentage of an initial principal value, regardless of the impact of<br />

market performance on your Account Value, subject to our program rules<br />

regarding the timing and amount of withdrawals.<br />

ENHANCED BENEFICIARY PROTECTION DEATH BENEFIT**<br />

We offer an Optional Death Benefit that provides an enhanced level of<br />

protection for your beneficiary(ies) by providing amounts in addition to the<br />

basic Death Benefit that can be used to offset federal and state taxes<br />

payable on any taxable gains in your Annuity at the time of your death.<br />

0.35% of average daily<br />

net assets of the<br />

Sub-accounts<br />

0.50% per year of the<br />

average Protected<br />

Income Value during<br />

each year; deducted<br />

annually in arrears each<br />

Annuity Year<br />

0.60% of average daily<br />

net assets of the<br />

Sub-accounts<br />

0.25% of average daily<br />

net assets of the<br />

Sub-accounts<br />

TOTAL ANNUAL<br />

CHARGE*<br />

1.90% in Annuity Years<br />

1–10; 0.90% in Annuity<br />

Years 11 and later; 1.65%<br />

for Qualified BCO<br />

2.00% in Annuity Years<br />

1–10; 1.00% in Annuity<br />

Years 11 and later; 1.75%<br />

for Qualified BCO<br />

1.65% in Annuity Years<br />

1–10; 0.65% in Annuity<br />

Years 11 and later<br />

PLUS<br />

0.50% per year of average<br />

Protected Income Value<br />

2.25% in Annuity Years<br />

1–10; 1.25% in Annuity<br />

Years 11 and later<br />

Contract described herein is no longer available for sale.<br />

1.90% in Annuity Years<br />

1–10; 0.90% in Annuity<br />

Years 11 and later<br />

6