Stagecoach XTra Credit SIX - Prudential Annuities

Stagecoach XTra Credit SIX - Prudential Annuities

Stagecoach XTra Credit SIX - Prudential Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

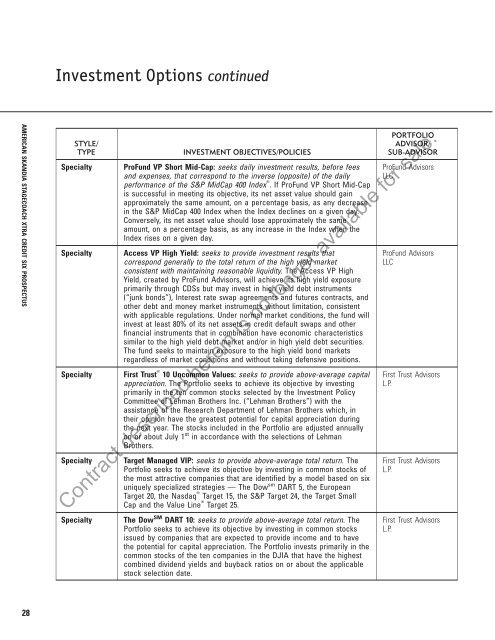

Investment Options continued<br />

AMERICAN SKANDIA STAGECOACH XTRA CREDIT <strong>SIX</strong> PROSPECTUS<br />

STYLE/<br />

TYPE<br />

Specialty<br />

Specialty<br />

Specialty<br />

Specialty<br />

Specialty<br />

INVESTMENT OBJECTIVES/POLICIES<br />

ProFund VP Short Mid-Cap: seeks daily investment results, before fees<br />

and expenses, that correspond to the inverse (opposite) of the daily<br />

performance of the S&P MidCap 400 Index T . If ProFund VP Short Mid-Cap<br />

is successful in meeting its objective, its net asset value should gain<br />

approximately the same amount, on a percentage basis, as any decrease<br />

in the S&P MidCap 400 Index when the Index declines on a given day.<br />

Conversely, its net asset value should lose approximately the same<br />

amount, on a percentage basis, as any increase in the Index when the<br />

Index rises on a given day.<br />

Access VP High Yield: seeks to provide investment results that<br />

correspond generally to the total return of the high yield market<br />

consistent with maintaining reasonable liquidity. The Access VP High<br />

Yield, created by ProFund Advisors, will achieve its high yield exposure<br />

primarily through CDSs but may invest in high yield debt instruments<br />

(“junk bonds”), Interest rate swap agreements and futures contracts, and<br />

other debt and money market instruments without limitation, consistent<br />

with applicable regulations. Under normal market conditions, the fund will<br />

invest at least 80% of its net assets in credit default swaps and other<br />

financial instruments that in combination have economic characteristics<br />

similar to the high yield debt market and/or in high yield debt securities.<br />

The fund seeks to maintain exposure to the high yield bond markets<br />

regardless of market conditions and without taking defensive positions.<br />

First Trust T 10 Uncommon Values: seeks to provide above-average capital<br />

appreciation. The Portfolio seeks to achieve its objective by investing<br />

primarily in the ten common stocks selected by the Investment Policy<br />

Committee of Lehman Brothers Inc. (“Lehman Brothers”) with the<br />

assistance of the Research Department of Lehman Brothers which, in<br />

their opinion have the greatest potential for capital appreciation during<br />

the next year. The stocks included in the Portfolio are adjusted annually<br />

on or about July 1 st in accordance with the selections of Lehman<br />

Brothers.<br />

Target Managed VIP: seeks to provide above-average total return. The<br />

Portfolio seeks to achieve its objective by investing in common stocks of<br />

the most attractive companies that are identified by a model based on six<br />

uniquely specialized strategies — The Dow sm DART 5, the European<br />

Target 20, the Nasdaq T Target 15, the S&P Target 24, the Target Small<br />

Cap and the Value Line T Target 25.<br />

The Dow SM DART 10: seeks to provide above-average total return. The<br />

Portfolio seeks to achieve its objective by investing in common stocks<br />

issued by companies that are expected to provide income and to have<br />

the potential for capital appreciation. The Portfolio invests primarily in the<br />

common stocks of the ten companies in the DJIA that have the highest<br />

combined dividend yields and buyback ratios on or about the applicable<br />

stock selection date.<br />

PORTFOLIO<br />

ADVISOR/<br />

SUB-ADVISOR<br />

ProFund Advisors<br />

LLC<br />

ProFund Advisors<br />

LLC<br />

First Trust Advisors<br />

L.P.<br />

First Trust Advisors<br />

L.P.<br />

Contract described herein is no longer available for sale.<br />

First Trust Advisors<br />

L.P.<br />

28