Stagecoach XTra Credit SIX - Prudential Annuities

Stagecoach XTra Credit SIX - Prudential Annuities

Stagecoach XTra Credit SIX - Prudential Annuities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

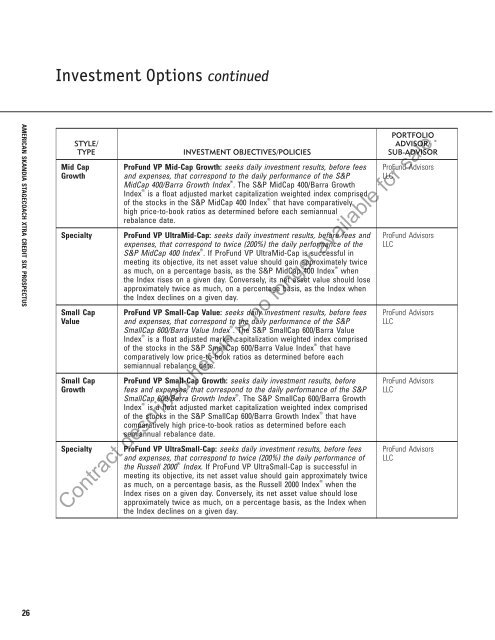

Investment Options continued<br />

AMERICAN SKANDIA STAGECOACH XTRA CREDIT <strong>SIX</strong> PROSPECTUS<br />

STYLE/<br />

TYPE<br />

Mid Cap<br />

Growth<br />

Specialty<br />

Small Cap<br />

Value<br />

Small Cap<br />

Growth<br />

Specialty<br />

INVESTMENT OBJECTIVES/POLICIES<br />

ProFund VP Mid-Cap Growth: seeks daily investment results, before fees<br />

and expenses, that correspond to the daily performance of the S&P<br />

MidCap 400/Barra Growth Index T . The S&P MidCap 400/Barra Growth<br />

Index T is a float adjusted market capitalization weighted index comprised<br />

of the stocks in the S&P MidCap 400 Index T that have comparatively<br />

high price-to-book ratios as determined before each semiannual<br />

rebalance date.<br />

ProFund VP UltraMid-Cap: seeks daily investment results, before fees and<br />

expenses, that correspond to twice (200%) the daily performance of the<br />

S&P MidCap 400 Index T . If ProFund VP UltraMid-Cap is successful in<br />

meeting its objective, its net asset value should gain approximately twice<br />

as much, on a percentage basis, as the S&P MidCap 400 Index T when<br />

the Index rises on a given day. Conversely, its net asset value should lose<br />

approximately twice as much, on a percentage basis, as the Index when<br />

the Index declines on a given day.<br />

ProFund VP Small-Cap Value: seeks daily investment results, before fees<br />

and expenses, that correspond to the daily performance of the S&P<br />

SmallCap 600/Barra Value Index T . The S&P SmallCap 600/Barra Value<br />

Index T is a float adjusted market capitalization weighted index comprised<br />

of the stocks in the S&P SmallCap 600/Barra Value Index T that have<br />

comparatively low price-to-book ratios as determined before each<br />

semiannual rebalance date.<br />

ProFund VP Small-Cap Growth: seeks daily investment results, before<br />

fees and expenses, that correspond to the daily performance of the S&P<br />

SmallCap 600/Barra Growth Index T . The S&P SmallCap 600/Barra Growth<br />

Index T is a float adjusted market capitalization weighted index comprised<br />

of the stocks in the S&P SmallCap 600/Barra Growth Index T that have<br />

comparatively high price-to-book ratios as determined before each<br />

semiannual rebalance date.<br />

ProFund VP UltraSmall-Cap: seeks daily investment results, before fees<br />

and expenses, that correspond to twice (200%) the daily performance of<br />

the Russell 2000 T Index. If ProFund VP UltraSmall-Cap is successful in<br />

meeting its objective, its net asset value should gain approximately twice<br />

as much, on a percentage basis, as the Russell 2000 Index T when the<br />

Index rises on a given day. Conversely, its net asset value should lose<br />

approximately twice as much, on a percentage basis, as the Index when<br />

the Index declines on a given day.<br />

PORTFOLIO<br />

ADVISOR/<br />

SUB-ADVISOR<br />

ProFund Advisors<br />

LLC<br />

ProFund Advisors<br />

LLC<br />

ProFund Advisors<br />

LLC<br />

ProFund Advisors<br />

LLC<br />

ProFund Advisors<br />

LLC<br />

Contract described herein is no longer available for sale.<br />

26