Stagecoach XTra Credit SIX - Prudential Annuities

Stagecoach XTra Credit SIX - Prudential Annuities

Stagecoach XTra Credit SIX - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

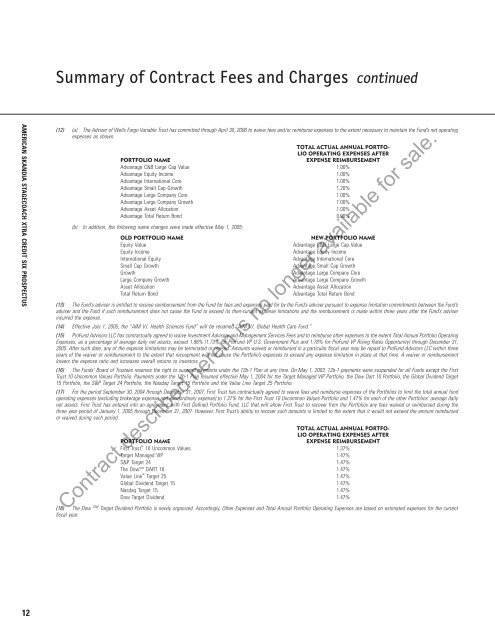

Summary of Contract Fees and Charges continued<br />

AMERICAN SKANDIA STAGECOACH XTRA CREDIT <strong>SIX</strong> PROSPECTUS<br />

(12) (a) The Adviser of Wells Fargo Variable Trust has committed through April 30, 2006 to waive fees and/or reimburse expenses to the extent necessary to maintain the Fund’s net operating<br />

expenses as shown.<br />

TOTAL ACTUAL ANNUAL PORTFO-<br />

LIO OPERATING EXPENSES AFTER<br />

PORTFOLIO NAME<br />

EXPENSE REIMBURSEMENT<br />

Advantage C&B Large Cap Value 1.00%<br />

Advantage Equity Income 1.00%<br />

Advantage International Core 1.00%<br />

Advantage Small Cap Growth 1.20%<br />

Advantage Large Company Core 1.00%<br />

Advantage Large Company Growth 1.00%<br />

Advantage Asset Allocation 1.00%<br />

Advantage Total Return Bond 0.90%<br />

(b) In addition, the following name changes were made effective May 1, 2005:<br />

OLD PORTFOLIO NAME<br />

Equity Value<br />

Equity Income<br />

International Equity<br />

Small Cap Growth<br />

Growth<br />

Large Company Growth<br />

Asset Allocation<br />

Total Return Bond<br />

NEW PORTFOLIO NAME<br />

Advantage C&B Large Cap Value<br />

Advantage Equity Income<br />

Advantage International Core<br />

Advantage Small Cap Growth<br />

Advantage Large Company Core<br />

Advantage Large Company Growth<br />

Advantage Asset Allocation<br />

Advantage Total Return Bond<br />

(13) The Fund’s adviser is entitled to receive reimbursement from the Fund for fees and expenses paid for by the Fund’s adviser pursuant to expense limitation commitments between the Fund’s<br />

adviser and the Fund if such reimbursement does not cause the Fund to exceed its then-current expense limitations and the reimbursement is made within three years after the Fund’s adviser<br />

incurred the expense.<br />

(14) Effective July 1, 2005, the “AIM V.I. Health Sciences Fund” will be renamed “AIM V.I. Global Health Care Fund.”<br />

(15) ProFund Advisors LLC has contractually agreed to waive Investment Advisory and Management Services Fees and to reimburse other expenses to the extent Total Annual Portfolio Operating<br />

Expenses, as a percentage of average daily net assets, exceed 1.98% (1.73% for ProFund VP U.S. Government Plus and 1.78% for ProFund VP Rising Rates Opportunity) through December 31,<br />

2005. After such date, any of the expense limitations may be terminated or revised. Amounts waived or reimbursed in a particular fiscal year may be repaid to ProFund Advisors LLC within three<br />

years of the waiver or reimbursement to the extent that recoupment will not cause the Portfolio’s expenses to exceed any expense limitation in place at that time. A waiver or reimbursement<br />

lowers the expense ratio and increases overall returns to investors.<br />

(16) The Funds’ Board of Trustees reserves the right to suspend payments under the 12b-1 Plan at any time. On May 1, 2003, 12b-1 payments were suspended for all Funds except the First<br />

Trust 10 Uncommon Values Portfolio. Payments under the 12b-1 Plan resumed effective May 1, 2004 for the Target Managed VIP Portfolio, the Dow Dart 10 Portfolio, the Global Dividend Target<br />

15 Portfolio, the S&P Target 24 Portfolio, the Nasdaq Target 15 Portfolio and the Value Line Target 25 Portfolio.<br />

(17) For the period September 30, 2004 through December 31, 2007, First Trust has contractually agreed to waive fees and reimburse expenses of the Portfolios to limit the total annual fund<br />

operating expenses (excluding brokerage expense and extraordinary expense) to 1.37% for the First Trust 10 Uncommon Values Portfolio and 1.47% for each of the other Portfolios’ average daily<br />

net assets. First Trust has entered into an agreement with First Defined Portfolio Fund, LLC that will allow First Trust to recover from the Portfolios any fees waived or reimbursed during the<br />

three year period of January 1, 2005 through December 31, 2007. However, First Trust’s ability to recover such amounts is limited to the extent that it would not exceed the amount reimbursed<br />

or waived during such period.<br />

TOTAL ACTUAL ANNUAL PORTFO-<br />

LIO OPERATING EXPENSES AFTER<br />

PORTFOLIO NAME<br />

EXPENSE REIMBURSEMENT<br />

First Trust T 10 Uncommon Values 1.37%<br />

Target Managed VIP 1.47%<br />

S&P Target 24 1.47%<br />

The Dow sm DART 10 1.47%<br />

Value Line T Target 25 1.47%<br />

Global Dividend Target 15 1.47%<br />

Nasdaq Target 15 1.47%<br />

Dow Target Dividend 1.47%<br />

Contract described herein is no longer available for sale.<br />

(18) The Dow SM Target Dividend Portfolio is newly organized. Accordingly, Other Expenses and Total Annual Portfolio Operating Expenses are based on estimated expenses for the current<br />

fiscal year.<br />

12