Stagecoach XTra Credit SIX - Prudential Annuities

Stagecoach XTra Credit SIX - Prudential Annuities

Stagecoach XTra Credit SIX - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Investment Options continued<br />

AMERICAN SKANDIA STAGECOACH XTRA CREDIT <strong>SIX</strong> PROSPECTUS<br />

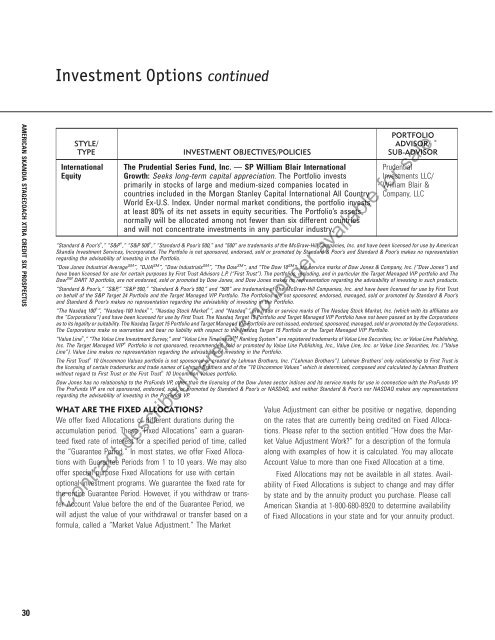

STYLE/<br />

TYPE<br />

International<br />

Equity<br />

INVESTMENT OBJECTIVES/POLICIES<br />

The <strong>Prudential</strong> Series Fund, Inc. — SP William Blair International<br />

Growth: Seeks long-term capital appreciation. The Portfolio invests<br />

primarily in stocks of large and medium-sized companies located in<br />

countries included in the Morgan Stanley Capital International All Country<br />

World Ex-U.S. Index. Under normal market conditions, the portfolio invests<br />

at least 80% of its net assets in equity securities. The Portfolio’s assets<br />

normally will be allocated among not fewer than six different countries<br />

and will not concentrate investments in any particular industry.<br />

PORTFOLIO<br />

ADVISOR/<br />

SUB-ADVISOR<br />

<strong>Prudential</strong><br />

Investments LLC/<br />

William Blair &<br />

Company, LLC<br />

“Standard & Poor’s T ,” “S&P T ,” “S&P 500 T ,” “Standard & Poor’s 500,” and “500” are trademarks of the McGraw-Hill Companies, Inc. and have been licensed for use by American<br />

Skandia Investment Services, Incorporated. The Portfolio is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s makes no representation<br />

regarding the advisability of investing in the Portfolio.<br />

“Dow Jones Industrial Average SM ”, “DJIA SM ”, “Dow Industrials SM ”, “The Dow SM ”, and “The Dow 10 SM ”, are service marks of Dow Jones & Company, Inc. (“Dow Jones”) and<br />

have been licensed for use for certain purposes by First Trust Advisors L.P. (“First Trust”). The portfolios, including, and in particular the Target Managed VIP portfolio and The<br />

Dow SM DART 10 portfolio, are not endorsed, sold or promoted by Dow Jones, and Dow Jones makes no representation regarding the advisability of investing in such products.<br />

“Standard & Poor’s,” “S&P,” “S&P 500,” “Standard & Poor’s 500,” and “500” are trademarks of The McGraw-Hill Companies, Inc. and have been licensed for usebyFirstTrust<br />

on behalf of the S&P Target 24 Portfolio and the Target Managed VIP Portfolio. The Portfolios are not sponsored, endorsed, managed, sold or promoted by Standard & Poor’s<br />

and Standard & Poor’s makes no representation regarding the advisability of investing in the Portfolio.<br />

“The Nasdaq 100 T ”, “Nasdaq-100 Index T ”, “Nasdaq Stock Market T ”, and “Nasdaq T ” are trade or service marks of The Nasdaq Stock Market, Inc. (which with its affiliates are<br />

the “Corporations”) and have been licensed for use by First Trust. The Nasdaq Target 15 Portfolio and Target Managed VIP Portfolio have not been passed on by the Corporations<br />

as to its legality or suitability. The Nasdaq Target 15 Portfolio and Target Managed VIP Portfolio are not issued, endorsed, sponsored, managed, sold or promoted by the Corporations.<br />

The Corporations make no warranties and bear no liability with respect to the Nasdaq Target 15 Portfolio or the Target Managed VIP Portfolio.<br />

“Value Line T ,” “The Value Line Investment Survey,” and “Value Line Timeliness TM Ranking System” are registered trademarks of Value Line Securities, Inc. or Value Line Publishing,<br />

Inc. The Target Managed VIP T Portfolio is not sponsored, recommended, sold or promoted by Value Line Publishing, Inc., Value Line, Inc. or Value Line Securities, Inc. (“Value<br />

Line”). Value Line makes no representation regarding the advisability of investing in the Portfolio.<br />

The First Trust T 10 Uncommon Values portfolio is not sponsored or created by Lehman Brothers, Inc. (“Lehman Brothers”). Lehman Brothers’ only relationship to First Trust is<br />

the licensing of certain trademarks and trade names of Lehman Brothers and of the “10 Uncommon Values” which is determined, composed and calculated by Lehman Brothers<br />

without regard to First Trust or the First Trust T 10 Uncommon Values portfolio.<br />

Dow Jones has no relationship to the ProFunds VP, other than the licensing of the Dow Jones sector indices and its service marks for use in connection with the ProFunds VP.<br />

The ProFunds VP are not sponsored, endorsed, sold, or promoted by Standard & Poor’s or NASDAQ, and neither Standard & Poor’s nor NASDAQ makes any representations<br />

regarding the advisability of investing in the ProFunds VP.<br />

WHAT ARE THE FIXED ALLOCATIONS?<br />

We offer fixed Allocations of different durations during the<br />

accumulation period. These “Fixed Allocations” earn a guaranteed<br />

fixed rate of interest for a specified period of time, called<br />

the “Guarantee Period.” In most states, we offer Fixed Allocations<br />

with Guarantee Periods from 1 to 10 years. We may also<br />

offer special purpose Fixed Allocations for use with certain<br />

optional investment programs. We guarantee the fixed rate for<br />

the entire Guarantee Period. However, if you withdraw or transfer<br />

Account Value before the end of the Guarantee Period, we<br />

will adjust the value of your withdrawal or transfer based on a<br />

formula, called a “Market Value Adjustment.” The Market<br />

Value Adjustment can either be positive or negative, depending<br />

on the rates that are currently being credited on Fixed Allocations.<br />

Please refer to the section entitled “How does the Market<br />

Value Adjustment Work?” for a description of the formula<br />

along with examples of how it is calculated. You may allocate<br />

Account Value to more than one Fixed Allocation at a time.<br />

Fixed Allocations may not be available in all states. Availability<br />

of Fixed Allocations is subject to change and may differ<br />

by state and by the annuity product you purchase. Please call<br />

American Skandia at 1-800-680-8920 to determine availability<br />

of Fixed Allocations in your state and for your annuity product.<br />

Contract described herein is no longer available for sale.<br />

30