ANNUAL REPORT AND ACCOUNTS 2012 - RSA, Annual Report ...

ANNUAL REPORT AND ACCOUNTS 2012 - RSA, Annual Report ...

ANNUAL REPORT AND ACCOUNTS 2012 - RSA, Annual Report ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RISK MANAGEMENT CONTINUED<br />

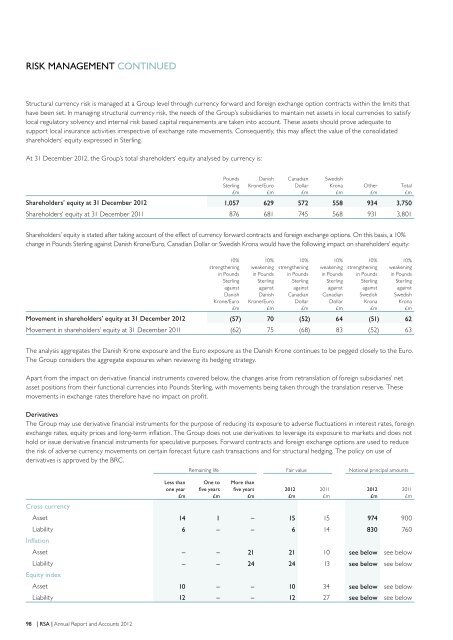

Structural currency risk is managed at a Group level through currency forward and foreign exchange option contracts within the limits that<br />

have been set. In managing structural currency risk, the needs of the Group’s subsidiaries to maintain net assets in local currencies to satisfy<br />

local regulatory solvency and internal risk based capital requirements are taken into account. These assets should prove adequate to<br />

support local insurance activities irrespective of exchange rate movements. Consequently, this may affect the value of the consolidated<br />

shareholders’ equity expressed in Sterling.<br />

At 31 December <strong>2012</strong>, the Group’s total shareholders’ equity analysed by currency is:<br />

Pounds<br />

Sterling<br />

£m<br />

Danish<br />

Krone/Euro<br />

£m<br />

Canadian<br />

Dollar<br />

£m<br />

Shareholders’ equity at 31 December <strong>2012</strong> 1,057 629 572 558 934 3,750<br />

Shareholders’ equity at 31 December 2011 876 681 745 568 931 3,801<br />

Swedish<br />

Krona<br />

£m<br />

Other<br />

£m<br />

Total<br />

£m<br />

Shareholders’ equity is stated after taking account of the effect of currency forward contracts and foreign exchange options. On this basis, a 10%<br />

change in Pounds Sterling against Danish Krone/Euro, Canadian Dollar or Swedish Krona would have the following impact on shareholders’ equity:<br />

10%<br />

strengthening<br />

in Pounds<br />

Sterling<br />

against<br />

Danish<br />

Krone/Euro<br />

£m<br />

10%<br />

weakening<br />

in Pounds<br />

Sterling<br />

against<br />

Danish<br />

Krone/Euro<br />

£m<br />

10%<br />

strengthening<br />

in Pounds<br />

Sterling<br />

against<br />

Canadian<br />

Dollar<br />

£m<br />

10%<br />

weakening<br />

in Pounds<br />

Sterling<br />

against<br />

Canadian<br />

Dollar<br />

£m<br />

10%<br />

strengthening<br />

in Pounds<br />

Sterling<br />

against<br />

Swedish<br />

Krona<br />

£m<br />

10%<br />

weakening<br />

in Pounds<br />

Sterling<br />

against<br />

Swedish<br />

Krona<br />

£m<br />

Movement in shareholders’ equity at 31 December <strong>2012</strong> (57) 70 (52) 64 (51) 62<br />

Movement in shareholders’ equity at 31 December 2011 (62) 75 (68) 83 (52) 63<br />

The analysis aggregates the Danish Krone exposure and the Euro exposure as the Danish Krone continues to be pegged closely to the Euro.<br />

The Group considers the aggregate exposures when reviewing its hedging strategy.<br />

Apart from the impact on derivative financial instruments covered below, the changes arise from retranslation of foreign subsidiaries’ net<br />

asset positions from their functional currencies into Pounds Sterling, with movements being taken through the translation reserve. These<br />

movements in exchange rates therefore have no impact on profit.<br />

Derivatives<br />

The Group may use derivative financial instruments for the purpose of reducing its exposure to adverse fluctuations in interest rates, foreign<br />

exchange rates, equity prices and long-term inflation. The Group does not use derivatives to leverage its exposure to markets and does not<br />

hold or issue derivative financial instruments for speculative purposes. Forward contracts and foreign exchange options are used to reduce<br />

the risk of adverse currency movements on certain forecast future cash transactions and for structural hedging. The policy on use of<br />

derivatives is approved by the BRC.<br />

Cross currency<br />

Less than<br />

one year<br />

£m<br />

Remaining life Fair value Notional principal amounts<br />

One to<br />

five years<br />

£m<br />

More than<br />

five years<br />

£m<br />

Asset 14 1 – 15 15 974 900<br />

Liability 6 – – 6 14 830 760<br />

Inflation<br />

Asset – – 21 21 10 see below see below<br />

Liability – – 24 24 13 see below see below<br />

Equity index<br />

Asset 10 – – 10 34 see below see below<br />

Liability 12 – – 12 27 see below see below<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

98<br />

| <strong>RSA</strong> | <strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2012</strong>