ANNUAL REPORT AND ACCOUNTS 2012 - RSA, Annual Report ...

ANNUAL REPORT AND ACCOUNTS 2012 - RSA, Annual Report ...

ANNUAL REPORT AND ACCOUNTS 2012 - RSA, Annual Report ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CORPORATE GOVERNANCE<br />

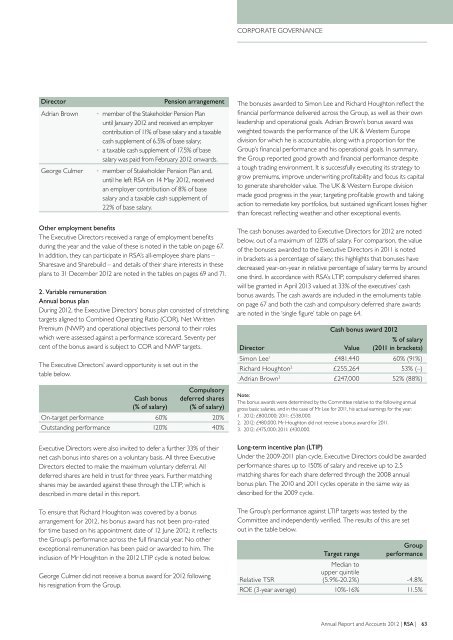

Director<br />

Adrian Brown<br />

George Culmer<br />

Pension arrangement<br />

• member of the Stakeholder Pension Plan<br />

until January <strong>2012</strong> and received an employer<br />

contribution of 11% of base salary and a taxable<br />

cash supplement of 6.5% of base salary;<br />

• a taxable cash supplement of 17.5% of base<br />

salary was paid from February <strong>2012</strong> onwards.<br />

• member of Stakeholder Pension Plan and,<br />

until he left <strong>RSA</strong> on 14 May <strong>2012</strong>, received<br />

an employer contribution of 8% of base<br />

salary and a taxable cash supplement of<br />

22% of base salary.<br />

The bonuses awarded to Simon Lee and Richard Houghton reflect the<br />

financial performance delivered across the Group, as well as their own<br />

leadership and operational goals. Adrian Brown’s bonus award was<br />

weighted towards the performance of the UK & Western Europe<br />

division for which he is accountable, along with a proportion for the<br />

Group’s financial performance and his operational goals. In summary,<br />

the Group reported good growth and financial performance despite<br />

a tough trading environment. It is successfully executing its strategy to<br />

grow premiums, improve underwriting profitability and focus its capital<br />

to generate shareholder value. The UK & Western Europe division<br />

made good progress in the year, targeting profitable growth and taking<br />

action to remediate key portfolios, but sustained significant losses higher<br />

than forecast reflecting weather and other exceptional events.<br />

Other employment benefits<br />

The Executive Directors received a range of employment benefits<br />

during the year and the value of these is noted in the table on page 67.<br />

In addition, they can participate in <strong>RSA</strong>’s all-employee share plans –<br />

Sharesave and Sharebuild – and details of their share interests in these<br />

plans to 31 December <strong>2012</strong> are noted in the tables on pages 69 and 71.<br />

2. Variable remuneration<br />

<strong>Annual</strong> bonus plan<br />

During <strong>2012</strong>, the Executive Directors’ bonus plan consisted of stretching<br />

targets aligned to Combined Operating Ratio (COR), Net Written<br />

Premium (NWP) and operational objectives personal to their roles<br />

which were assessed against a performance scorecard. Seventy per<br />

cent of the bonus award is subject to COR and NWP targets.<br />

The Executive Directors’ award opportunity is set out in the<br />

table below.<br />

Cash bonus<br />

(% of salary)<br />

Compulsory<br />

deferred shares<br />

(% of salary)<br />

On-target performance 60% 20%<br />

Outstanding performance 120% 40%<br />

Executive Directors were also invited to defer a further 33% of their<br />

net cash bonus into shares on a voluntary basis. All three Executive<br />

Directors elected to make the maximum voluntary deferral. All<br />

deferred shares are held in trust for three years. Further matching<br />

shares may be awarded against these through the LTIP, which is<br />

described in more detail in this report.<br />

To ensure that Richard Houghton was covered by a bonus<br />

arrangement for <strong>2012</strong>, his bonus award has not been pro-rated<br />

for time based on his appointment date of 12 June <strong>2012</strong>; it reflects<br />

the Group’s performance across the full financial year. No other<br />

exceptional remuneration has been paid or awarded to him. The<br />

inclusion of Mr Houghton in the <strong>2012</strong> LTIP cycle is noted below.<br />

George Culmer did not receive a bonus award for <strong>2012</strong> following<br />

his resignation from the Group.<br />

The cash bonuses awarded to Executive Directors for <strong>2012</strong> are noted<br />

below, out of a maximum of 120% of salary. For comparison, the value<br />

of the bonuses awarded to the Executive Directors in 2011 is noted<br />

in brackets as a percentage of salary; this highlights that bonuses have<br />

decreased year-on-year in relative percentage of salary terms by around<br />

one third. In accordance with <strong>RSA</strong>’s LTIP, compulsory deferred shares<br />

will be granted in April 2013 valued at 33% of the executives’ cash<br />

bonus awards. The cash awards are included in the emoluments table<br />

on page 67 and both the cash and compulsory deferred share awards<br />

are noted in the ‘single figure’ table on page 64.<br />

Cash bonus award <strong>2012</strong><br />

% of salary<br />

Director<br />

Value (2011 in brackets)<br />

Simon Lee 1 £481,440 60% (91%)<br />

Richard Houghton 2 £255,264 53% (–)<br />

Adrian Brown 3 £247,000 52% (88%)<br />

Note:<br />

The bonus awards were determined by the Committee relative to the following annual<br />

gross basic salaries, and in the case of Mr Lee for 2011, his actual earnings for the year.<br />

1. <strong>2012</strong>: £800,000; 2011: £538,000.<br />

2. <strong>2012</strong>: £480,000. Mr Houghton did not receive a bonus award for 2011.<br />

3. <strong>2012</strong>: £475,000; 2011: £430,000.<br />

Long-term incentive plan (LTIP)<br />

Under the 2009-2011 plan cycle, Executive Directors could be awarded<br />

performance shares up to 150% of salary and receive up to 2.5<br />

matching shares for each share deferred through the 2008 annual<br />

bonus plan. The 2010 and 2011 cycles operate in the same way as<br />

described for the 2009 cycle.<br />

The Group’s performance against LTIP targets was tested by the<br />

Committee and independently verified. The results of this are set<br />

out in the table below.<br />

Group<br />

Target range performance<br />

Relative TSR<br />

Median to<br />

upper quintile<br />

(5.9%-20.2%) -4.8%<br />

ROE (3-year average) 10%-16% 11.5%<br />

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2012</strong> | <strong>RSA</strong> | 63