ANNUAL REPORT AND ACCOUNTS 2012 - RSA, Annual Report ...

ANNUAL REPORT AND ACCOUNTS 2012 - RSA, Annual Report ...

ANNUAL REPORT AND ACCOUNTS 2012 - RSA, Annual Report ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL STATEMENTS<br />

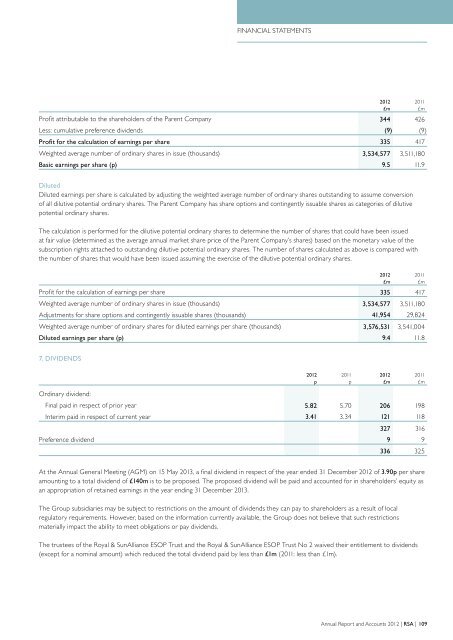

Profit attributable to the shareholders of the Parent Company 344 426<br />

Less: cumulative preference dividends (9) (9)<br />

Profit for the calculation of earnings per share 335 417<br />

Weighted average number of ordinary shares in issue (thousands) 3,534,577 3,511,180<br />

Basic earnings per share (p) 9.5 11.9<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

Diluted<br />

Diluted earnings per share is calculated by adjusting the weighted average number of ordinary shares outstanding to assume conversion<br />

of all dilutive potential ordinary shares. The Parent Company has share options and contingently issuable shares as categories of dilutive<br />

potential ordinary shares.<br />

The calculation is performed for the dilutive potential ordinary shares to determine the number of shares that could have been issued<br />

at fair value (determined as the average annual market share price of the Parent Company’s shares) based on the monetary value of the<br />

subscription rights attached to outstanding dilutive potential ordinary shares. The number of shares calculated as above is compared with<br />

the number of shares that would have been issued assuming the exercise of the dilutive potential ordinary shares.<br />

Profit for the calculation of earnings per share 335 417<br />

Weighted average number of ordinary shares in issue (thousands) 3,534,577 3,511,180<br />

Adjustments for share options and contingently issuable shares (thousands) 41,954 29,824<br />

Weighted average number of ordinary shares for diluted earnings per share (thousands) 3,576,531 3,541,004<br />

Diluted earnings per share (p) 9.4 11.8<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

7. DIVIDENDS<br />

Ordinary dividend:<br />

Final paid in respect of prior year 5.82 5.70 206 198<br />

Interim paid in respect of current year 3.41 3.34 121 118<br />

<strong>2012</strong><br />

p<br />

2011<br />

p<br />

<strong>2012</strong><br />

£m<br />

2011<br />

£m<br />

327 316<br />

Preference dividend 9 9<br />

336 325<br />

At the <strong>Annual</strong> General Meeting (AGM) on 15 May 2013, a final dividend in respect of the year ended 31 December <strong>2012</strong> of 3.90p per share<br />

amounting to a total dividend of £140m is to be proposed. The proposed dividend will be paid and accounted for in shareholders’ equity as<br />

an appropriation of retained earnings in the year ending 31 December 2013.<br />

The Group subsidiaries may be subject to restrictions on the amount of dividends they can pay to shareholders as a result of local<br />

regulatory requirements. However, based on the information currently available, the Group does not believe that such restrictions<br />

materially impact the ability to meet obligations or pay dividends.<br />

The trustees of the Royal & SunAlliance ESOP Trust and the Royal & SunAlliance ESOP Trust No 2 waived their entitlement to dividends<br />

(except for a nominal amount) which reduced the total dividend paid by less than £1m (2011: less than £1m).<br />

<strong>Annual</strong> <strong>Report</strong> and Accounts <strong>2012</strong> | <strong>RSA</strong> | 109