EIF Prospectus - Bright Directions

EIF Prospectus - Bright Directions

EIF Prospectus - Bright Directions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MFS Value Fund<br />

Description of Share Classes<br />

The fund offers Class A, Class B, Class C, Class I, Class 529A,<br />

Class 529B, Class 529C, Class R1, Class R2, Class R3, Class R4,<br />

and Class R5 shares through this prospectus. All classes of the fund<br />

have the same investment objective and investments, but each class<br />

has its own sales charge and expense structure. Your financial<br />

intermediary may also charge you additional fees, commissions, or<br />

other charges. You should consult with your financial intermediary<br />

to help you determine which class is most appropriate for you.<br />

Class I shares generally are available only to the following eligible<br />

investors:<br />

<br />

certain retirement plans established for the benefit of<br />

employees and former employees of MFS or its<br />

affiliates;<br />

defined benefit retirement plans, endowments or<br />

foundations;<br />

bank trust departments or law firms acting as trustee or<br />

manager for trust accounts;<br />

investors who purchase shares through asset-based fee<br />

programs available through financial intermediaries;<br />

employees and former employees of MFS and its<br />

subsidiaries who were employed by MFS or its<br />

subsidiaries on or after January 1, 2013, trusts,<br />

pension, profit-sharing or other retirement plans for the<br />

sole benefit of such persons, and joint accounts with<br />

such persons' spouses or legal equivalents under<br />

applicable state law; and<br />

trustees and former trustees of any investment<br />

company for which MFD serves as a distributor and<br />

who served as trustee on or after January 1, 2013,<br />

trusts, pension, profit-sharing or other retirement plans<br />

for the sole benefit of such persons, and joint accounts<br />

with such persons' spouses or legal equivalents under<br />

applicable state law.<br />

In addition, MFD may accept, in its sole discretion, investments in<br />

Class I shares from purchasers not listed above.<br />

Class 529A, Class 529B and Class 529C shares generally are<br />

available only to qualified tuition programs established in<br />

accordance with Section 529 of the Code (tuition programs).<br />

Class R1, Class R2, Class R3, Class R4, and Class R5 shares<br />

generally are available only to eligible retirement plans (401(k)<br />

plans, 457 plans, employer-sponsored 403(b) plans, profit sharing<br />

and money purchase pension plans, defined benefit plans and nonqualified<br />

deferred compensation plans any of whose accounts are<br />

maintained by the fund at an omnibus level (“Employer Retirement<br />

Plans”)). Additionally, Class R5 shares are available to funds<br />

distributed by MFD. Class R1, Class R2, Class R3, Class R4, and<br />

Class R5 shares are not generally available to retail non-retirement<br />

accounts, traditional and Roth IRAs, Coverdell Educational Savings<br />

Accounts, SEPs, SAR-SEPs, SIMPLE IRAs, salary reduction only<br />

403(b) plans, and 529 tuition plans (except that Class R5 shares are<br />

available to funds distributed by MFD).<br />

Shareholders may be able to convert between Class A shares and<br />

Class I shares of the fund if they satisfy eligibility requirements for<br />

the other class, if any. Class I shareholders may be able to convert<br />

their Class I shares to Class R5 shares of the fund if they satisfy<br />

eligibility requirements of Class R5 shares.<br />

Class C shareholders may be able to convert their Class C shares not<br />

subject to a CDSC to Class I shares of the fund if they satisfy<br />

eligibility requirements of Class I shares.<br />

If a shareholder converts from one share class to another share class<br />

of the fund, the transaction will be based on the respective net asset<br />

value of each class as of the trade date for the conversion.<br />

Consequently, the converting shareholder may receive fewer shares<br />

or more shares than originally owned, depending on that day‟s net<br />

asset values. The total value of the initially held shares, however,<br />

will equal the total value of the converted shares. A conversion<br />

between share classes in the same fund is a nontaxable event.<br />

Sales Charges and Waivers or Reductions<br />

You may be subject to an initial sales charge when you purchase<br />

Class A or Class 529A shares, or a CDSC when you redeem Class<br />

A, Class B, Class C, Class 529B or Class 529C shares. These sales<br />

charges are paid to MFD.<br />

In the circumstances described below, you may qualify for a sales<br />

charge waiver or reduction for purchases or redemptions of Class A,<br />

Class B, Class C, Class 529A, Class 529B, and Class 529C shares.<br />

In addition, other sales charge waivers or reductions apply to certain<br />

transactions by retirement plans, section 529 tuition programs, and<br />

certain other groups (e.g., affiliated persons of MFS) and with<br />

respect to certain types of investment programs (e.g., asset-based fee<br />

programs available through certain financial intermediaries). Details<br />

regarding the types of investment programs and categories of<br />

investors eligible for these waivers or reductions are provided in the<br />

SAI, which is available to you free of charge and on the fund‟s Web<br />

site at mfs.com. Some of these programs and waivers or reductions<br />

are not available to you if your shares are held through certain types<br />

of accounts, such as retirement accounts and 529 plans, or certain<br />

accounts that you have with your financial intermediary. Waivers or<br />

reductions may be eliminated, modified, and added at any time<br />

without providing advance notice to shareholders.<br />

Class A and Class 529A Shares. You may purchase Class A and<br />

Class 529A shares at the offering price (which includes the<br />

applicable initial sales charge).<br />

The amount of the initial sales charge you pay when you buy Class<br />

A or Class 529A shares differs depending upon the amount you<br />

invest, as follows:<br />

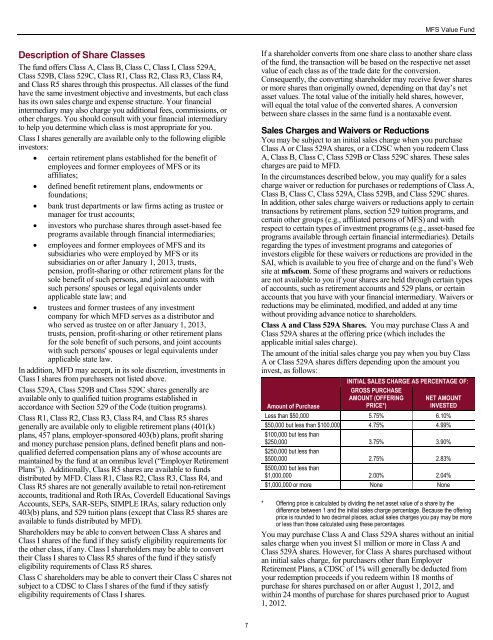

Amount of Purchase<br />

INITIAL SALES CHARGE AS PERCENTAGE OF:<br />

GROSS PURCHASE<br />

AMOUNT (OFFERING NET AMOUNT<br />

PRICE*)<br />

INVESTED<br />

Less than $50,000 5.75% 6.10%<br />

$50,000 but less than $100,000 4.75% 4.99%<br />

$100,000 but less than<br />

$250,000 3.75% 3.90%<br />

$250,000 but less than<br />

$500,000 2.75% 2.83%<br />

$500,000 but less than<br />

$1,000,000 2.00% 2.04%<br />

$1,000,000 or more None None<br />

* Offering price is calculated by dividing the net asset value of a share by the<br />

difference between 1 and the initial sales charge percentage. Because the offering<br />

price is rounded to two decimal places, actual sales charges you pay may be more<br />

or less than those calculated using these percentages.<br />

You may purchase Class A and Class 529A shares without an initial<br />

sales charge when you invest $1 million or more in Class A and<br />

Class 529A shares. However, for Class A shares purchased without<br />

an initial sales charge, for purchasers other than Employer<br />

Retirement Plans, a CDSC of 1% will generally be deducted from<br />

your redemption proceeds if you redeem within 18 months of<br />

purchase for shares purchased on or after August 1, 2012, and<br />

within 24 months of purchase for shares purchased prior to August<br />

1, 2012.<br />

7