You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key performance indicators<br />

There are a num<strong>be</strong>r of measures that are used in finance to look at a set of cash<br />

flows (money out and money in). We will <strong>be</strong>gin by describing these relatively<br />

simple measures.<br />

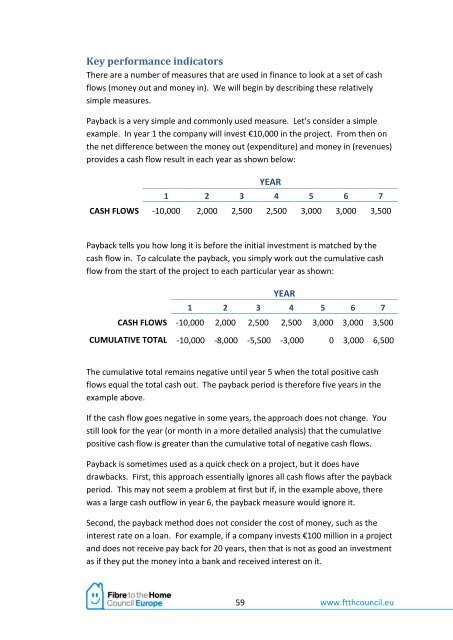

Payback is a very simple and commonly used measure. Let’s consider a simple<br />

example. In year 1 the company will invest €10,000 in the project. From then on<br />

the net difference <strong>be</strong>tween the money out (expenditure) and money in (revenues)<br />

provides a cash flow result in each year as shown <strong>be</strong>low:<br />

YEAR<br />

1 2 3 4 5 6 7<br />

CASH FLOWS -10,000 2,000 2,500 2,500 3,000 3,000 3,500<br />

Payback tells you how long it is <strong>be</strong>fore the initial investment is matched by the<br />

cash flow in. To calculate the payback, you simply work out the cumulative cash<br />

flow from the start of the project to each particular year as shown:<br />

YEAR<br />

1 2 3 4 5 6 7<br />

CASH FLOWS -10,000 2,000 2,500 2,500 3,000 3,000 3,500<br />

CUMULATIVE TOTAL -10,000 -8,000 -5,500 -3,000 0 3,000 6,500<br />

The cumulative total remains negative until year 5 when the total positive cash<br />

flows equal the total cash out. The payback period is therefore five years in the<br />

example above.<br />

If the cash flow goes negative in some years, the approach does not change. You<br />

still look for the year (or month in a more detailed analysis) that the cumulative<br />

positive cash flow is greater than the cumulative total of negative cash flows.<br />

Payback is sometimes used as a quick check on a project, but it does have<br />

drawbacks. First, this approach essentially ignores all cash flows after the payback<br />

period. This may not seem a problem at first but if, in the example above, there<br />

was a large cash outflow in year 6, the payback measure would ignore it.<br />

Second, the payback method does not consider the cost of money, such as the<br />

interest rate on a loan. For example, if a company invests €100 million in a project<br />

and does not receive pay back for 20 years, then that is not as good an investment<br />

as if they put the money into a bank and received interest on it.<br />

59 www.ftthcouncil.eu