You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

analysts and bankers will want to know very clearly why you are going to do <strong>be</strong>tter<br />

than a company for whom they have a <strong>be</strong>nchmark.<br />

If you are targeting an EBITDA margin of 90percent for a vertically-integrated <strong>FTTH</strong><br />

business then, unless you have some incredible advantage, this figure is likely to<br />

<strong>be</strong> too high (see the comparative chart for some real world figures). If your<br />

business case suggests only 10 percent then you need to think very hard about<br />

whether the venture is worth doing. Even a minor problem for the company could<br />

wipe out that 10 percent and leave the company with an operating loss, and that’s<br />

<strong>be</strong>fore other factors like depreciation are taken into account.<br />

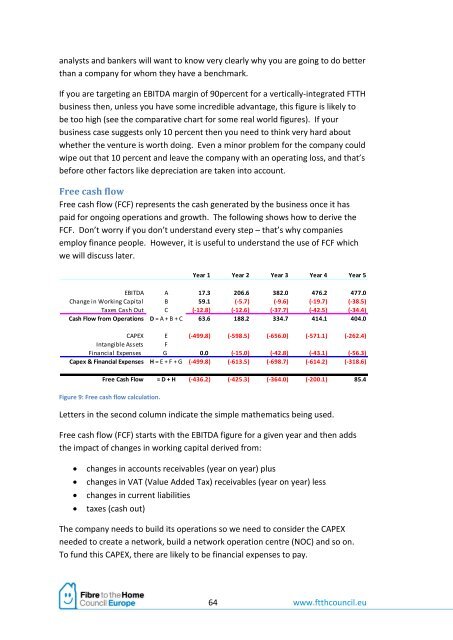

Free cash flow<br />

Free cash flow (FCF) represents the cash generated by the business once it has<br />

paid for ongoing operations and growth. The following shows how to derive the<br />

FCF. Don’t worry if you don’t understand every step – that’s why companies<br />

employ finance people. However, it is useful to understand the use of FCF which<br />

we will discuss later.<br />

Figure 9: Free cash flow calculation.<br />

Letters in the second column indicate the simple mathematics <strong>be</strong>ing used.<br />

Free cash flow (FCF) starts with the EBITDA figure for a given year and then adds<br />

the impact of changes in working capital derived from:<br />

� changes in accounts receivables (year on year) plus<br />

� changes in VAT (Value Added Tax) receivables (year on year) less<br />

� changes in current liabilities<br />

� taxes (cash out)<br />

Year 1 Year 2 Year 3 Year 4 Year 5<br />

EBITDA A 17.3 206.6 382.0 476.2 477.0<br />

Change in Working Capital B 59.1 (-5.7) (-9.6) (-19.7) (-38.5)<br />

Taxes Cash Out C (-12.8) (-12.6) (-37.7) (-42.5) (-34.4)<br />

Cash Flow from Operations D = A + B + C 63.6 188.2 334.7 414.1 404.0<br />

CAPEX E (-499.8) (-598.5) (-656.0) (-571.1) (-262.4)<br />

Intangible Assets F<br />

Financial Expenses G 0.0 (-15.0) (-42.8) (-43.1) (-56.3)<br />

Capex & Financial Expenses H = E + F + G (-499.8) (-613.5) (-698.7) (-614.2) (-318.6)<br />

Free Cash Flow = D + H (-436.2) (-425.3) (-364.0) (-200.1) 85.4<br />

The company needs to build its operations so we need to consider the CAPEX<br />

needed to create a network, build a network operation centre (NOC) and so on.<br />

To fund this CAPEX, there are likely to <strong>be</strong> financial expenses to pay.<br />

64 www.ftthcouncil.eu