You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

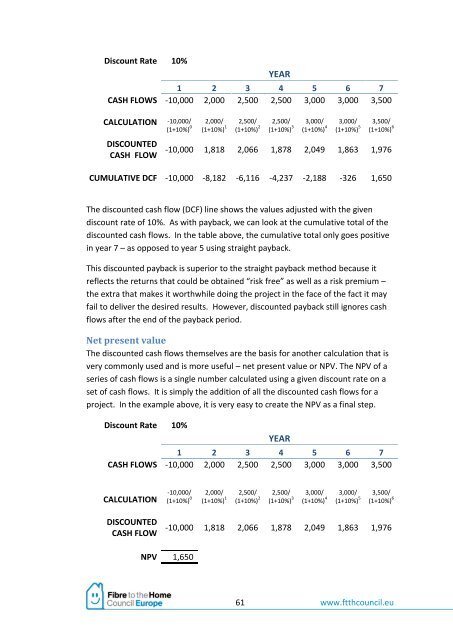

Discount Rate 10%<br />

YEAR<br />

1 2 3 4 5 6 7<br />

CASH FLOWS -10,000 2,000 2,500 2,500 3,000 3,000 3,500<br />

CALCULATION -10,000/<br />

(1+10%) 0<br />

DISCOUNTED<br />

CASH FLOW<br />

2,000/<br />

(1+10%) 1<br />

2,500/<br />

(1+10%) 2<br />

2,500/<br />

(1+10%) 3<br />

3,000/<br />

(1+10%) 4<br />

3,000/<br />

(1+10%) 5<br />

3,500/<br />

(1+10%) 6<br />

-10,000 1,818 2,066 1,878 2,049 1,863 1,976<br />

CUMULATIVE DCF -10,000 -8,182 -6,116 -4,237 -2,188 -326 1,650<br />

The discounted cash flow (DCF) line shows the values adjusted with the given<br />

discount rate of 10%. As with payback, we can look at the cumulative total of the<br />

discounted cash flows. In the table above, the cumulative total only goes positive<br />

in year 7 – as opposed to year 5 using straight payback.<br />

This discounted payback is superior to the straight payback method <strong>be</strong>cause it<br />

reflects the returns that could <strong>be</strong> obtained “risk free” as well as a risk premium –<br />

the extra that makes it worthwhile doing the project in the face of the fact it may<br />

fail to deliver the desired results. However, discounted payback still ignores cash<br />

flows after the end of the payback period.<br />

Net present value<br />

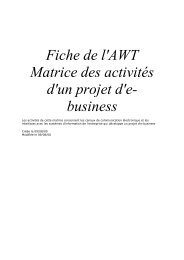

The discounted cash flows themselves are the basis for another calculation that is<br />

very commonly used and is more useful – net present value or NPV. The NPV of a<br />

series of cash flows is a single num<strong>be</strong>r calculated using a given discount rate on a<br />

set of cash flows. It is simply the addition of all the discounted cash flows for a<br />

project. In the example above, it is very easy to create the NPV as a final step.<br />

Discount Rate 10%<br />

YEAR<br />

1 2 3 4 5 6 7<br />

CASH FLOWS -10,000 2,000 2,500 2,500 3,000 3,000 3,500<br />

CALCULATION<br />

DISCOUNTED<br />

CASH FLOW<br />

-10,000/<br />

(1+10%) 0<br />

2,000/<br />

(1+10%) 1<br />

2,500/<br />

(1+10%) 2<br />

2,500/<br />

(1+10%) 3<br />

3,000/<br />

(1+10%) 4<br />

3,000/<br />

(1+10%) 5<br />

3,500/<br />

(1+10%) 6<br />

-10,000 1,818 2,066 1,878 2,049 1,863 1,976<br />

NPV 1,650<br />

61 www.ftthcouncil.eu