Annual Report & Accounts 2009 - Anglo Irish Bank

Annual Report & Accounts 2009 - Anglo Irish Bank

Annual Report & Accounts 2009 - Anglo Irish Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the financial statements continued<br />

51. Risk management and control continued<br />

120<br />

Treasury credit risk continued<br />

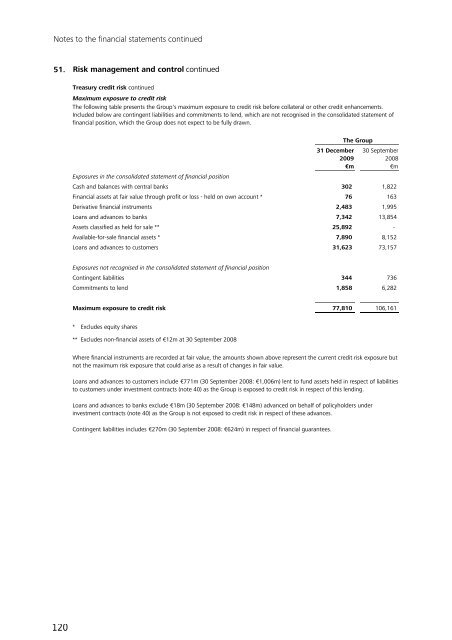

Maximum exposure to credit risk<br />

The following table presents the Group's maximum exposure to credit risk before collateral or other credit enhancements.<br />

Included below are contingent liabilities and commitments to lend, which are not recognised in the consolidated statement of<br />

financial position, which the Group does not expect to be fully drawn.<br />

Exposures in the consolidated statement of financial position<br />

Cash and balances with central banks<br />

Financial assets at fair value through profit or loss - held on own account *<br />

Derivative financial instruments<br />

Loans and advances to banks<br />

Assets classified as held for sale **<br />

Available-for-sale financial assets *<br />

Loans and advances to customers<br />

Exposures not recognised in the consolidated statement of financial position<br />

Contingent liabilities<br />

Commitments to lend<br />

Maximum exposure to credit risk<br />

* Excludes equity shares<br />

** Excludes non-financial assets of €12m at 30 September 2008<br />

31 December 30 September<br />

<strong>2009</strong> 2008<br />

€m €m<br />

302 1,822<br />

76 163<br />

2,483 1,995<br />

7,342 13,854<br />

25,892 -<br />

7,890 8,152<br />

31,623 73,157<br />

344 736<br />

1,858 6,282<br />

77,810 106,161<br />

Where financial instruments are recorded at fair value, the amounts shown above represent the current credit risk exposure but<br />

not the maximum risk exposure that could arise as a result of changes in fair value.<br />

Loans and advances to customers include €771m (30 September 2008: €1,006m) lent to fund assets held in respect of liabilities<br />

to customers under investment contracts (note 40) as the Group is exposed to credit risk in respect of this lending.<br />

Loans and advances to banks exclude €18m (30 September 2008: €148m) advanced on behalf of policyholders under<br />

investment contracts (note 40) as the Group is not exposed to credit risk in respect of these advances.<br />

Contingent liabilities includes €270m (30 September 2008: €624m) in respect of financial guarantees.<br />

The Group