Annual Report & Accounts 2009 - Anglo Irish Bank

Annual Report & Accounts 2009 - Anglo Irish Bank

Annual Report & Accounts 2009 - Anglo Irish Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Business review continued<br />

€1.5 billion of cash collateral placed with counterparties<br />

to offset credit risk arising from derivative contracts. At<br />

30 September 2008 placements with banks included<br />

€7.5 billion of short term placements with <strong>Irish</strong> Life &<br />

Permanent plc.<br />

During the period the Group increased the amount of<br />

assets eligible for open market repo transactions through<br />

the expansion of the <strong>Bank</strong>’s covered bond and commercial<br />

mortgage backed security programmes as well as the<br />

establishment of <strong>Anglo</strong> <strong>Irish</strong> Mortgage <strong>Bank</strong> in October 2008.<br />

The total amount of loan assets assigned as collateral under<br />

rated securitisation programmes and secured central bank<br />

borrowings as at 31 December <strong>2009</strong> was €29.7 billion<br />

(30 September 2008: €11.8 billion).<br />

Yen financing structure<br />

Included within foreign exchange contracts is the impact<br />

of a non-trading Japanese Yen financing arrangement, which<br />

was first entered into in May 2008 and ended during<br />

December 2008 and January <strong>2009</strong>. The financing arrangement<br />

was intended to reduce the Group’s overall net cost<br />

of funding and was structured in a manner which was<br />

anticipated to result in no net after tax loss for the Group<br />

arising from currency fluctuations. In the six months to<br />

31 March <strong>2009</strong> the arrangement resulted in a pre-tax loss of<br />

€181 million and an after tax benefit of €17 million. However,<br />

because of the significant operating losses incurred by the<br />

Group in the nine months to 31 December <strong>2009</strong>, €97 million<br />

of taxation benefit has not been recognised resulting in a<br />

pre-tax loss for the fifteen month period to 31 December<br />

<strong>2009</strong> of €181 million (2008: €31 million) and an after tax<br />

cost of €80 million (2008: gain of €6 million).<br />

Treasury assets<br />

The <strong>Bank</strong> maintains a portfolio of debt securities that are<br />

held for investment purposes or liquidity reasons. Most debt<br />

securities are classified as available-for-sale (‘AFS’) though<br />

certain investments with embedded derivatives are included<br />

within Financial assets at fair value through profit or loss.<br />

The debt securities portfolio comprises sovereign investments,<br />

debt issued by financial institutions, residential mortgage<br />

backed securities and other asset backed securities.<br />

Debt securities are marked to market using independent<br />

prices obtained from external pricing sources including<br />

brokers/dealers and other independent third parties. The<br />

14<br />

<strong>Bank</strong> does not use internal models to value its debt securities<br />

for financial reporting purposes.<br />

The Group recognised gains of €25 million on the sale of<br />

€0.8 billion of government bonds during the period. Capital<br />

gains were offset by capital losses of €20 million on the<br />

disposal of asset backed securities (‘ABS’) and investments in<br />

bank subordinated debt. A net capital gain of €5 million is<br />

reported in Other operating income.<br />

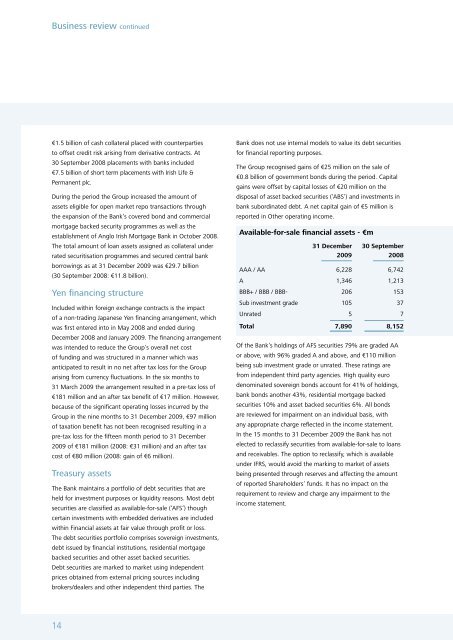

Available-for-sale financial assets - €m<br />

31 December<br />

<strong>2009</strong><br />

30 September<br />

2008<br />

AAA / AA 6,228 6,742<br />

A 1,346 1,213<br />

BBB+ / BBB / BBB- 206 153<br />

Sub investment grade 105 37<br />

Unrated 5 7<br />

Total 7,890 8,152<br />

Of the <strong>Bank</strong>’s holdings of AFS securities 79% are graded AA<br />

or above, with 96% graded A and above, and €110 million<br />

being sub investment grade or unrated. These ratings are<br />

from independent third party agencies. High quality euro<br />

denominated sovereign bonds account for 41% of holdings,<br />

bank bonds another 43%, residential mortgage backed<br />

securities 10% and asset backed securities 6%. All bonds<br />

are reviewed for impairment on an individual basis, with<br />

any appropriate charge reflected in the income statement.<br />

In the 15 months to 31 December <strong>2009</strong> the <strong>Bank</strong> has not<br />

elected to reclassify securities from available-for-sale to loans<br />

and receivables. The option to reclassify, which is available<br />

under IFRS, would avoid the marking to market of assets<br />

being presented through reserves and affecting the amount<br />

of reported Shareholders’ funds. It has no impact on the<br />

requirement to review and charge any impairment to the<br />

income statement.