Annual Report & Accounts 2009 - Anglo Irish Bank

Annual Report & Accounts 2009 - Anglo Irish Bank

Annual Report & Accounts 2009 - Anglo Irish Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

(4)<br />

(5)<br />

(6)<br />

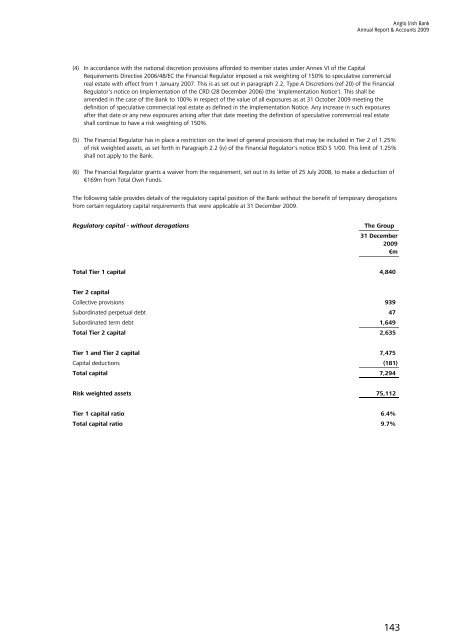

Regulatory capital - without derogations The Group<br />

31 December<br />

<strong>2009</strong><br />

€m<br />

Total Tier 1 capital 4,840<br />

Tier 2 capital<br />

<strong>Anglo</strong> <strong>Irish</strong> <strong>Bank</strong><br />

<strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2009</strong><br />

In accordance with the national discretion provisions afforded to member states under Annex VI of the Capital<br />

Requirements Directive 2006/48/EC the Financial Regulator imposed a risk weighting of 150% to speculative commercial<br />

real estate with effect from 1 January 2007. This is as set out in paragraph 2.2, Type A Discretions (ref 20) of the Financial<br />

Regulator's notice on Implementation of the CRD (28 December 2006) (the 'Implementation Notice'). This shall be<br />

amended in the case of the <strong>Bank</strong> to 100% in respect of the value of all exposures as at 31 October <strong>2009</strong> meeting the<br />

definition of speculative commercial real estate as defined in the Implementation Notice. Any increase in such exposures<br />

after that date or any new exposures arising after that date meeting the definition of speculative commercial real estate<br />

shall continue to have a risk weighting of 150%.<br />

The Financial Regulator has in place a restriction on the level of general provisions that may be included in Tier 2 of 1.25%<br />

of risk weighted assets, as set forth in Paragraph 2.2 (iv) of the Financial Regulator's notice BSD S 1/00. This limit of 1.25%<br />

shall not apply to the <strong>Bank</strong>.<br />

The Financial Regulator grants a waiver from the requirement, set out in its letter of 25 July 2008, to make a deduction of<br />

€169m from Total Own Funds.<br />

The following table provides details of the regulatory capital position of the <strong>Bank</strong> without the benefit of temporary derogations<br />

from certain regulatory capital requirements that were applicable at 31 December <strong>2009</strong>.<br />

Collective provisions 939<br />

Subordinated perpetual debt 47<br />

Subordinated term debt 1,649<br />

Total Tier 2 capital 2,635<br />

Tier 1 and Tier 2 capital 7,475<br />

Capital deductions (181)<br />

Total capital 7,294<br />

Risk weighted assets 75,112<br />

Tier 1 capital ratio 6.4%<br />

Total capital ratio 9.7%<br />

143