1998 Annual Report - Four Seasons Hotels and Resorts

1998 Annual Report - Four Seasons Hotels and Resorts

1998 Annual Report - Four Seasons Hotels and Resorts

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

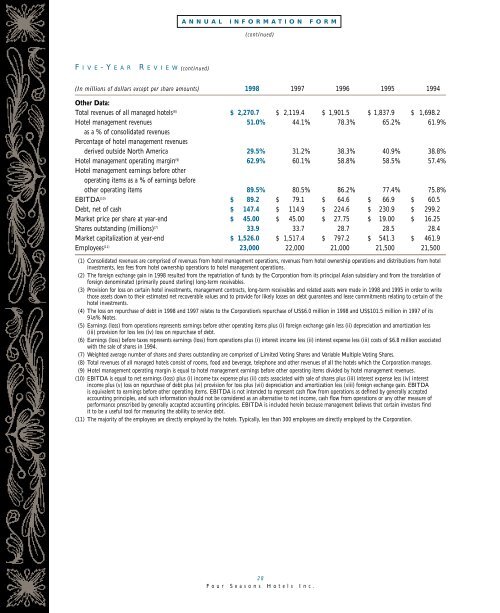

ANNUAL INFORMATION FORM(continued)F I V E-Y E A RR E V I E W (continued)(In millions of dollars except per share amounts) <strong>1998</strong> 1997 1996 1995 1994Other Data:Total revenues of all managed hotels (8) $ 2,270.7 $ 2,119.4 $ 1,901.5 $ 1,837.9 $ 1,698.2Hotel management revenues 51.0% 44.1% 78.3% 65.2% 61.9%as a % of consolidated revenuesPercentage of hotel management revenuesderived outside North America 29.5% 31.2% 38.3% 40.9% 38.8%Hotel management operating margin (9) 62.9% 60.1% 58.8% 58.5% 57.4%Hotel management earnings before otheroperating items as a % of earnings beforeother operating items 89.5% 80.5% 86.2% 77.4% 75.8%EBITDA (10) $ 89.2 $ 79.1 $ 64.6 $ 66.9 $ 60.5Debt, net of cash $ 147.4 $ 114.9 $ 224.6 $ 230.9 $ 299.2Market price per share at year-end $ 45.00 $ 45.00 $ 27.75 $ 19.00 $ 16.25Shares outst<strong>and</strong>ing (millions) (7) 33.9 33.7 28.7 28.5 28.4Market capitalization at year-end $ 1,526.0 $ 1,517.4 $ 797.2 $ 541.3 $ 461.9Employees (11) 23,000 22,000 21,000 21,500 21,500(1) Consolidated revenues are comprised of revenues from hotel management operations, revenues from hotel ownership operations <strong>and</strong> distributions from hotelinvestments, less fees from hotel ownership operations to hotel management operations.(2) The foreign exchange gain in <strong>1998</strong> resulted from the repatriation of funds by the Corporation from its principal Asian subsidiary <strong>and</strong> from the translation offoreign denominated (primarily pound sterling) long-term receivables.(3) Provision for loss on certain hotel investments, management contracts, long-term receivables <strong>and</strong> related assets were made in <strong>1998</strong> <strong>and</strong> 1995 in order to writethose assets down to their estimated net recoverable values <strong>and</strong> to provide for likely losses on debt guarantees <strong>and</strong> lease commitments relating to certain of thehotel investments.(4) The loss on repurchase of debt in <strong>1998</strong> <strong>and</strong> 1997 relates to the Corporation’s repurchase of US$6.0 million in <strong>1998</strong> <strong>and</strong> US$101.5 million in 1997 of its91/8% Notes.(5) Earnings (loss) from operations represents earnings before other operating items plus (i) foreign exchange gain less (ii) depreciation <strong>and</strong> amortization less(iii) provision for loss less (iv) loss on repurchase of debt.(6) Earnings (loss) before taxes represents earnings (loss) from operations plus (i) interest income less (ii) interest expense less (iii) costs of $6.8 million associatedwith the sale of shares in 1994.(7) Weighted average number of shares <strong>and</strong> shares outst<strong>and</strong>ing are comprised of Limited Voting Shares <strong>and</strong> Variable Multiple Voting Shares.(8) Total revenues of all managed hotels consist of rooms, food <strong>and</strong> beverage, telephone <strong>and</strong> other revenues of all the hotels which the Corporation manages.(9) Hotel management operating margin is equal to hotel management earnings before other operating items divided by hotel management revenues.(10) EBITDA is equal to net earnings (loss) plus (i) income tax expense plus (ii) costs associated with sale of shares plus (iii) interest expense less (iv) interestincome plus (v) loss on repurchase of debt plus (vi) provision for loss plus (vii) depreciation <strong>and</strong> amortization less (viii) foreign exchange gain. EBITDAis equivalent to earnings before other operating items. EBITDA is not intended to represent cash flow from operations as defined by generally acceptedaccounting principles, <strong>and</strong> such information should not be considered as an alternative to net income, cash flow from operations or any other measure ofperformance prescribed by generally accepted accounting principles. EBITDA is included herein because management believes that certain investors findit to be a useful tool for measuring the ability to service debt.(11) The majority of the employees are directly employed by the hotels. Typically, less than 300 employees are directly employed by the Corporation.28<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.