1998 Annual Report - Four Seasons Hotels and Resorts

1998 Annual Report - Four Seasons Hotels and Resorts

1998 Annual Report - Four Seasons Hotels and Resorts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

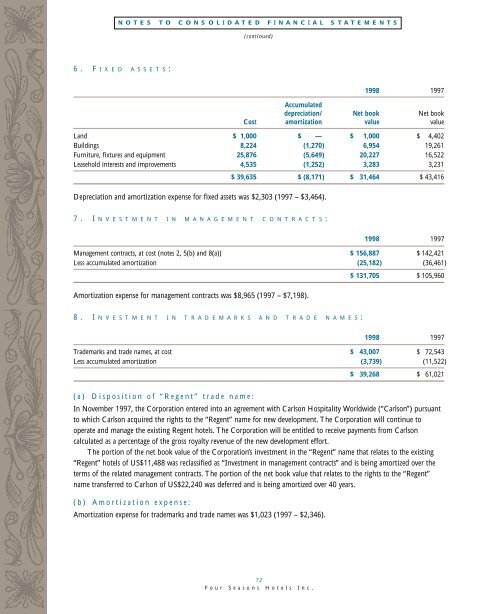

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(continued)6. F I X E D A S S E T S:<strong>1998</strong> 1997Accumulateddepreciation/ Net book Net bookCost amortization value valueL<strong>and</strong> $ 1,000 $ — $ 1,000 $ 4,402Buildings 8,224 (1,270) 6,954 19,261Furniture, fixtures <strong>and</strong> equipment 25,876 (5,649) 20,227 16,522Leasehold interests <strong>and</strong> improvements 4,535 (1,252) 3,283 3,231Depreciation <strong>and</strong> amortization expense for fixed assets was $2,303 (1997 – $3,464).$ 39,635 $ (8,171) $ 31,464 $ 43,4167. I N V E S T M E N T I N M A N A G E M E N T C O N T R A C T S:<strong>1998</strong> 1997Management contracts, at cost (notes 2, 5(b) <strong>and</strong> 8(a)) $ 156,887 $ 142,421Less accumulated amortization (25,182) (36,461)Amortization expense for management contracts was $8,965 (1997 – $7,198).$ 131,705 $ 105,9608. I N V E S T M E N T I N T R A D E M A R K S A N D T R A D E N A M E S:<strong>1998</strong> 1997Trademarks <strong>and</strong> trade names, at cost $ 43,007 $ 72,543Less accumulated amortization (3,739) (11,522)$ 39,268 $ 61,021(a) Disposition of “Regent” trade name:In November 1997, the Corporation entered into an agreement with Carlson Hospitality Worldwide (“Carlson”) pursuantto which Carlson acquired the rights to the “Regent” name for new development. The Corporation will continue tooperate <strong>and</strong> manage the existing Regent hotels. The Corporation will be entitled to receive payments from Carlsoncalculated as a percentage of the gross royalty revenue of the new development effort.The portion of the net book value of the Corporation’s investment in the “Regent” name that relates to the existing“Regent” hotels of US$11,488 was reclassified as “Investment in management contracts” <strong>and</strong> is being amortized over theterms of the related management contracts. The portion of the net book value that relates to the rights to the “Regent”name transferred to Carlson of US$22,240 was deferred <strong>and</strong> is being amortized over 40 years.(b) Amortization expense:Amortization expense for trademarks <strong>and</strong> trade names was $1,023 (1997 – $2,346).72<strong>Four</strong> <strong>Seasons</strong> <strong>Hotels</strong> Inc.