City of Methuen Annual Report: 2012

City of Methuen Annual Report: 2012

City of Methuen Annual Report: 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

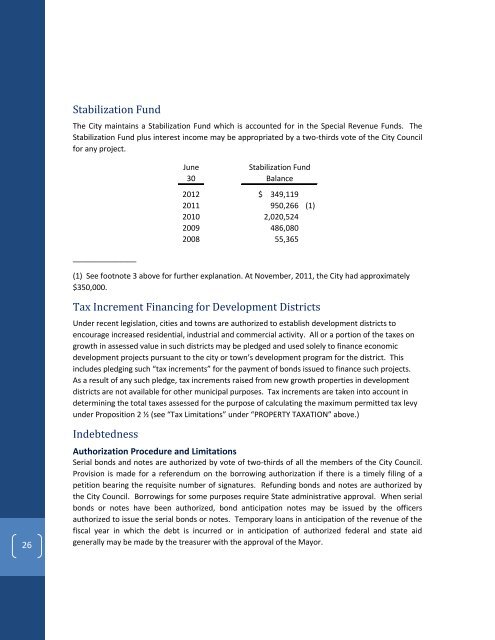

C i t y o f M e t h u e n A n n u a l R e p o r t : 2 0 1 2Stabilization FundThe <strong>City</strong> maintains a Stabilization Fund which is accounted for in the Special Revenue Funds. TheStabilization Fund plus interest income may be appropriated by a two-thirds vote <strong>of</strong> the <strong>City</strong> Councilfor any project.JuneStabilization Fund30 Balance<strong>2012</strong> $ 349,1192011 950,266 (1)2010 2,020,5242009 486,0802008 55,365_______________(1) See footnote 3 above for further explanation. At November, 2011, the <strong>City</strong> had approximately$350,000.Tax Increment Financing for Development DistrictsUnder recent legislation, cities and towns are authorized to establish development districts toencourage increased residential, industrial and commercial activity. All or a portion <strong>of</strong> the taxes ongrowth in assessed value in such districts may be pledged and used solely to finance economicdevelopment projects pursuant to the city or town’s development program for the district. Thisincludes pledging such “tax increments” for the payment <strong>of</strong> bonds issued to finance such projects.As a result <strong>of</strong> any such pledge, tax increments raised from new growth properties in developmentdistricts are not available for other municipal purposes. Tax increments are taken into account indetermining the total taxes assessed for the purpose <strong>of</strong> calculating the maximum permitted tax levyunder Proposition 2 ½ (see “Tax Limitations” under “PROPERTY TAXATION” above.)26IndebtednessAuthorization Procedure and LimitationsSerial bonds and notes are authorized by vote <strong>of</strong> two-thirds <strong>of</strong> all the members <strong>of</strong> the <strong>City</strong> Council.Provision is made for a referendum on the borrowing authorization if there is a timely filing <strong>of</strong> apetition bearing the requisite number <strong>of</strong> signatures. Refunding bonds and notes are authorized bythe <strong>City</strong> Council. Borrowings for some purposes require State administrative approval. When serialbonds or notes have been authorized, bond anticipation notes may be issued by the <strong>of</strong>ficersauthorized to issue the serial bonds or notes. Temporary loans in anticipation <strong>of</strong> the revenue <strong>of</strong> thefiscal year in which the debt is incurred or in anticipation <strong>of</strong> authorized federal and state aidgenerally may be made by the treasurer with the approval <strong>of</strong> the Mayor.