6. Monetary PolicyThe monetary management in <strong>Qatar</strong> is implemented by <strong>Qatar</strong> Central Bank (QCB) which was establishedby Law No. 15 for the year 1993, from what was formerly called the <strong>Qatar</strong> Monetary Agency (QMA).The main objective of the QCB is to regulate the monetary, credit and banking policies in accordancewith the general plans of the State, in order to support the national economy and the stability of thecurrency. QCB has full powers over the monetary policies of the State, and supervises and controlsbanks and financial institutions.An effective monetary tool utilised by the QCB is the imposition of minimum reserve requirements forcommercial banks. In February 2000, QCB instructed banks to maintain cash reserves equal to 2.75%of total deposits (including foreign deposits) instead of 19% of total demand deposits, previously ineffect.Another important monetary tool used by the QCB is the loans-to-deposit ratio limit applied to commercialbanks, which is set at 90% of the total deposits base and any bank that exceeds this limit is penalisedby the QCB.6.1 Domestic LiquidityDomestic Liquidity increased by 21.1% during the first half of <strong>2006</strong> to reach a record level of QR 77.8billion, compared to QR 64.3 billion as at year-end 2005 (Table 6.1). High domestic liquidity has resultedfrom an increase in energy prices. During the first half of <strong>2006</strong>, narrow money supply (M1) increasedby 21.0% to reach QR 27.1 billion, from QR 22.4 billion at year-end 2005. The increase in M1 resultedfrom an increase in demand deposits, which rose by 21.6% to reach QR 23.7 billion. Savings and timedeposits increased by 34.6% to reach QR 35.1 billion, compared to QR 26.1 billion as at year-end2005.Table 6.1Money Supply(2002 - June <strong>2006</strong>)(QR Million) 2002 2003 2004 2005 June <strong>2006</strong>Currency with public 1,921 2,148 2,594 2,866 3,355Demand deposits 4,368 9,130 12,004 19,497 23,700Narrow Money Supply (M1) 6,289 11,278 14,598 22,363 27,055Savings and time deposits 19,002 17,958 20,621 26,059 35,069Foreign currency deposits 6,856 7,987 9,646 15,849 15,710Total quasi money 25,858 25,945 30,267 41,908 50,779Broad Money Supply (M2) 32,147 37,223 44,865 64,271 77,834Source: <strong>Qatar</strong> Central Bank.6.2 Exchange Rate PolicyThe <strong>Qatar</strong>i Riyal is officially pegged to the US dollar at a rate of 1 US$ = QR 3.640. During the first half of<strong>2006</strong>, the <strong>Qatar</strong>i Riyal declined marginally against major european currencies, while making a slight gainagainst the Japanese Yen. During the first half of <strong>2006</strong>, the <strong>Qatar</strong>i Riyal declined by 1.7% against theEuro, by 1.3% against the Sterling Pound and by 1.0% against the Swiss Franc (Table 6.2). Also duringthe first half of <strong>2006</strong>, the <strong>Qatar</strong>i riyal appreciated by 3.8% against the Japanese Yen.In 2005, the <strong>Qatar</strong>i Riyal made moderate gains against most major currencies, further to the strengtheningof the US dollar. QCB average exchange rate data for 2005 shows that the <strong>Qatar</strong>i Riyal appreciated by1.8% against the Japanese Yen, by 0.6% against the Sterling Pound, and by 0.1% against the SwissFranc. The <strong>Qatar</strong>i Riyal saw a marginal decline by 0.2% against the Euro in 2005.MONETARY POLICY 38

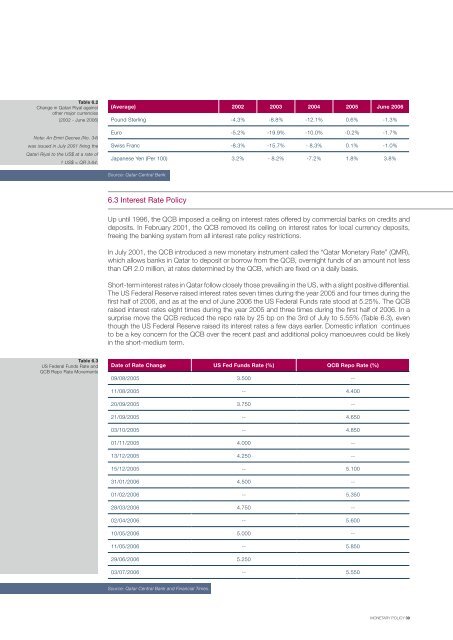

Table 6.2Change in <strong>Qatar</strong>i Riyal againstother major currencies(2002 - June <strong>2006</strong>)Note: An Emiri Decree (No. 34)was issued in July 2001 fixing the<strong>Qatar</strong>i Riyal to the US$ at a rate of1 US$ = QR 3.64.(Average) 2002 2003 2004 2005 June <strong>2006</strong>Pound Sterling -4.3% -8.8% -12.1% 0.6% -1.3%Euro -5.2% -19.9% -10.0% -0.2% -1.7%Swiss Franc -8.3% -15.7% - 8.3% 0.1% -1.0%Japanese Yen (Per 100) 3.2% - 8.2% -7.2% 1.8% 3.8%Source: <strong>Qatar</strong> Central Bank.6.3 Interest Rate PolicyUp until 1996, the QCB imposed a ceiling on interest rates offered by commercial banks on credits anddeposits. In February 2001, the QCB removed its ceiling on interest rates for local currency deposits,freeing the banking system from all interest rate policy restrictions.In July 2001, the QCB introduced a new monetary instrument called the “<strong>Qatar</strong> Monetary Rate” (QMR),which allows banks in <strong>Qatar</strong> to deposit or borrow from the QCB, overnight funds of an amount not lessthan QR 2.0 million, at rates determined by the QCB, which are fixed on a daily basis.Short-term interest rates in <strong>Qatar</strong> follow closely those prevailing in the US, with a slight positive differential.The US Federal Reserve raised interest rates seven times during the year 2005 and four times during thefirst half of <strong>2006</strong>, and as at the end of June <strong>2006</strong> the US Federal Funds rate stood at 5.25%. The QCBraised interest rates eight times during the year 2005 and three times during the first half of <strong>2006</strong>. In asurprise move the QCB reduced the repo rate by 25 bp on the 3rd of July to 5.55% (Table 6.3), eventhough the US Federal Reserve raised its interest rates a few days earlier. Domestic inflation continuesto be a key concern for the QCB over the recent past and additional policy manoeuvres could be likelyin the short-medium term.Table 6.3US Federal Funds Rate andQCB Repo Rate MovementsDate of Rate Change US Fed Funds Rate (%) QCB Repo Rate (%)09/08/2005 3.500 --11/08/2005 -- 4.40020/09/2005 3.750 --21/09/2005 -- 4.65003/10/2005 -- 4.85001/11/2005 4.000 --13/12/2005 4.250 --15/12/2005 -- 5.10031/01/<strong>2006</strong> 4.500 --01/02/<strong>2006</strong> -- 5.35028/03/<strong>2006</strong> 4.750 --02/04/<strong>2006</strong> -- 5.60010/05/<strong>2006</strong> 5.000 --11/05/<strong>2006</strong> -- 5.85029/06/<strong>2006</strong> 5.25003/07/<strong>2006</strong> -- 5.550Source: <strong>Qatar</strong> Central Bank and Financial Times.MONETARY POLICY 39