Qatar Economic Review 2006(September) - QNB

Qatar Economic Review 2006(September) - QNB

Qatar Economic Review 2006(September) - QNB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

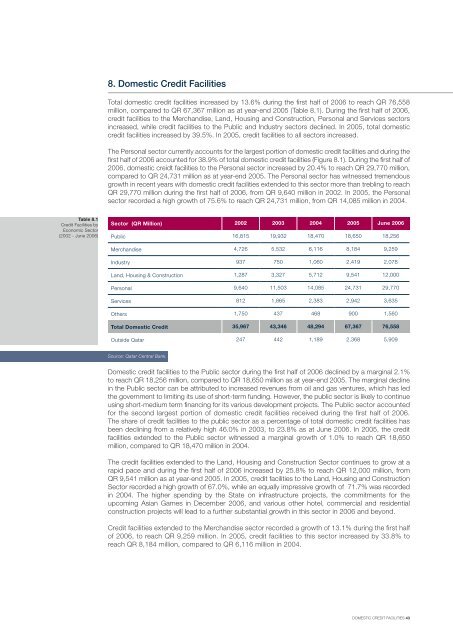

8. Domestic Credit FacilitiesTotal domestic credit facilities increased by 13.6% during the first half of <strong>2006</strong> to reach QR 76,558million, compared to QR 67,367 million as at year-end 2005 (Table 8.1). During the first half of <strong>2006</strong>,credit facilities to the Merchandise, Land, Housing and Construction, Personal and Services sectorsincreased, while credit facilities to the Public and Industry sectors declined. In 2005, total domesticcredit facilities increased by 39.5%. In 2005, credit facilities to all sectors increased.The Personal sector currently accounts for the largest portion of domestic credit facilities and during thefirst half of <strong>2006</strong> accounted for 38.9% of total domestic credit facilities (Figure 8.1). During the first half of<strong>2006</strong>, domestic creidt facilities to the Personal sector increased by 20.4% to reach QR 29,770 million,compared to QR 24,731 million as at year-end 2005. The Personal sector has witnessed tremendousgrowth in recent years with domestic credit facilities extended to this sector more than trebling to reachQR 29,770 million during the first half of <strong>2006</strong>, from QR 9,640 million in 2002. In 2005, the Personalsector recorded a high growth of 75.6% to reach QR 24,731 million, from QR 14,085 million in 2004.Table 8.1Credit Facilities by<strong>Economic</strong> Sector(2002 - June <strong>2006</strong>)Sector (QR Million) 2002 2003 2004 2005 June <strong>2006</strong>Public 16,815 19,932 18,470 18,650 18,256Merchandise 4,726 5,532 6,116 8,184 9,259Industry 937 750 1,060 2,419 2,078Land, Housing & Construction 1,287 3,327 5,712 9,541 12,000Personal 9,640 11,503 14,085 24,731 29,770Services 812 1,865 2,383 2,942 3,635Others 1,750 437 468 900 1,560Total Domestic Credit 35,967 43,346 48,294 67,367 76,558Outside <strong>Qatar</strong> 247 442 1,189 2,368 5,909Source: <strong>Qatar</strong> Central Bank.Domestic credit facilities to the Public sector during the first half of <strong>2006</strong> declined by a marginal 2.1%to reach QR 18,256 million, compared to QR 18,650 million as at year-end 2005. The marginal declinein the Public sector can be attributed to increased revenues from oil and gas ventures, which has ledthe government to limiting its use of short-term funding. However, the public sector is likely to continueusing short-medium term financing for its various development projects. The Public sector accountedfor the second largest portion of domestic credit facilities received during the first half of <strong>2006</strong>.The share of credit facilities to the public sector as a percentage of total domestic credit facilities hasbeen declining from a relatively high 46.0% in 2003, to 23.8% as at June <strong>2006</strong>. In 2005, the creditfacilities extended to the Public sector witnessed a marginal growth of 1.0% to reach QR 18,650million, compared to QR 18,470 million in 2004.The credit facilities extended to the Land, Housing and Construction Sector continues to grow at arapid pace and during the first half of <strong>2006</strong> increased by 25.8% to reach QR 12,000 million, fromQR 9,541 million as at year-end 2005. In 2005, credit facilities to the Land, Housing and ConstructionSector recorded a high growth of 67.0%, while an equally impressive growth of 71.7% was recordedin 2004. The higher spending by the State on infrastructure projects, the commitments for theupcoming Asian Games in December <strong>2006</strong>, and various other hotel, commercial and residentialconstruction projects will lead to a further substantial growth in this sector in <strong>2006</strong> and beyond.Credit facilities extended to the Merchandise sector recorded a growth of 13.1% during the first halfof <strong>2006</strong>, to reach QR 9,259 million. In 2005, credit facilities to this sector increased by 33.8% toreach QR 8,184 million, compared to QR 6,116 million in 2004.DOMESTIC CREDIT FACILITIES 43