Qatar Economic Review 2006(September) - QNB

Qatar Economic Review 2006(September) - QNB

Qatar Economic Review 2006(September) - QNB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

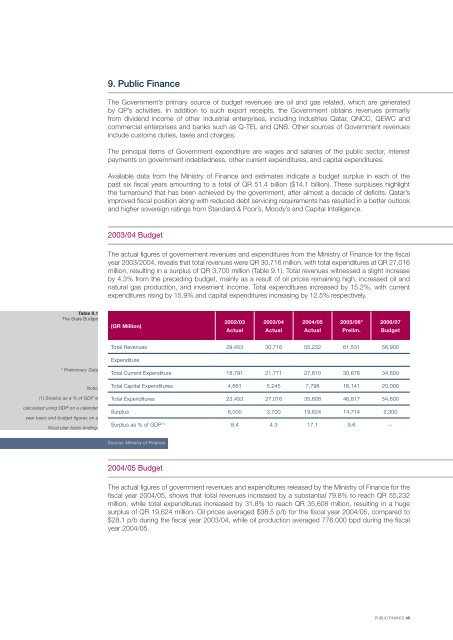

9. Public FinanceThe Government’s primary source of budget revenues are oil and gas related, which are generatedby QP’s activities. In addition to such export receipts, the Government obtains revenues primarilyfrom dividend income of other industrial enterprises, including Industries <strong>Qatar</strong>, QNCC, QEWC andcommercial enterprises and banks such as Q-TEL and <strong>QNB</strong>. Other sources of Government revenuesinclude customs duties, taxes and charges.The principal items of Government expenditure are wages and salaries of the public sector, interestpayments on government indebtedness, other current expenditures, and capital expenditures.Available data from the Ministry of Finance and estimates indicate a budget surplus in each of thepast six fiscal years amounting to a total of QR 51.4 billion ($14.1 billion). These surpluses highlightthe turnaround that has been achieved by the government, after almost a decade of deficits. <strong>Qatar</strong>’simproved fiscal position along with reduced debt servicing requirements has resulted in a better outlookand higher sovereign ratings from Standard & Poor’s, Moody’s and Capital Intelligence.2003/04 BudgetThe actual figures of governement revenues and expenditures from the Ministry of Finance for the fiscalyear 2003/2004, reveals that total revenues were QR 30,716 million, with total expenditures at QR 27,016million, resulting in a surplus of QR 3,700 million (Table 9.1). Total revenues witnessed a slight increaseby 4.3% from the preceding budget, mainly as a result of oil prices remaining high, increased oil andnatural gas production, and invesment income. Total expenditures increased by 15.2%, with currentexpenditures rising by 15.9% and capital expenditures increasing by 12.5% respectively.Table 9.1The State Budget(QR Million)2002/03Actual2003/04Actual2004/05Actual2005/06*Prelim.<strong>2006</strong>/07BudgetTotal Revenues 29,453 30,716 55,232 61,531 56,900Expenditure* Preliminary DataNote:(1) Surplus as a % of GDP iscalculated using GDP on a calendaryear basis and budget figures on afiscal year basis ending.Total Current Expenditure 18,791 21,771 27,810 30,676 34,600Total Capital Expenditures 4,661 5,245 7,798 16,141 20,000Total Expenditures 23,453 27,016 35,608 46,817 54,600Surplus 6,000 3,700 19,624 14,714 2,300Surplus as % of GDP (1) 8.4 4.3 17.1 9.6 --Source: Ministry of Finance.2004/05 BudgetThe actual figures of government revenues and expenditures released by the Ministry of Finance for thefiscal year 2004/05, shows that total revenues increased by a substantial 79.8% to reach QR 55,232million, while total expenditures increased by 31.8% to reach QR 35,608 million, resulting in a hugesurplus of QR 19,624 million. Oil prices averaged $38.5 p/b for the fiscal year 2004/05, compared to$28.1 p/b during the fiscal year 2003/04, while oil production averaged 776,000 bpd during the fiscalyear 2004/05.PUBLIC FINANCE 45