Eur - Danske Analyse - Danske Bank

Eur - Danske Analyse - Danske Bank

Eur - Danske Analyse - Danske Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

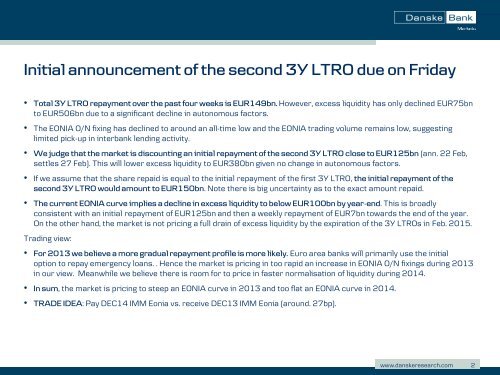

Initial announcement of the second 3Y LTRO due on Friday• Total 3Y LTRO repayment over the past four weeks is EUR149bn. However, excess liquidity has only declined EUR75bnto EUR506bn due to a significant decline in autonomous factors.• The EONIA O/N fixing has declined to around an all-time low and the EONIA trading volume remains low, suggestinglimited pick-up in interbank lending activity.• We judge that the market is discounting an initial repayment of the second 3Y LTRO close to EUR125bn (ann. 22 Feb,settles 27 Feb). This will lower excess liquidity to EUR380bn given no change in autonomous factors.• If we assume that the share repaid is equal to the initial repayment of the first 3Y LTRO, the initial repayment of thesecond 3Y LTRO would amount to EUR150bn. Note there is big uncertainty as to the exact amount repaid.• The current EONIA curve implies a decline in excess liquidity to below EUR100bn by year-end. This is broadlyconsistent with an initial repayment of EUR125bn and then a weekly repayment of EUR7bn towards the end of the year.On the other hand, the market is not pricing a full drain of excess liquidity by the expiration of the 3Y LTROs in Feb. 2015.Trading view:• For 2013 we believe a more gradual repayment profile is more likely. <strong>Eur</strong>o area banks will primarily use the initialoption to repay emergency loans. . Hence the market is pricing in too rapid an increase in EONIA O/N fixings during 2013in our view. Meanwhile we believe there is room for to price in faster normalisation of liquidity during 2014.• In sum, the market is pricing to steep an EONIA curve in 2013 and too flat an EONIA curve in 2014.• TRADE IDEA: Pay DEC14 IMM Eonia vs. receive DEC13 IMM Eonia (around. 27bp).www.danskeresearch.com2