Reading the Markets Sweden - Danske Analyse - Danske Bank

Reading the Markets Sweden - Danske Analyse - Danske Bank

Reading the Markets Sweden - Danske Analyse - Danske Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

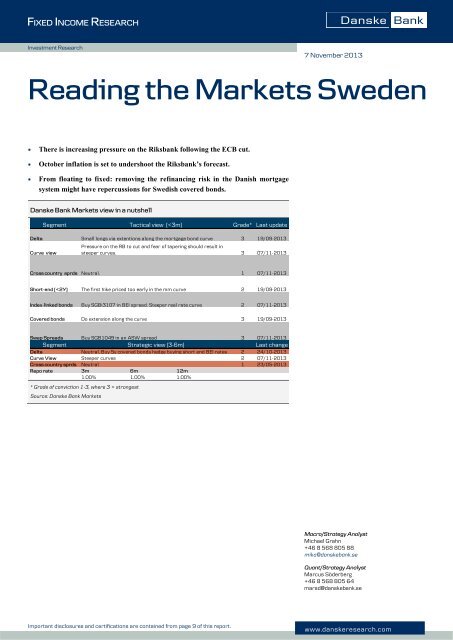

<strong>Reading</strong> <strong>the</strong> <strong>Markets</strong> <strong>Sweden</strong>Increasing pressure for Riksbank rate cutThe Riksbank’s monetary minutes contained no real news but it still feels as though <strong>the</strong>prospects of <strong>the</strong> Riksbank being able to effect its repo rate forecast is worsening. First,two members of <strong>the</strong> Executive Board (Per Jansson and Cecilia Skingsley) have suggestedthat stronger data may not automatically imply an upward adjustment of <strong>the</strong> repo rateforecast. Jansson conditions his view on <strong>the</strong> assumption that <strong>the</strong> household debt ratio doesnot deteriorate, while Skingsley argues that <strong>the</strong> precision of <strong>the</strong> macro forecast is not suchthat <strong>the</strong> relationship to <strong>the</strong> repo rate path is 1:1. Both have <strong>the</strong>refore suggested that <strong>the</strong>reis a ‘cap’ for <strong>the</strong> repo rate.Second, Governor Stefan Ingves said: ‘Estimates of <strong>the</strong> impact of macro-prudentialsupervision on inflation and resource utilisation will always be truly difficult. Even after<strong>the</strong> introduction of macro-prudential instruments, trade-offs for monetary policy willremain. Ingves <strong>the</strong>refore concluded that until measures are in place and are expected tohave [an] impact <strong>the</strong> repo rate will need to be higher than o<strong>the</strong>rwise.’ This sounds pretty‘hawkish’ but, by extension, this means that as <strong>the</strong> FSA starts to introduce variousmeasures aimed at combating a fur<strong>the</strong>r increase in household debt, <strong>the</strong> degree of freedomfor <strong>the</strong> Riksbank to lower <strong>the</strong> repo rate will increase. This said, <strong>the</strong> latest figures from <strong>the</strong>SKOP (October/November) suggest households have record-high expectations of houseprices, with 59% believing in rising condo prices and 51% believing in higher houseprices (which is synonymous with accelerating credit growth and rising household debt).Hence, short term, <strong>the</strong> board majority is likely to continue to worry. Despite this, it isdifficult to escape <strong>the</strong> impression that <strong>the</strong>re is a lot suggesting <strong>the</strong> Riksbank will again beforced to push out <strong>the</strong> repo rate path, or pull it down a notch, i.e. risk/reward suggests that<strong>the</strong>re is considerable downside risk to macroeconomic forecasts.In particular, this applies to <strong>the</strong> inflation outlook, which we dug into in <strong>Reading</strong> <strong>the</strong><strong>Markets</strong> <strong>Sweden</strong>, 31 October, where we argued that <strong>the</strong> Riksbank is overestimatinginflationary pressures in coming years . Here we concentrate on October inflation but infuture we intend to look fur<strong>the</strong>r at <strong>the</strong> tricky (if not impossible) task of pushing upinflation to <strong>the</strong> target over coming years.The chart below shows that Macrobond expects electricity and gasoline prices to pulldown <strong>the</strong> monthly inflation rate by a total of 0.15 percentage points. This is a quite safeassessment. The uncertainty lies mainly in <strong>the</strong> ‘transportation services’ component, whichhas shown considerable volatility due to price movements in airline tickets. Theuncertainty is especially high this time, as prices have fallen sharply two months in a row,with <strong>the</strong> latter month being ‘seasonally non-normal’. Thus, we expect a rebound to addabout 0.1 percentage points this month. It may be more than this. However, <strong>the</strong>re is also arisk that <strong>the</strong> price declines of recent months reflect increased competition and hence pricepressure in <strong>the</strong> airline industry. Hence, one cannot exclude <strong>the</strong> possibility that pricescould be cut again in October. Our CPI (0.14% y/y ) and CPIF (0.81% y/y ) forecasts bo<strong>the</strong>nd 0.2 percentage points below <strong>the</strong> Riksbank’s forecasts. Our assessment is, <strong>the</strong>refore,that <strong>the</strong> inflation outcome too will put additional pressure on <strong>the</strong> board majority’s stanceon <strong>the</strong> policy rate.2 | 7 November 2013www.danskeresearch.com

<strong>Reading</strong> <strong>the</strong> <strong>Markets</strong> <strong>Sweden</strong>Contribution to October inflation (% m/m)0.100.080.060.040.020.00-0.02-0.04-0.06-0.08-0.10-0.12CPIFCPIMiscellaneousRestaurantsRecreationCommunicationTransportationCarsFuelHealthFurnitureElectricityCapital stockRatesMortgage costRentClothingAlcoholFoodCPIF-forecasts: <strong>Danske</strong> <strong>Bank</strong> vs RiksbankSource: MacrobondSource Macrobond, <strong>Danske</strong> <strong>Bank</strong>Finally, <strong>the</strong> ECB’s decision to cut its key interest rate to 0.5%, with <strong>the</strong> potential forano<strong>the</strong>r shot, is very likely to increase <strong>the</strong> doubt among <strong>the</strong> Riksbank’s Executive Boardmajority about how to act going forward. It is clear to us that <strong>the</strong> ECB’s Executive Boardhas concluded that economic development was considerably weaker than expected andthat deflationary pressure is growing; it will be difficult for <strong>the</strong> Riksbank to take adifferent approach.In <strong>the</strong> Monetary Policy Report in October, <strong>the</strong> Riksbank revised down its assessment ofglobal growth for this year and <strong>the</strong> years to come. However, <strong>the</strong> assessment of euro areagrowth remained unchanged. There is a risk that it will have to adjust <strong>the</strong> forecast as well as<strong>the</strong> assessment of imported inflation. It can hardly have escaped anyone’s notice that euroarea core inflation is at a record low and that deflationary risks again loom large. At <strong>the</strong> pressconference, ECB president Mario Draghi said that although he does not expect deflation in<strong>the</strong> proper sense, <strong>the</strong> euro economy could face ‘a prolonged period of low inflation’.Reasonably, this assessment should have a bearing on <strong>the</strong> Riksbank’s view on import pricesand hence on Swedish inflation. Therefore, <strong>the</strong>re is a parallel risk for Swedish inflation. TheRiksbank and, in particular, <strong>the</strong> Executive Board majority has received criticism regardingmissing <strong>the</strong> target and instead focusing on household debt and this criticism is not likely to bealleviated by <strong>the</strong> ECB recognising that <strong>the</strong> eurozone also has such a problem.Falling euro inflation puts pressure on <strong>Sweden</strong>Source: Macrobond3 | 7 November 2013www.danskeresearch.com

<strong>Reading</strong> <strong>the</strong> <strong>Markets</strong> <strong>Sweden</strong>Risk of steeper curvesDespite <strong>the</strong> uncertainty regarding <strong>the</strong> debt ceiling and <strong>the</strong> still ongoing political trenchwarfare, <strong>the</strong> US economy seems to have wea<strong>the</strong>red <strong>the</strong> past few months relatively well.We have not yet received all data for this period but so far macroeconomic data has beendecent and surveys point towards continued expansion. Thus, we find it more likely thattapering could re-emerge as a market <strong>the</strong>me.While Fed’s next step may very well be a less expansive monetary policy in <strong>the</strong> shape ofsmaller bond purchases, in <strong>the</strong> eurozone <strong>the</strong> need for fur<strong>the</strong>r stimulus is becomingincreasingly clear. The October inflation figure (+0.7% y/y) was a shock to <strong>the</strong> marketand it partly reflects <strong>the</strong> effect of <strong>the</strong> very high unemployment rate in sou<strong>the</strong>rn Europe.Low wage pressure translates into low consumer price increases in non-core countries andinflation is generally hovering around 0%. Even in core countries, <strong>the</strong> inflation rate hasbeen below 2%. Given <strong>the</strong> significant output gap, this situation is unlikely to changeanytime soon, especially as <strong>the</strong> commodity super cycle may be over. Even though <strong>the</strong>reare few options at <strong>the</strong> ECB’s disposal, we expect some kind of response. Worth noting inthis context is that EURUSD remains at high levels despite <strong>the</strong> recent fall and couldhamper export growth. Thus, even though our base case was a December cut, today’s ratecut did not surprised us.What effect will <strong>the</strong> situation in Europe have on <strong>the</strong> Riksbank? To some extent, we mayimport <strong>the</strong> low price pressure. Also, looser monetary policy from <strong>the</strong> ECB wouldprobably set <strong>the</strong> bar lower for <strong>the</strong> Riksbank through <strong>the</strong> currency channel. Everything elsebeing equal, it should translate into more supportive monetary policy. Overall, <strong>the</strong> neteffect of a potentially softer ECB should be largest at <strong>the</strong> short end of <strong>the</strong> Swedish yieldcurve.Fur<strong>the</strong>r out on <strong>the</strong> Swedish yield curve fears about bond tapering might get <strong>the</strong> upperhand. We have previously shown that <strong>the</strong> cross-country spread between <strong>Sweden</strong> andGermany has been highly directional (see chart below). Higher rates have meant thatSwedish rates have underperformed on a relative basis. From a macroeconomicperspective, it would make sense that <strong>Sweden</strong> is better able to capitalise on a continuedglobal recovery.<strong>Sweden</strong> vs Germany spread highly directional2.42.221.81.61.41.2>110dec-12 jan-13 mar-13 maj-13 jun-13 aug-13 okt-13 nov-13 jan-14706050403020Source: <strong>Danske</strong> <strong>Bank</strong> <strong>Markets</strong>Overall, we <strong>the</strong>refore see a risk of a worse environment for long-dated bonds on <strong>the</strong> backof still-steady growth in <strong>the</strong> US. At <strong>the</strong> same time, a softer ECB could put fur<strong>the</strong>r pressureon <strong>the</strong> Riksbank to keep rates low for a significant period. The net effect on <strong>the</strong> Swedishcurve could be fur<strong>the</strong>r steepening pressure. However, <strong>the</strong> timing may be difficult asmarket movements may be volatile.4 | 7 November 2013www.danskeresearch.com

<strong>Reading</strong> <strong>the</strong> <strong>Markets</strong> <strong>Sweden</strong>In any case, we see this as a strong reason to alter our recommendations. We havepreviously recommended receiving SEK 5Y5Y versus 1Y1Y. As <strong>the</strong> environment nowappears less supportive of longer bonds, we close this position with a minimal profit of2bp. Instead, we look for opportunities to take position for steeper curves.From floating to fixed – removing <strong>the</strong> refinancing risk in <strong>the</strong>Danish mortgage systemThe Danish Government yesterday introduced a new proposal for removing <strong>the</strong>refinancing risk in <strong>the</strong> Danish mortgage market. In our view, this is a major game changerin <strong>the</strong> Danish mortgage market, as <strong>the</strong> refinancing risk is basically moved from <strong>the</strong>borrower/mortgage bank/bank to <strong>the</strong> investor. The new proposal will be implemented by1 January 2014 if <strong>the</strong> government has a majority in <strong>the</strong> parliament. We expect <strong>the</strong>proposal to be implemented. We have not seen such a move by ei<strong>the</strong>r regulators orlawmakers in o<strong>the</strong>r European covered bond markets where <strong>the</strong> refinancing risk is movedaway from <strong>the</strong> borrower/mortgage bank and to <strong>the</strong> investor. The main points in <strong>the</strong> newproposal are as follows.Danish covered bonds with a maturity shorter than <strong>the</strong> maturity on <strong>the</strong> loan can have amaturity extension corresponding to <strong>the</strong> underlying loan behind <strong>the</strong> non-callablebond. The proposal covers non-callables, short- and medium-term capped floaters,Cibor floaters and <strong>the</strong> new CITA floaters.The extension happens if an auction of non-callables fails or if <strong>the</strong> rate at <strong>the</strong>refinancing auction is higher than 5pp + <strong>the</strong> coupon on <strong>the</strong> bond that matures. Hence,<strong>the</strong> non-callable bond will be ‘knocked-in’ to a fixed rate callable bond if <strong>the</strong> yield at<strong>the</strong> refinancing auction is greater than 5% +coupon of <strong>the</strong> underlying bond.Hence, investors will receive a new fixed rate callable bond with a high coupon ra<strong>the</strong>rthan <strong>the</strong> principal on <strong>the</strong> non-callable bond. The cash flow on <strong>the</strong> new fixed ratecallable bond will match <strong>the</strong> cash flow on <strong>the</strong> loans that are backing <strong>the</strong> non-callablebond. Hence, <strong>the</strong> investor can possibly receive a fixed-rate callable bond with amaturity up to 30 years.Comments so far from <strong>the</strong> Ministry and mortgage banks indicate that <strong>the</strong> existing noncallablebonds will be grandfa<strong>the</strong>red. Hence, <strong>the</strong> existing non-callable covered bonds willbenefit from <strong>the</strong> change in <strong>the</strong> law and we expect <strong>the</strong> upcoming refinancing auction to bevery well received by investors.The exact mechanics of <strong>the</strong> switch into a fixed-rate callable bond is uncertain: will <strong>the</strong>switch happen if <strong>the</strong> rate is higher before, during or after <strong>the</strong> auction? The knock-inoption is attached to <strong>the</strong> existing coupon, so <strong>the</strong> investor with a 5Y bond has a risk if ratesrise by more than 5% during <strong>the</strong> 5Y period. Fur<strong>the</strong>rmore, rising rates over a longer periodwill affect <strong>the</strong> pricing of <strong>the</strong> knock-in option. The price of <strong>the</strong> option will increase andhence <strong>the</strong> ASW-spread of <strong>the</strong> new non-callables would rise.Assuming that <strong>the</strong> existing bonds will be grandfa<strong>the</strong>red, we list some of <strong>the</strong> positivefactors regarding <strong>the</strong> new proposal.It is very supportive of <strong>the</strong> mortgage banks, as it removes <strong>the</strong> refinancing risk from<strong>the</strong> banks.It is positive for borrowers if rates rise dramatically, as <strong>the</strong>y have a cap on <strong>the</strong>irmortgage rate going forward.There should be a positive effect on <strong>the</strong> rating and OC requirements going forward.We expect a positive statement from <strong>the</strong> rating agencies as <strong>the</strong>y asked for a solutionlike <strong>the</strong> new proposal.5 | 7 November 2013www.danskeresearch.com

<strong>Reading</strong> <strong>the</strong> <strong>Markets</strong> <strong>Sweden</strong>It could also have a positive effect on <strong>the</strong> net stable funding ratio (NSFR) if <strong>the</strong> 1Ybond with extension can be included in <strong>the</strong> NSFR. We would not expect that a 1Ybond could be included but we do not know this. This is probably up to <strong>the</strong> regulators.However, <strong>the</strong>re are also a number of possible negatives.There will be more ISIN codes, as mortgage banks will open new bonds – henceliquidity will be ‘diluted’.The knock-in option has a cost for <strong>the</strong> borrower. Some market participants estimate acost of 5bp but <strong>the</strong> premium is highly uncertain, as it is dependent on <strong>the</strong> shape of <strong>the</strong>yield curve, <strong>the</strong> volatility, <strong>the</strong> credit spread/risk, and <strong>the</strong> risk of going from a 1Y bondto a 30Y.There could be a possible negative effect on <strong>the</strong> existing 30Y callables. There is anincreased risk premium given <strong>the</strong> risk of a sudden increase in <strong>the</strong> supply of 30Y fixedratecallable bonds. The effect is difficult to price given <strong>the</strong> very low risk of a rise inrates of more than 5%.Finally, who will buy <strong>the</strong> new bonds? This is a major issue, as <strong>the</strong>re are a number offoreign investors in <strong>the</strong> existing 1Y bonds. It is uncertain whe<strong>the</strong>r <strong>the</strong>y can and/or willbuy <strong>the</strong> new bonds. Similarly for funded investors, will <strong>the</strong>y buy <strong>the</strong> bonds given <strong>the</strong>extension risk. It is also uncertain whe<strong>the</strong>r mutual funds with a maturity target around1Y will be allowed to buy <strong>the</strong> bonds.So, could this have repercussions for <strong>the</strong> Swedish covered bond market? Theuncertainties surrounding <strong>the</strong> new setup in Denmark might dent demand for flex bonds, assome investors might be less keen on having such uncertainty in <strong>the</strong>ir portfolios. Will<strong>the</strong>y buy a short-term bond that could possibly be extended into a 30Y fixed-rate callablebond? Hence, Swedish covered bonds might stand out as more attractive on a relativebasis, at least until <strong>the</strong> dust has settled in Denmark.In addition, with a more fragmented Danish mortgage bond market, <strong>the</strong> Swedish market,which relies on a few benchmark bonds with bigger volumes, might be easier for someinvestors to grasp. Hence, as existing Danish flex bonds mature, a few investors mightgradually move into Swedish peers instead. Thus, long term, this might be supportive of<strong>the</strong> Swedish covered bond market. The step taken in Denmark is probably positive but, inour view, it is likely to give rise to some uncertainty for investors.6 | 7 November 2013www.danskeresearch.com

<strong>Reading</strong> <strong>the</strong> <strong>Markets</strong> <strong>Sweden</strong>Open strategiesType Trade Idea Target & P/L StatusCovered/BEIBuy SGBi3107 vs. SGB1051, After <strong>the</strong> recent flattening of <strong>the</strong> mm curve Opened 24 okt 2013 Holdand sell SHYP1576 buy<strong>the</strong> long end trades too steep and too high Start 15900.00SHYP1580Target/Stop 13500/17500Now 15800.66P/L 1.0Money market Recieve FRAJUN14Low for longer, low voaltility, risk tilted for Opened 22 okt 2013 Profitlower rates tell us to buy covered bonds Start 1.31 takenTarget/Stop 1.2/1.38Now 1.2P/L 12.0Fwd spread Rec. 5y5y and Pay 1y1y RB on hold for longer and more bond friendly Opened 21 okt 2013 Holdglobal environment.Start 176Target/Stop 155/190Now 173.5P/L 2.5Fwd ASWBuy NDH5529 vs. NDH5527 vs Short end BEIs trade cheap - hedge by rec. 4y Opened 17 okt 2013 Holdfwd swapEUR swapStart 73.5Target/Stop 55/88.5Now 64.2P/L 9.3ASW spread Buy 2DEC13 vs. matching swap We see signs of lack of short-end supply. This Opened 04 sep 2013 Holdmight mount as SEK 40bn of T-bills mature Start -39.5in mid September.Target/Stop -50/-32Now -38.3P/L -1.2Money market Sell RibaDec13 As a cheap hedge we like selling RibaDec13. Opened 02 aug 2013 HoldStart 0.97Target/Stop 0.9/1.05Now 1P/L -3.0Source: <strong>Danske</strong> <strong>Bank</strong> <strong>Markets</strong>7 | 7 November 2013www.danskeresearch.com

<strong>Reading</strong> <strong>the</strong> <strong>Markets</strong> <strong>Sweden</strong>Calendar week beginning 11 November 2013Monday, 11 November, 2013Period <strong>Danske</strong> <strong>Bank</strong> Konsensus Previous00:00 JAP Eco Watchers Survey Outlook (Current) Index Oct 54.2(52.8)00:50 JAP <strong>Bank</strong> lending y/y Oct 2.0%09:00 DEN CPI m/m|y/y Oct 0.0%|0.6% 0.3%|0.5%10:00 weco3 Industrial production m/m|y/y Sep -0.3%|-4.6%10:00 NOR Consumer prices m/m|y/y Oct 0.5%|2.8%10:00 NOR Core inflation (CPI-ATE) m/m|y/y Oct 0.4%|1.7%Tuesday, 12 November, 2013 Period <strong>Danske</strong> <strong>Bank</strong> Konsensus Previous00:50 JAP Tertiary industry index m/m Sep 0.2% 0.7%06:00 JAP Consumer confidence Oct 45.408:00 GER HICP, final m/m|y/y Oct -0.2%|1.3%09:30 SWE CPI m/m|y/y Oct 0.0%|0.1% 0.4%|0.1%09:30 SWE Underlying inflation CPIF m/m|y/y Oct 0.0%|0.8% 0.4%|0.9%10:00 ITA HICP, final y/y Oct 0.7%10:30 UK PPI - Output m/m|y/y Oct -0.1%|1.2%10:30 UK CPI/HICP Inflation m/m|y/y Oct 0.4%|2.7%13:30 US NFIB small business optimism Index Oct 93.9Wednesday, 13 November, 2013Period <strong>Danske</strong> <strong>Bank</strong> Konsensus Previous00:50 JAP Machine orders m/m|y/y Sep -2.3%|14.2% 5.4%|10.3%00:50 JAP Domestic CGPI m/m|y/y Oct -0.2%|2.6% 0.3%|2.3%10:30 UK Average Earnings 3Ms/YoY Sep 0.7%10:30 UK ILO Unemployment rate % Sep 7.711:00 EMU Industrial production m/m|y/y Sep 0.0%|0.4% 1.0%|-2.1%11:30 UK BoE Inflation report20:00 US Budget statement USD bn Oct22:45 NZ Retail sales q/q Q3 1.7%Thursday, 14 November, 2013Period <strong>Danske</strong> <strong>Bank</strong> Konsensus Previous00:50 JAP GDP, preliminary q/q|ann. Q3 0.4%|1.6% 0.9%|3.8%05:30 JAP Industrial production, final m/m|y/y Sep 1.5%|5.4%07:30 FRA GDP, preliminary q/q|y/y Q3 0.5%|0.4%08:00 GER GDP, preliminary q/q|y/y Q3 0.3%|0.6% 0.7%|0.5%08:45 FRA HICP m/m|y/y Oct -0.2%|1.0%09:30 SWE Unemployment % Oct 7.4 7.5%09:30 SWE Unemployment s.a. % Oct 8 8.0%10:00 EMU ECB monthly report Nov10:00 ITA GDP, preliminary q/q|y/y Q3 -0.3%|-2.1%10:30 UK Retail Sales m/m|y/y Oct 0.6%|2.2%11:00 EMU GDP, preliminary q/q|y/y Q3 0.1%|-0.3% 0.3%|-0.5%14:30 US Unit labour cost, preliminary q/q Q3 1.5% 0.0%14:30 US Trade balance USD bn Sep -39.0 -38.815:00 EMU Eurogroup meetingFriday, 15 November, 2013Period <strong>Danske</strong> <strong>Bank</strong> Konsensus Previous09:00 EMU ECOFIN meeting09:30 SWE Capacity utilization, industry % Q3 86.2%10:00 NOR Trade balance NOK bn Oct -21.711:00 EMU HICP m/m|y/y Oct -0.1%|0.7% 0.5%|1.1%11:00 EMU HICP core, final y/y Oct 0.8%14:30 US Import prices m/m|y/y Oct -0.6%| 0.2%|-1.0%14:30 US Empire manufacturing PMI m/m Nov 4.00 1.5215:15 US Industrial production m/m Oct 0.2% 0.6%15:15 US Capacity utilization % Oct 78.3% 78.3%15:30 EMU EU-US brief press on trade talksSource: Compiled from various sources by <strong>Danske</strong> <strong>Bank</strong> <strong>Markets</strong>8 | 7 November 2013www.danskeresearch.com

<strong>Reading</strong> <strong>the</strong> <strong>Markets</strong> <strong>Sweden</strong>DisclosuresThis research report has been prepared by <strong>Danske</strong> <strong>Bank</strong> <strong>Markets</strong>, a division of <strong>Danske</strong> <strong>Bank</strong> A/S (‘<strong>Danske</strong><strong>Bank</strong>’). The authors of this research report are Michael Grahn, Macro/Strategy Analyst, and Marcus Söderberg,Quant/Strategy Analyst.Analyst certificationEach research analyst responsible for <strong>the</strong> content of this research report certifies that <strong>the</strong> views expressed in <strong>the</strong>research report accurately reflect <strong>the</strong> research analyst’s personal view about <strong>the</strong> financial instruments and issuerscovered by <strong>the</strong> research report. Each responsible research analyst fur<strong>the</strong>r certifies that no part of <strong>the</strong> compensationof <strong>the</strong> research analyst was, is or will be, directly or indirectly, related to <strong>the</strong> specific recommendations expressedin <strong>the</strong> research report.Regulation<strong>Danske</strong> <strong>Bank</strong> is authorised and subject to regulation by <strong>the</strong> Danish Financial Supervisory Authority and is subjectto <strong>the</strong> rules and regulation of <strong>the</strong> relevant regulators in all o<strong>the</strong>r jurisdictions where it conducts business. <strong>Danske</strong><strong>Bank</strong> is subject to limited regulation by <strong>the</strong> Financial Conduct Authority and <strong>the</strong> Prudential Regulation Authority(UK). Details on <strong>the</strong> extent of <strong>the</strong> regulation by <strong>the</strong> Financial Conduct Authority and <strong>the</strong> Prudential RegulationAuthority are available from <strong>Danske</strong> <strong>Bank</strong> on request.The research reports of <strong>Danske</strong> <strong>Bank</strong> are prepared in accordance with <strong>the</strong> Danish Society of Financial Analysts’rules of ethics and <strong>the</strong> recommendations of <strong>the</strong> Danish Securities Dealers Association.Conflicts of interest<strong>Danske</strong> <strong>Bank</strong> has established procedures to prevent conflicts of interest and to ensure <strong>the</strong> provision of highqualityresearch based on research objectivity and independence. These procedures are documented in <strong>Danske</strong><strong>Bank</strong>’s research policies. Employees within <strong>Danske</strong> <strong>Bank</strong>’s Research Departments have been instructed that anyrequest that might impair <strong>the</strong> objectivity and independence of research shall be referred to Research Managementand <strong>the</strong> Compliance Department. <strong>Danske</strong> <strong>Bank</strong>’s Research Departments are organised independently from and donot report to o<strong>the</strong>r business areas within <strong>Danske</strong> <strong>Bank</strong>.Research analysts are remunerated in part based on <strong>the</strong> overall profitability of <strong>Danske</strong> <strong>Bank</strong>, which includesinvestment banking revenues, but do not receive bonuses or o<strong>the</strong>r remuneration linked to specific corporatefinance or debt capital transactions.Financial models and/or methodology used in this research reportCalculations and presentations in this research report are based on standard econometric tools and methodologyas well as publicly available statistics for each individual security, issuer and/or country. Documentation can beobtained from <strong>the</strong> authors upon request.Risk warningMajor risks connected with recommendations or opinions in this research report, including a sensitivity analysisof relevant assumptions, are stated throughout <strong>the</strong> text.Date of first publicationSee <strong>the</strong> front page of this research report for <strong>the</strong> date of first publication.General disclaimerThis research has been prepared by <strong>Danske</strong> <strong>Bank</strong> <strong>Markets</strong> (a division of <strong>Danske</strong> <strong>Bank</strong> A/S). It is provided forinformational purposes only. It does not constitute or form part of, and shall under no circumstances beconsidered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments(i.e. financial instruments mentioned herein or o<strong>the</strong>r financial instruments of any issuer mentioned herein and/oroptions, warrants, rights or o<strong>the</strong>r interests with respect to any such financial instruments) (‘Relevant FinancialInstruments’).The research report has been prepared independently and solely on <strong>the</strong> basis of publicly available information that<strong>Danske</strong> <strong>Bank</strong> considers to be reliable. While reasonable care has been taken to ensure that its contents are notuntrue or misleading, no representation is made as to its accuracy or completeness and <strong>Danske</strong> <strong>Bank</strong>, its affiliatesand subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitationany loss of profits, arising from reliance on this research report.The opinions expressed herein are <strong>the</strong> opinions of <strong>the</strong> research analysts responsible for <strong>the</strong> research report andreflect <strong>the</strong>ir judgement as of <strong>the</strong> date hereof. These opinions are subject to change, and <strong>Danske</strong> <strong>Bank</strong> does notundertake to notify any recipient of this research report of any such change nor of any o<strong>the</strong>r changes related to <strong>the</strong>information provided in this research report.This research report is not intended for retail customers in <strong>the</strong> United Kingdom or <strong>the</strong> United States.9 | 7 November 2013www.danskeresearch.com

<strong>Reading</strong> <strong>the</strong> <strong>Markets</strong> <strong>Sweden</strong>This research report is protected by copyright and is intended solely for <strong>the</strong> designated addressee. It may not bereproduced or distributed, in whole or in part, by any recipient for any purpose without <strong>Danske</strong> <strong>Bank</strong>’s priorwritten consent.Disclaimer related to distribution in <strong>the</strong> United StatesThis research report is distributed in <strong>the</strong> United States by <strong>Danske</strong> <strong>Markets</strong> Inc., a U.S. registered broker-dealerand subsidiary of <strong>Danske</strong> <strong>Bank</strong>, pursuant to SEC Rule 15a-6 and related interpretations issued by <strong>the</strong> U.S.Securities and Exchange Commission. The research report is intended for distribution in <strong>the</strong> United States solelyto ‘U.S. institutional investors’ as defined in SEC Rule 15a-6. <strong>Danske</strong> <strong>Markets</strong> Inc. accepts responsibility for thisresearch report in connection with distribution in <strong>the</strong> United States solely to ‘U.S. institutional investors’.<strong>Danske</strong> <strong>Bank</strong> is not subject to U.S. rules with regard to <strong>the</strong> preparation of research reports and <strong>the</strong> independenceof research analysts. In addition, <strong>the</strong> research analysts of <strong>Danske</strong> <strong>Bank</strong> who have prepared this research report arenot registered or qualified as research analysts with <strong>the</strong> NYSE or FINRA but satisfy <strong>the</strong> applicable requirementsof a non-U.S. jurisdiction.Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant FinancialInstrument may do so only by contacting <strong>Danske</strong> <strong>Markets</strong> Inc. directly and should be aware that investing in non-U.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not beregistered with <strong>the</strong> U.S. Securities and Exchange Commission and may not be subject to <strong>the</strong> reporting andauditing standards of <strong>the</strong> U.S. Securities and Exchange Commission.10 | 7 November 2013www.danskeresearch.com