Reading the Markets Sweden - Danske Analyse - Danske Bank

Reading the Markets Sweden - Danske Analyse - Danske Bank

Reading the Markets Sweden - Danske Analyse - Danske Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

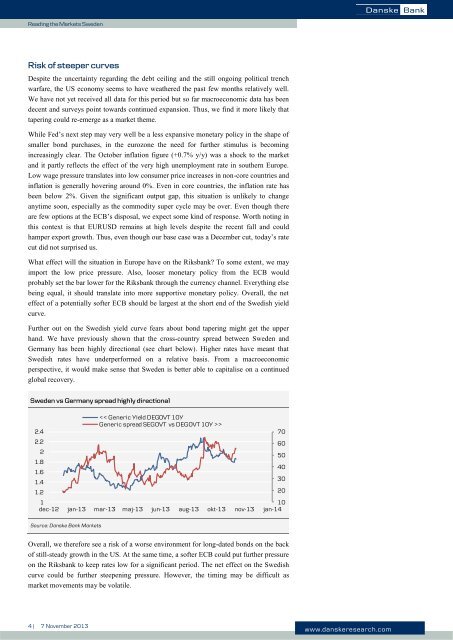

<strong>Reading</strong> <strong>the</strong> <strong>Markets</strong> <strong>Sweden</strong>Risk of steeper curvesDespite <strong>the</strong> uncertainty regarding <strong>the</strong> debt ceiling and <strong>the</strong> still ongoing political trenchwarfare, <strong>the</strong> US economy seems to have wea<strong>the</strong>red <strong>the</strong> past few months relatively well.We have not yet received all data for this period but so far macroeconomic data has beendecent and surveys point towards continued expansion. Thus, we find it more likely thattapering could re-emerge as a market <strong>the</strong>me.While Fed’s next step may very well be a less expansive monetary policy in <strong>the</strong> shape ofsmaller bond purchases, in <strong>the</strong> eurozone <strong>the</strong> need for fur<strong>the</strong>r stimulus is becomingincreasingly clear. The October inflation figure (+0.7% y/y) was a shock to <strong>the</strong> marketand it partly reflects <strong>the</strong> effect of <strong>the</strong> very high unemployment rate in sou<strong>the</strong>rn Europe.Low wage pressure translates into low consumer price increases in non-core countries andinflation is generally hovering around 0%. Even in core countries, <strong>the</strong> inflation rate hasbeen below 2%. Given <strong>the</strong> significant output gap, this situation is unlikely to changeanytime soon, especially as <strong>the</strong> commodity super cycle may be over. Even though <strong>the</strong>reare few options at <strong>the</strong> ECB’s disposal, we expect some kind of response. Worth noting inthis context is that EURUSD remains at high levels despite <strong>the</strong> recent fall and couldhamper export growth. Thus, even though our base case was a December cut, today’s ratecut did not surprised us.What effect will <strong>the</strong> situation in Europe have on <strong>the</strong> Riksbank? To some extent, we mayimport <strong>the</strong> low price pressure. Also, looser monetary policy from <strong>the</strong> ECB wouldprobably set <strong>the</strong> bar lower for <strong>the</strong> Riksbank through <strong>the</strong> currency channel. Everything elsebeing equal, it should translate into more supportive monetary policy. Overall, <strong>the</strong> neteffect of a potentially softer ECB should be largest at <strong>the</strong> short end of <strong>the</strong> Swedish yieldcurve.Fur<strong>the</strong>r out on <strong>the</strong> Swedish yield curve fears about bond tapering might get <strong>the</strong> upperhand. We have previously shown that <strong>the</strong> cross-country spread between <strong>Sweden</strong> andGermany has been highly directional (see chart below). Higher rates have meant thatSwedish rates have underperformed on a relative basis. From a macroeconomicperspective, it would make sense that <strong>Sweden</strong> is better able to capitalise on a continuedglobal recovery.<strong>Sweden</strong> vs Germany spread highly directional2.42.221.81.61.41.2>110dec-12 jan-13 mar-13 maj-13 jun-13 aug-13 okt-13 nov-13 jan-14706050403020Source: <strong>Danske</strong> <strong>Bank</strong> <strong>Markets</strong>Overall, we <strong>the</strong>refore see a risk of a worse environment for long-dated bonds on <strong>the</strong> backof still-steady growth in <strong>the</strong> US. At <strong>the</strong> same time, a softer ECB could put fur<strong>the</strong>r pressureon <strong>the</strong> Riksbank to keep rates low for a significant period. The net effect on <strong>the</strong> Swedishcurve could be fur<strong>the</strong>r steepening pressure. However, <strong>the</strong> timing may be difficult asmarket movements may be volatile.4 | 7 November 2013www.danskeresearch.com