Budapest Internetbank - Budapest Bank

Budapest Internetbank - Budapest Bank

Budapest Internetbank - Budapest Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

USER’S MANUALFOR THE ACCOUNT KEEPING SYSTEM OFBUDAPEST INTERNETBANK(Second edition for the expanded version)November 2005 (ver2.0b)

Table of contentsINTRODUCTION ................................................................................................................................................... 3HOW TO USE THE BOOK?..................................................................................................................................... 31. WHAT DOES THE INTERNETBANK OFFER TO YOU?.................................................................... 32. GUARANTEED SECURITY IN USING INTERNETBANK.................................................................. 43. HOW TO BECOME AN INTERNETBANK USER?........................................................................... 4THE CONDITIONS FOR CONCLUDING THE CONTRACT........................................................................................... 4OTHER INFORMATION RELATED TO CONTRACTING ............................................................................................. 5SELECTING THE METHOD OF ACCESS................................................................................................................... 5A GUIDE FOR THE POSSIBLE ACCOUNT CONNECTIONS ......................................................................................... 6ACTIVATING THE SERVICE .................................................................................................................................. 74. ACCESSING BUDAPEST INTERNETBANK..................................................................................... 8USING THE BUDAPEST INTERNETBANK ACCOUNT KEEPING SYSTEM FOR THE FIRST TIME .................................. 8THE FIRST LEVEL OF LOGGING IN ........................................................................................................................ 9THE SECOND LEVEL OF LOGGING IN .................................................................................................................... 9OTHER IMPORTANT INFORMATION.................................................................................................................... 125. WHAT OPPORTUNITIES DO YOU HAVE IN THE INTERNETBANK SYSTEM?................... 13ACCOUNT INFORMATION ................................................................................................................................... 141. Account overview ................................................................................................................................. 142. Account history .................................................................................................................................... 153. Account statements............................................................................................................................... 164. List of transactions............................................................................................................................... 17PAYMENT ORDERS ............................................................................................................................................ 191. HUF payment order ............................................................................................................................. 192. HUF carry over.................................................................................................................................... 223. Payment order in foreign exchange ..................................................................................................... 234. Batched (group) payment order ........................................................................................................... 275. Authorisations of operations ................................................................................................................ 28BANK CARD....................................................................................................................................................... 291. Card suspension................................................................................................................................... 292. Card authorisation............................................................................................................................... 293. Card activation .................................................................................................................................... 304. Daily limit query .................................................................................................................................. 305. Setting of ATM limit ............................................................................................................................. 316. Setting of purchase limit....................................................................................................................... 31MAILBOX.......................................................................................................................................................... 321. Inbox .................................................................................................................................................... 322. Sent mail............................................................................................................................................... 333. Writing new mail.................................................................................................................................. 33SETTINGS.......................................................................................................................................................... 341. Partners................................................................................................................................................ 342. Foreign exchange templates................................................................................................................. 363. Password change ................................................................................................................................. 374. Customisation....................................................................................................................................... 374. Customisation....................................................................................................................................... 385. Mobile tool ........................................................................................................................................... 416. Contact details ..................................................................................................................................... 42LOGGING OUT ................................................................................................................................................... 42ANNEXES .......................................................................................................................................................... 43<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual2<strong>Budapest</strong>, November 2005. (ver.2.0)

INTRODUCTIONThe electronic banking services offered by <strong>Budapest</strong> <strong>Bank</strong>, accessible through theInternet, allow for performing the banking operations required for taking care of day-todayfinances. You can use the following services with the system’s help, even fromhome:Account Keeping SystemInvestment servicesYou are reading the information you need to know about requesting and using <strong>Budapest</strong><strong>Internetbank</strong> Account Keeping System.HOW TO USE THE BOOK?The following symbols help to overview the book:☻suggestions for more efficient use benefitsuseful informationwhat you should pay attention towhat you should never do1. WHAT DOES THE INTERNETBANK OFFER TO YOU?<strong>Budapest</strong> <strong>Internetbank</strong> is a <strong>Budapest</strong> <strong>Bank</strong> service available through the Internet withthe help of which you can keep track of your accounts held at our <strong>Bank</strong> from anywhere(from your home, office or even from an Internet café). You can give transfer orders orperform various bank card operations in connection with the accounts.<strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System…- is comfortable, because wherever you are in the world, you can use ourservices 24 hours a day, 7 days a week, without standing in line no matter where youare in the world. This way, you can look at the information related to your account andperform various transactions as you like;- is simple to use, because services can be used easily, with the help of only aweb browser. No supplementary tool or installation is required;- is secure, because a security system of the highest standard guarantees that noother persons can abuse the opportunities offered by the service in any case.Furthermore, in addition to a secret PIN code, access to the accounts is secured by acode – to be used only once – that you get in a short text message and by e-mail<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual3<strong>Budapest</strong>, November 2005. (ver.2.0)

immediately on entry. The use of this independent communication channel offers extrasecurity that is unique in the market, but as an alternative, you may wish to usetraditional PIN code identification;- is economical, because, in addition to saving you time, the fee for bankingoperations performed through the Internet is considerably more favourable than ofpaper-based instruction submitted at bank branches.2. GUARANTEED SECURITY IN USING INTERNETBANKIn order to protect you data, our <strong>Bank</strong> secures dataflow using the SSL protocol. SSLstands for Secure Socket Layer, which is an accepted encryption procedure.Nowadays, this is the safest and most broadly used security system in electronic tradingand in data protection. The SSL used by our <strong>Bank</strong> supports 128-bit encryption, which isthe strongest today. SSL encrypts your data before transmitting them, so they reach our<strong>Bank</strong> in a coded form and that cannot be interpreted by unauthorised persons.Full-fledged security is created by a so-called “armour connection” already when youaccess the <strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System homepage through theInternet. This point-to-point connection makes it impossible e.g. for unauthorisedpersons to abuse the situation even if they happened to get hold of one of your secretcodes. As there are two levels of identification and second-level password is alwaysunique, and may be used only and exclusively for the “armour connection” created onthe given access to the system, unauthorised persons are not able to abuse theopportunities offered to you by <strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System.3. HOW TO BECOME AN INTERNETBANK USER?<strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System is offered to both retail and smallercorporate customers.All you have do is to request the Account Keeping System by visiting any <strong>Budapest</strong> <strong>Bank</strong>branch and conclude a simple contract for <strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping.Corporate clients should sign the contract only at the account keeping branch.THE CONDITIONS FOR CONCLUDING THE CONTRACTThe contract for <strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System can be concluded bycustomers already have at least one of the following account types:• Retail HUF current account• Retail FX current account• Família deposit account• Investment card account• Corporate HUF current account• Corporate FX current account• Lawyer’s escrow account<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual4<strong>Budapest</strong>, November 2005. (ver.2.0)

The account holder is entitled to conclude the contract for <strong>Budapest</strong> <strong>Internetbank</strong>Account Keeping System, whether he requests access to the service for himself or forany other users. In case of corporate current accounts, this can be done by theperson(s) authorised to sign on behalf of the company. Both the Account Owner and theUser must be present in person when concluding the contract.OTHER INFORMATION RELATED TO CONTRACTINGThe account number(s) that you wish to use in the framework of the service must beindicated in the contract form.At the time of concluding the contract, you have to specify a user name, for which wegenerate a random three-digit number to ensure complete uniqueness, this is how youridentifier for the <strong>Internetbank</strong> Account Keeping System will be created (e.g.kovacsi489).You get the so-called e-PIN card containing the secret codes required for access, the firstpassword for the first logging in and the so-called e-PIN code will be given to you onconcluding the contract. Our <strong>Bank</strong> has been using e-PIN cards instead of the earlier PINcode envelop since the spring of 2003. The e-PIN code currently used corresponds to theNetPIN code used earlier, so that the two may be considered to be synonyms. It is very important that you handle these codes with great care andconfidentially.SELECTING THE METHOD OF ACCESSWhen requesting the services, you have a choice of two ways of access:I. If you select identification by the e-PIN (or NetPIN) code, you will have to enter threecharacters of the 6-digit number on the e-PIN card requested in a random order.☻ Its advantage is that, in addition to the password, this is the only code you have toremember, and it never changes. Furthermore, the e-PIN is necessary also if you call<strong>Budapest</strong> Telebank with a question related to the Account Keeping System.II. If you use identification with the SMS/E-MAIL PIN code, which is for a single use,you always get the code to be used only for that particular access in SMS and/or by e-mail on each access, after specifying your identifier and password.☻ Its advantage is that the password for a single use, transmitted through anindependent communication channel, provides extra security and that there is no needfor you to remember a code for access other than your password, as you get a newpassword each time you access the service, in the form most comfortable for you.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual5<strong>Budapest</strong>, November 2005. (ver.2.0)

A GUIDE FOR THE POSSIBLE ACCOUNT CONNECTIONSIn the case of accounts held at <strong>Budapest</strong> <strong>Bank</strong>, the owner of the given account mayspecify other persons entitled to dispose over the account or to access the account.If the Account Owner wishes to enable other User(s) to access the given accountsthrough the <strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System, he may select one of thefollowing opportunities to set the authorisations. It is important to know that in the case of the <strong>Budapest</strong> <strong>Internetbank</strong> AccountKeeping System, those persons may be entitled to access the given bank account whowere specified by the Account Owner as a persons entitled to dispose over the bankaccount, in the manner required by the <strong>Bank</strong>, according to the relevant provisions of thebank account contract.Naturally, the Account Owner is the single person entitled to give instructions concerningthe given account, e.g. for giving transfer instructions, which he confirms by hissignature.Users who are not Account Owners may have the following authorisations:“E” – Single person authorised to give transfer instructions Users with an “E” authorisation may give transfer orders without the approval ofany other person. Account Owners (marked with “O”) all have E authorisations.“A” – Persons entitled to give transfer instructions with another (“E”, “A”, “B”)person Users with “A” authorisation may give transfer orders but another person mustapprove this instruction to give it effect. In this case, the approval may be given byperson who has “E”, “A” or “B” authorisations for the given account.“B” – Persons entitled to give transfer instructions with another (“E”, “A”)person Users with “B” authorisations differ from persons with “A” authorisations in thattheir transfer instructions may not be approved by persons with a similar, “B”authorisation.“T” – Authorised only to enter data Users with a “T” authorisation may only record the data of the transfer instructionbut the transfer may be approved only by the Account Owner.“N” – Authorised only for queries Users with a “N” authorisation may not dispose over the account and may lookonly at the data and turnover on the account.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual6<strong>Budapest</strong>, November 2005. (ver.2.0)

ACTIVATING THE SERVICEYour data are processed within three banking days after you conclude the contract for<strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System, and you are notified about this in ashort text message and/or by e-mail. The message will be sent to the e-mail address ormobile phone number you specified at the time of concluding the contract. If themessage is not received on time, please contact our Telebank or notify the officers at the<strong>Bank</strong> branch to clarify your data.For security reasons, you must activate the <strong>Budapest</strong> <strong>Internetbank</strong> Account KeepingSystem before starting to use it, and you can do so immediately after receiving thenotification. If you fail to activate the service, you will get an error message on access.Activation may be done by either of the following two ways:By SMSPlease send the command “NBA” in a short text message to the <strong>Budapest</strong> Mobilbanknumber 06/30-92-66-245. (Send only these three letters, which stand for Net<strong>Bank</strong>Activation.) You will receive a confirmation message about activating the <strong>Budapest</strong><strong>Internetbank</strong> Account Keeping. You can use the service immediately after this.With the help of Telebank, by phonePlease call <strong>Budapest</strong> Telebank at the “blue number” 06/40-477-777, for local rates,where we will be happy to help you round the clock. (If calling from abroad: +36-1-477-7777) You have to specify your Username*, personal details and the 3 digits of theNetPIN* code requested by the telephone administrator, after which we will activate the<strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System for you so that it is ready to be use.* The <strong>Bank</strong> gives you the final username on concluding the contract, and the e-PIN code can befound on the e-PIN card you received at the time of concluding the contract.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual7<strong>Budapest</strong>, November 2005. (ver.2.0)

THE FIRST LEVEL OF LOGGING INOn logging in, first you have to enter your identifier and password for the <strong>Budapest</strong><strong>Internetbank</strong> Account Keeping System. Proceed by pressing the LOG-IN button.THE SECOND LEVEL OF LOGGING INAt the time of concluding the contract you had the opportunity to select the method ofsecond-level identification: identification by an SMS/E-Mail PIN code to be used only one(A) or using a constant e-PIN code (B). Naturally, you can change you initial choice lateron, as explained in Chapter 5, Miscellaneous / Settings. A. SMS/E-Mail PIN: This is a password for a single use, which you get in a textmessage or e-mail after first-level identification. This password changes every time youaccess the service, and may be used only for the “armour connection” that was createdfor the given access. The so-called connection identifier seen both on the screen forsecond-level long-in and the message serves to identify the given connection and therelated code, which allows for verifying whether the given secret code is appropriate forthe given screen.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual9<strong>Budapest</strong>, November 2005. (ver.2.0)

B. e-PIN: a 6-digit number on the e-PIN card received in the bank branch at thetime of concluding the contract, out of which the system requests 3 random characters.If you opted for this form of identification, you have to enter the random requestedcharacters out of the secret code every time you access the service. If identification by text message/E-MAIL PIN code was selected: Enter thecode you received immediately after first-level entry in SMS or e-mail, which may beused only for this particular access:For instance:The short text message received after first-level log-in shall be as follows:“Your code: ab12CD34 Connection code*: 123456. This code may be used for logging in until14:19:56 but keep it for the transactions. BB”And/or the e-mail received:Dear customer.Your code: ab12CD34Connection code*: 123456The connection code is to be used when you want to log in from more than one locations. In this casethis code identifies the point of entry and the related code.This code may be used for logging in until 14:19:56 but keep it for the transactions.If it was not you who attempted to enter our system, please contact our Telebank.<strong>Budapest</strong> <strong>Bank</strong> Customer service* The so-called “connection code” created to match the given connection and the related codeserves only control purposes, and is included in both the screen for second-level log-in and themessage, so that you can make sure whether the given secret code is correct for the given screen.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual10<strong>Budapest</strong>, November 2005. (ver.2.0)

You can read the following on the second-level access page for <strong>Budapest</strong> <strong>Internetbank</strong>Account Keeping System:You can check herewhether the messagesreceived are reallyrelated to this <strong>Internetbank</strong> connection.Enter the code receivedin SMS or e-mail here.(e.g. AB12cd34) f you selected identification by the e-PIN:The requested characters of the e-PIN must be entered in the appropriate order. You canread the following on the second-level access page for <strong>Budapest</strong> <strong>Internetbank</strong> AccountKeeping System:Enter the appropriatecharacters of the e-PINcode here.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual11<strong>Budapest</strong>, November 2005. (ver.2.0)

OTHER IMPORTANT INFORMATION If you enter the wrong password you will see the following window and you willhave to retry. The system suspends the possibility of logging in with the given username after 5 failed attempts. In this case – or if you forgot your password – please callTelebank at 06/40-477-777 and get your NetPIN code, or request a new password forthe <strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System in the branch. Please safeguard your e-PIN code because Telebank will identify you and provideany information to you based on it. Time lock: Further security for using the <strong>Budapest</strong> <strong>Internetbank</strong> Account KeepingSystem is provided by the fact that if you remain in the same webpage but start to makeno actions, the system will temporarily suspend use after 15 minutes. 2 minutes beforeyou will receive a warning message. If you wish to return to use, you have to enter thecode used for second-level identification in the appropriate cell for confirmation. Oncethis code is entered, you may continue to use the Account Keeping System. If you needmore than 15 minutes to record your instructions (e.g. due to incoming telephone callsor answering your mail) you may extend the time lock simply by clicking on the countdown clock. If you do not extend your time and time lock logs off you, all yourpreviously typed information will be lost. It is very important that you should never leave your computer unattended whileusing the Account Keeping System, to avoid anybody else looking into your finances.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual12<strong>Budapest</strong>, November 2005. (ver.2.0)

ACCOUNT INFORMATION1. Account overviewThe first menu point on entering the system 1 is the Account overview. This is where youcan look at the names, identifiers and current balances of your accounts included in the<strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System. Status will show you whether therehave been any changes concerning the given account since last viewed. The lines containing data on the last log-in provide very important information tohelp you learn about any attempts at abuse.You can check the place and timeof your last entry.To ensure confidentiality, the balance will be displayedonly if you move the pointer over the icon next to thebalance column.If you click on the icon, the amount will not disappearafter moving the pointer.Status shows whetherthere has been any changeon the given account sinceyour last log-in.You will get an alert message if there is new mail inyour <strong>Internetbank</strong> mailbox.1 Except for the first entry into the system, when the first window after entry will be the mandatory passwordchange. Detailed information on this can be found in Chapter 5 “Settings” “3 Change password”.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual14<strong>Budapest</strong>, November 2005. (ver.2.0)

2. Account historyIn this menu point you can look at transactions on the selected account.The given account may be selected based on the account name. After selection, theaccount identifier and the 24-diigt GIRO account number will also be displayed, whichallows to verify whether the proper account was selected. The query list can benarrowed or expanded by entering the desired date and clicking on the “Query” button.The account history contains transactions only for the last 45 days. Movements of theaccount before that can be looked at under the account statement menu point. The account name is the name you specified on concluding the contract for the<strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System.For information, you can also look at data on the commission reserved and interest onthe given account."The balance shown below the account history shows the real balance on the account.Transactions in the account history only serve information purposes and do not containcertain items booked as interest, commission and credit repayment.You can select the account to be queried based onthe account name.You can set the desired period and start filteringby clicking on the „Query” button. By default, thelast 45 days appear.Clicking on the appropriate arrow allowsyou to display items in an ascending ordescending order by date or by amount.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual15<strong>Budapest</strong>, November 2005. (ver.2.0)

3. Account statementsThis menu point serves to look at the statements for the selected account.Similarly to the previous function, the account may be selected based on account namehere as well. After selecting the account, the account identifier and the 24-digit GIROaccount number are also displayed, which allow for verifying whether the correct accounthas been selected. The query list can be narrowed or expanded by entering the desireddate and clicking on the “Query” button. The list contains the date of preparing thestatement and the statement number, and uses small icons to indicate the types ofqueries you can choose from. For information, it also shows the closing balance of thegiven statement.Select the statement for the account you would like to see by clicking on the correctstatement number. Using the four different little icons, you can select the form ofstatement that is most convenient for you. Clicking on the “e” icon in the box allowed for producing an e-statement andstoring it on your computer. Save the .pdf file on your computer if you want to look at itlater on while offline.Simplified, single-columnstatement:Credits and debits can be seenin a single column, inchronological order.Traditional, two-column statement:Credits and debits are shown in separatecolumns, in chronological order, summed upat the bottom of the page.DOWNLOADABLE e-statement (pdf):The electronic equivalent of theofficial paper- based statement, inpdf format. It is completely identicalto its paper-based counterpart interms of both form and contents.Summary of debits and credits:First debits, then credits are listed and addedup separately.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual16<strong>Budapest</strong>, November 2005. (ver.2.0)

4. List of transactionsThis is where you can look at the list of transactions in progress, transactionssuccessfully completed or failed. By default, it shows transaction details retrospectivelyfor one month; they can be successful, failed, in progress, reversed (i.e.cancelled), or recorded in advance (i.e. waiting for approval). You can narrow orexpand the query for the list of transactions based on these status types.In addition to statuses, there is a possibility for more detailed filtering by pressing the“Detailed query” button. This allows for extending queries with the following possibilities:• Specify period (even for antedated items)• By partner• By partner group• By source of registration (traditional web or group /file/ recording.)• By sender (the transaction was sent by me or by anther party)Select the account for which you wish to seetransactions.Select the criteria fornarrowing orextending the query.Clicking on “Detailedquery” displaysadditional screeningconditions.Select the period for which you wish tosee transactions.The buttons indicated offeradditional possibilities for refiningyour query, so you can set theparties launching the transactionsand the parties for whom thetransaction is launched.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual17<strong>Budapest</strong>, November 2005. (ver.2.0)

Once the parameters are set, you can query the desired list using the “Query” button,and look at the details of transactions in the list.You can start additional functions using the “action” buttons for each transaction item:• Transfer: You can launch items entered into the system earlier• Recall: You can recall items not yet executed (set for value dates, pre-recorded)• Repeat transfer: You can complete a transaction form with data completelyidentical to a transaction proposed earlier, which you can then even modify asrequired.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual18<strong>Budapest</strong>, November 2005. (ver.2.0)

PAYMENT ORDERS1. HUF payment orderUsing the <strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System allows you to give paymentorders without having to fill a paper form and drop it off in the bank branch.The format of electronic payment order corresponds to completing the paper-basedpayment order found at branches. The bank processes payment orders received within the deadline specified in theAnnouncement and the General Terms and Conditions on the given banking day, andthose received after the deadline on the next banking day, unless you specify a differentvalue date.Select the accountnumber here.You can retrieve thebeneficiary’s detailsfrom the partner file.The certificateidentification code maybe used to distinguishbetween similarpayment orders, e.g.you can specify thecontract number thatserves as the basis ofsettlement.You can retrieve theannouncement from thedatabase storedautomatically earlier.You can decide whetheryou start the transfer(for the same day or fora specific value date) oryou only pre-record it.Account data asreminder.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual19<strong>Budapest</strong>, November 2005. (ver.2.0)

☻ When specifying the Remitters account, you can select the account registered for<strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System you wish to launch the given paymentfrom out of a dropdown list. The additional data of the account to be debited areautomatically displayed. The remitter’s accounts include Família Deposit account as well,from which you cannot make a transfer, only carry over. If you try to make a transferfrom this account, we will reject performance of your transaction in the reply letter.☻ You can enter the number of the Beneficiary account manually or you can retrievethe data from the existing partner file. Clicking on the icon next to the account numberbrings up the window below, containing the list of partners.If you click on the given partner, the system inserts the account number and fills thefields of the payment order with the additional partner data.For the Value date, you can enter any date (the current date or any day in the future).If the day specified is a non-working day, the system will make the payment on the nextbanking day.☻ On entering the Announcement, you can enter the desired text (in max 32characters per line) or you have the option to select the text of an announcementwritten for the given partner earlier by clicking on it. By default, the system collects onlyannouncements linked to the given partner. If you wish to choose out of all theannouncements written earlier and not just those related to the given partner, click onthe “Detailed list” button.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual20<strong>Budapest</strong>, November 2005. (ver.2.0)

The complete filled out document will appear again for verification. The system asks forsecond-level identification as confirmation (certain characters of the your NetPIN or e-PIN code or the one-off e-mail/sms code). After entering the code, press the “approve”button. The system sends a confirmation of recording the transaction into your mailbox.The payment order status can be seen in the list of account information/transactions.In this example, the system uses identification with the constant e-PIN code, although youcould choose to use the SMS/E-MAIL PIN code.When entering the code, please watch out for the correct use and order of characters inlower and upper case!<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual21<strong>Budapest</strong>, November 2005. (ver.2.0)

2. HUF carry overYou can give HUF carry over orders between your accounts held at <strong>Budapest</strong> <strong>Bank</strong> andregistered for the <strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System. To start a HUF carryover order, select the remitter’s account and the beneficiary’s account out of thecorresponding drop-down lists. Otherwise, everything is the same as for payment ordersSelect theremittingaccount here...…andbeneficiaryaccount here.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual22<strong>Budapest</strong>, November 2005. (ver.2.0)

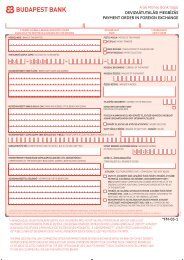

3. Payment order in foreign exchangeIn this field you can fill in a payment order to the debit of your account kept in HUF or inother currency to credit of account of your partners kept• abroad• domestic (at other bank)• at <strong>Budapest</strong> <strong>Bank</strong> Ltd. Payment orders in foreign exchange (especially in case of internationalmoney transfer) contain much more data than domestic (HUF) payment orders.It is recommended that you check all important data with your partner (IBANaccount number of your partner, details of his account holder bank, etc.) beforesending in the payment order. During filling in payment orders in foreignexchange (basically in all case) help is available for you, reading of help textsmay make your work easier! The <strong>Bank</strong> will process the incoming payment orders received before cut off time(which is determined in the Notice and in General Contractual Conditions) on the givenbanking workday, the ones received after cut off time will be processed on the nextbanking workday. In case of payment orders in foreign exchange there is no possibilityto indicate value date of payment.Completing a payment order in foreign exchange (or templateIn this case select Payment. If you are an inexperienced user, it is worth using (reading)help. Click the button “?”. Correctness of details of payment orders in foreign exchange is mostimportant. Correctness of some details (mostly in connection with beneficiary)can not be checked even by our bank completely, so we can process your orderaccording to your instructions only. Inaccuracy has extra expenses occurred byinvolved banks as a consequence in most cases, which we are obliged to debitto account of our clients, but it can prevent even processing of payment order.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual23<strong>Budapest</strong>, November 2005. (ver.2.0)

Which data do we have to pay attention to especially?Country code of BeneficiaryCountry code of beneficiary is available for you as per information of your partner. Thiscountry code results from legal status (resident) of your partner, so it accords with thecountry where premises of beneficiary take place only in case beneficiary is residentthere. Usually this is the typical case.Country code is a two digit code according to ISO standard (for example Germany: DE,Austria: AT), you can select it from the Combo Box. Please click button next to datafield.Specifying the correct country code of beneficiary will become important later when youwill select legal title of payment because country code of remitter (you) and thebeneficiary (your partner) together will determinate set of legal titles which can beselected.Account number of beneficiaryIt is recommended to use IBAN format account numbers within member-states ofEuropean Union. Therefore please ask your partner to submit their correct, IBAN formataccount number. When using non IBAN format account number the systems which processinternational payments can not process the payment order automatically (format of theaccount number does not meet their requirements), they may charge additional charges(NonSTP).We are obliged to debit your account with such extra expenses.You can find more detailed information about IBAN format account numbers at ourhomepage (www.budapestbank.hu) at Corporate services/FX számlavezetés/Informationon using international account numbers (IBAN).The data input interface that is available for you in case you selected IBAN format willcheck if the account number that you keyed in is formally correct (if it corresponds withthe standard of the given country).What to do in case you received an IBAN format but incorrect account number from yourpartner?• Inform your partner (ask for correction), if sending in of the payment order canwait• or select Non IBAN format on the screen, in this case the check function will beswitched off (but it can involve the risk of additional charges as mentionedbefore).Name and address of BeneficiaryThese are important data because of the following:• Regulation of law of certain countries with regard to prevention of moneylaundering demand them.• In case account number of beneficiary is not correct (e.g. your partner gavewrong information to you) in many cases your partner’s bank can make paymentaccording to these data only.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual24<strong>Budapest</strong>, November 2005. (ver.2.0)

• The indicated account number should belong to the beneficiary given (the nameand the account number should be identical with each other).Identifier code of beneficiary’s bankUsually BIC (<strong>Bank</strong> Identifier Code) applied by SWIFT system is used as identifier code,which works basically like a postal code of the head office or certain branch of a bank ina certain country. Send your questions to our bank (Mailbox, New mail) and we shall help you.Beneficiary’s bank (name, address)These are important data, too, especially if the above mentioned bank identifier code isnot correct. The correct name/address data can help to specify the correct identifiercode.Correspondent of beneficiary’s bank (name, identifier code, address)In case data (name, identifier code, address) of the bank that keeps an account in thecurrency of the payment order for the beneficiary’s bank are available for you, pleaseindicate them (name, identifier code, address) and we shall make payment according tothese particulars. If this field remains empty, we shall use payment route known by<strong>Budapest</strong> <strong>Bank</strong>.Currency and amount of payment order Amount of payment order to be understood in currency of payment order.Usually payment orders indicate these two data, so if you remit EUR 1200 from yourHUF account, currency of payment order will be EUR, while the amount will be 1200.Currency of executionThere is reason for indicating this fact only if it differs from the (default) currency of thepayment order. For such a case, here is an example that shows the point:• Currency of payment order: HUF• Amount of payment order: 12.000• Currency of execution: EURThe payment will be made for EUR equivalent of HUF 12.000 counted at current rate.Individual exchange rateAn agreement of a special exchange rate can be concluded in cases described inConditions of <strong>Budapest</strong> <strong>Bank</strong>. Please transfer your payment order to the bank only if theagreement of a special rate has already been concluded (but then at once, indicatingaccepted special exchange rate).<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual25<strong>Budapest</strong>, November 2005. (ver.2.0)

Urgent executionYou can ask for urgent execution on payment of charges described in Terms andConditions of <strong>Budapest</strong> <strong>Bank</strong>. In this case we shall execute payment with value date T+1banking workday instead of usual T+2 banking workday. T means the day of executionof payment order, which is• the same day in case the payment order was received until cut off time• the next banking workday in case the payment order was received after cut offtime.Request of a SWIFT copy to be sent to a fax numberIf your partner asks you to confirm with a document that the payment had been made,you can request our bank to send the copy of our authenticated SWIFT advice ofexecution to a fax number.This service can be requested on payment of the fee indicated in List of Terms andConditions. The given fax number may belong to you only, our bank can not afford tosend fax to your partner, abroad.Correctness of the given (domestic) fax number will not be checked by our bank. Ourbank assumes no responsibility for data sent to not competent (third) party due to anyincorrect fax number.Title of paymentAs per relevant rules of the National <strong>Bank</strong> of Hungary you are obliged to specify aparticular title of the payment in foreign exchange.Our Internet system lends you a helping hand to select applicable title of payment,please read Help texts.Commissions and banking chargesUsually business partners agree who and to what degree has to bear commissions andcharges of the transaction. In practice of our clients the shared defrayal is typical.It is an important fact, please read Help texts, too.Completing Import Collection The import collection has always banking preliminaries, upon receipt ofdocuments we advise our client of collection in writing (Advice of Import Collection).In case of import collection the reference number is highly important data.Reference number of Import CollectionYou can find reference number in advice of Import Collection on the right-hand sideabove. The beginning of the reference number is always the same (501CI), so you haveto key in the five-digit numerical characters next to 501CI only.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual26<strong>Budapest</strong>, November 2005. (ver.2.0)

4. Batched (group) payment orderThis menu point allows you to load several payment orders at the same time from a filecreated in advance according to an appropriate format. Detailed information on fileformat is included in “Annex No. 1: Import file format”. This way, you can create abatched payment order package containing maximum 400 records out your accountingsystem, which you can upload to our system at the same time.Once you prepared the file in the given format, all you have to do is find the file byclicking on the “browse” button, then by clicking on the “import” button the system willread in the data contained in the file. The system will indicate which payment order dataare valid or invalid (if, for instance you specified an account number from which youcannot make a payment order), and will indicate the number of items to be read and atwhat amount.Finally, you have to enter the requested characters of your second-level entry code toapprove the items, then click on “approve” button.ATTENTION: After reading in, items will go to the items to be approved, where you haveto approve them in batch (further information can be found in the next section entitledAuthorisation of operations).<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual27<strong>Budapest</strong>, November 2005. (ver.2.0)

5. Authorisations of operationsThis menu point allows you to see and authorise the payment or carry over ordersentered by a user, who is entitled to start transfers only together with another person.(For further details, see the section: A guide for the possible account connections.)This menu point also allows you to authorise payment or carry over orders that you onlypre-recorded and for which you did not specify a value date or prompt processing.Batched payment orders are also approved here.Naturally, you can reject as well as approve a given payment order.You can set filtering conditions such as time interval for displaying the items.To authorise the given operations, enter the required characters of your second-levelentry code, then click “Approve”.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual28<strong>Budapest</strong>, November 2005. (ver.2.0)

BANK CARDIf you have a bank card that belongs to a private individual in connection with anaccount registered for the service, this is where you can suspend the bank card orrelease its suspension, activate the card and query or modify various limits for bank carduse. A message will be sent to the mailbox in the <strong>Internetbank</strong> AccountKeeping System about the success of each operation.Selecting each menu point allows you to use the following services:1. Card suspensionCard suspension:You can use this function tosuspend use of the selectedbank card. It is very important that bank card suspension is not the same asblocking the card! The <strong>Bank</strong> assumes liability only for blocks proposed throughTelebank or in a bank branch. Another difference is that bank card blockscannot be withdrawn while suspension can. Cancellation of suspensioncorresponds to authorising the card.2. Card authorisationCard authorisation:You can lift the suspension ona selected bank card.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual29<strong>Budapest</strong>, November 2005. (ver.2.0)

3. Card activationCard activation:This is where you can activate your renewed card received after your bank card hasexpired (or was lost).4. Daily limit queryDaily limit query:You have the possibility to query the daily limit linked to your bank card, so that youget a notification about the amount still free for use in your mailbox.(For instance, if the daily limit was set at HUF 50,000 and you have used up HUF10,000 out of that on the given day, you still have HUF 40,000 available out of thedaily limit, provided that the required funds are available on your account).<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual30<strong>Budapest</strong>, November 2005. (ver.2.0)

5. Setting of ATM limitATM limit modification:You can modify the limit settings of your bank card for collecting cash (from ATM),by entering the new limit amount and then clicking ”Execute”.6. Setting of purchase limitPurchase limit modification:You can modify the limit settings of your bank card for purchases (POS), byentering the new limit amount and then clicking ”Execute”.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual31<strong>Budapest</strong>, November 2005. (ver.2.0)

MAILBOXIn the framework of the <strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System, you have ahigh-security mailbox available to you in which you can read feedback on the varioustransaction orders given in <strong>Internetbank</strong> and you also have an opportunity tocommunicate with our <strong>Bank</strong>.1. InboxThe first menu point is the inbox, where you can look at mails received in the<strong>Internetbank</strong> mailbox. You can see the exact date of receiving the incoming message, itssubject and status (new or read).You can tick off the messages to be deleted in the checkboxes at the beginning of eachline, so you can delete older mail one by one or in groups to maintain your mailbox.The following figure shows a sample message received. After reading the message youcan answer the <strong>Bank</strong>’s Customer Service by a single click.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual32<strong>Budapest</strong>, November 2005. (ver.2.0)

2. Sent mailThis is where you can look at the list of mail sent by you, in a manner similar to theinbox. The difference is due to the status types (waiting to be sent orsent).3. Writing new mailAs already mentioned, you have the possibility to communicate with the <strong>Bank</strong> directly.You can address mail to our Customer Service containing questions, complaints orcomments, and we will reply shortly.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual33<strong>Budapest</strong>, November 2005. (ver.2.0)

SETTINGS1. PartnersThis menu point lets you create a list about your partners’ data to specify paymentorders in an even simpler and faster way. The list is sorted by your partner’s nickname.Above 50 partner’s an abc menu bar will appear which helps you referring to the chosenpartner.Partners already recordedcan be sorted in manyways using the filterbuttons.Click on thisbutton to enternew partners!If no group is specified,the partner enters intothe ”General" list.In the list, you find five so-called action buttons below each partner, offering you thefollowing possibilities:Clicking on the Details button, we let you see all data on the partner in the list. Clickingthe button again returns you to the basic list details.Clicking on the Modify button lets you change any entries that have been changedconcerning the given partner.Delete allows you to delete the partners included in the list.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual34<strong>Budapest</strong>, November 2005. (ver.2.0)

Clicking on the TR list lets you collect all the transactions launched for that givenpartner.Clicking on the Transfer icon displays a payment order form complete with the detailsof the relevant partner in the right places and all you have to do is enter anannouncement and start transfer. For further details, see the section on payment orders.If you wish to enter data for a new partner in the list, clicking on the “New partner”button lets you specify the following data:☻ When specifying the partner group, you can either select one of the groupsalready specified or, by clicking on the small keyboard icon next to the field, you canswitch to data entry mode and enter a new partner group. The legal title field indicates the financial type of transaction, which must be specifiedfor each transaction according to the instructions of the National <strong>Bank</strong> of Hungary. Bydefault, select “000”. You will need a different legal title code if you are not performing adomestic transaction or either of the parties (remitter or beneficiary) is a non-resident forforeign exchange purposes.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual35<strong>Budapest</strong>, November 2005. (ver.2.0)

If you log in as a corporate user than you will have an individual partner’s list and acorporate partner’s list. The individual list belongs to only one user, meanwhile the corporatepartner’s list is shared among all user’s belonging to the company’s accounts.2. Foreign exchange templatesIn connection with foreign exchange payment orders canquite easily happen that you have to remit money to thesame partner with partly or completely same data. In thiscase we recommend to use Foreign exchange templates.A template is basically a payment order in foreign exchange,you can fill in all data that are needed.Why to use Templates?• The template can be loaded easily into the actual payment order in foreignexchange, you have to select it only.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual36<strong>Budapest</strong>, November 2005. (ver.2.0)

• You can key in all details that have already been checked (validated) with yourpartner even if not all are available for you (it can be completed later).• It is not necessary to fill in each field of the template, especially if there werevariable data (e.g. amount, currency, information for the beneficiary) in it.• The template may be amended (corrected) at any time, especially if the <strong>Bank</strong> hadadvised you of the correct data at your request or you revised it according to theDebit advice sent to you with reference to payment made.After loading of the template details of the actual payment order in foreign exchange(every one of them) may be overwritten respectively completed (typicallybecause of variable data) When completing the template (or an actual payment order in foreign exchange)our <strong>Bank</strong> is at your disposal with pleasure, in case you have particular questions (detailsof beneficiary’s account holding bank, SWIFT BIC codes, correspondents of beneficiary’sbank, IBAN account numbers, etc.). You can use <strong>Budapest</strong> <strong>Internetbank</strong> Mailbox Service,where you can ask for our help in writing and we will answer to your questions inwriting.Therefore, previous checking of details (especially if they are used in a template) canprovide correctness of foreign exchange payments’ process in the future, may decreaseamount of connected charges and increase Your and your partner’s satisfaction.3. Password changeThis where you can change the password to be used on first-level identification whenentering the <strong>Budapest</strong> <strong>Internetbank</strong> Account Keeping System.It is mandatory to change this password when you first enter the system, this is themenu point that will automatically appear. You will have the change the password atleast every 90 days again and again, the system will automatically alert you to do that.To increase security, it is possible to set a password validity of 60 or 30 days instead of90 days in the Miscellaneous / Settings menu point. Format requirements of passwords: at least 8 characters long, containing at least2 letters in lower case, 2 in upper case and 2 numbers.You have toenter the newpassword twicefor confirmation.Use this button to savethe new password youentered. When the nextenter the system, thiswill be the password tobe used.4.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual37If you do not want tochange yourpassword after all,click on this button.<strong>Budapest</strong>, November 2005. (ver.2.0)

CustomisationYou can modify a number of personal details provided at the time of concluding thecontract in this menu point.• You can modify your e-mail address, or specify more than one e-mail addressesseparated by semi-colons. (In the future, you will receive the password to beused only once required for entry to these e-mail addresses if you selected thatform of entry.)• You can modify your mobile phone number. (In the future, you will receive thepassword to be used only once required for entry to these mobile phone numbersif you selected that form of entry.) If you opted for entry using your NetPIN (or,by its new name, e-PIN), we will send you a short text message to the phonenumber specified here about entry attempts.Maintenance of contact possibilities is shown in the following figure:You can make additional settings for password management:• You can set the frequency of changing passwords (to 30/60/90 days)• You can change the method for second-level entry (e-PIN or SMS/e-mailpassword to be used only once)• You can change the channel for sending the password to be used only once(SMS/e-mail):- Only SMS- Only e-mail- SMS and e-mail<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual38<strong>Budapest</strong>, November 2005. (ver.2.0)

Furthermore, you can set the default language and account number to be debited whenusing the <strong>Budapest</strong> <strong>Internetbank</strong> services:You can indicate here, which of your accounts should bethe default account when creating payment orders.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual39<strong>Budapest</strong>, November 2005. (ver.2.0)

In addition to password management, you can authorise downloading certain of youraccount data to your palmtop in the Customisation menu point.In order to do so, enter the name of your Mobile tool (palmtop) and tick the button“Service package switched on”, then click on “Approve” to store settings.Additional information can be found in the next chapter entitled Mobile tool.Synchronisation of <strong>Internetbank</strong> and your palmtop can be found in a separate usermanual, in the manual for palmtop use in detail.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual40<strong>Budapest</strong>, November 2005. (ver.2.0)

5. Mobile toolIf you authorised downloading of your account data in the Settings / Customise menupoint into your palmtop, you can set the account data to be downloaded in this menupoint:- Account history- Statements- List of transactionsYou can also specify the period for which statements should be downloaded.To use this function, you can download the “bbsync.exe” programme you need to installto synchronise data from the <strong>Internetbank</strong> mobile tool menu point. A detailed descriptioncan be found in the document entitled Manual for palmtop use.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual41<strong>Budapest</strong>, November 2005. (ver.2.0)

6. Contact detailsPlease do not hesitate to contact us!LOGGING OUTYou can exit the <strong>Internetbank</strong> by clicking on the last (logout) menu point. You still havea possibility to go back to the service, to open BB’s Internet website or to close thewindow.<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual42<strong>Budapest</strong>, November 2005. (ver.2.0)

ANNEXESAnnex No. 1: Import file formatImport file name:Any file with a “.txt” extension, e.g.: transfer.txtFormat: Text format, ISO 8859-2 (Latin 2, Central European) character set, at eachrow-end trolley back with characters (0D/chr(13)) + line feed (0A/chr(10)). At the endof the file mark the file end: (1A/chr(26))Record structure:No. Position Length Type Description Example1 001 – 020 20 AN Number of certificate AZ2003052 021 – 023 3 NTransaction code:410- 410: Transfer, carryover3 024 – 047 24 ANAccount number of the customer to 101020861234567812345678be debited4 048 – 079 32 ANName and premises of the Sender, H-1111 Bp, Small Str 10customer to be debited5 080 – 083 4 NTo be completed with spaces „ „or”4515”6 084 – 107 24 ANAccount number of the customer to 101020861111111111111111be recognised7 108 – 139 32 ANName and premises of the Receiver, H-1101 Bp, Oak Str 7customer to be recognised8 140 – 147 8 N Value date (due date) 200605259 148 – 162 15 N Amount to be transferred 195012.0010 163 – 165 3 A Currency ("HUF") HUF11 166 – 197 32 AN Announcement – 1 This is the 1st line of the note12 198 – 229 32 AN Announcement – 2 This is the 2nd line of the note13 230 – 261 32 AN Announcement – 3 This is the 3rd line of the note14 262 – 263 2 ACountry code of the customer to be HUdebited (eg. “HU”)15 264 – 266 3 AN Legal title (eg. “010”) 00016 267 – 281 15 AN Complete with spaces17 282 – 291 10 AN Reserve fieldType abbreviations:AN – alfanumeral , numbers and fonts could be given in this fieldN - numeral, only numbers are allowed in this fieldA – alfa type, only fonts (letters) are allowed in this fieldExample:„AZ200305 410101020861234567812345678Sender, H-1111 Bp, Small Str 10 101020861111111111111111Receiver, H-1101 Bp, Oak Str 7 20030525 9012.00HUF This is the 1st line of the noteThis is the 2nd line ofthe noteThis is the 3rd line of the noteHU000 ”Datas should be aligned to the left. Special notes:Number of certificate: only the first 8 characters will be recognised in the accountsystemDebitor and creditor account numbers (GIRO) fields should be aligned to the leftwithout any hyphen.Amounts should be given in format: 999999999999.99 aligned to the right. In case ofHUF transfer, the value of the decimal palces should be zero.Value date (due date) format: yyyymmdd (yyyy – year in 4 characters, mm – month in2 characters, dd – days in 2 characters)<strong>Budapest</strong> <strong>Internetbank</strong>User’s Manual43<strong>Budapest</strong>, November 2005. (ver.2.0)