Building Competitiveness and Business Performance with ICT

Building Competitiveness and Business Performance with ICT

Building Competitiveness and Business Performance with ICT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

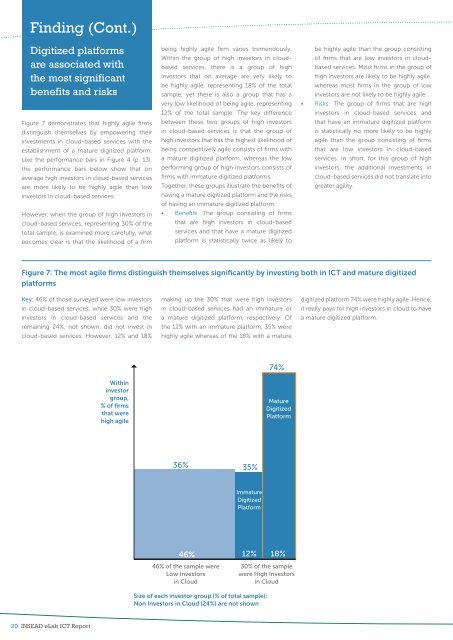

Finding (Cont.)Digitized platformsare associated <strong>with</strong>the most significantbenefits <strong>and</strong> risksFigure 7 demonstrates that highly agile firmsdistinguish themselves by empowering theirinvestments in cloud-based services <strong>with</strong> theestablishment of a mature digitized platform.Like the performance bars in Figure 4 (p. 13),the performance bars below show that onaverage high investors in cloud-based servicesare more likely to be highly agile than lowinvestors in cloud-based services.However, when the group of high investors incloud-based services, representing 30% of thetotal sample, is examined more carefully, whatbecomes clear is that the likelihood of a firmbeing highly agile firm varies tremendously.Within the group of high investors in cloudbasedservices, there is a group of highinvestors that on average are very likely tobe highly agile, representing 18% of the totalsample; yet there is also a group that has avery low likelihood of being agile, representing12% of the total sample. The key differencebetween these two groups of high investorsin cloud-based services is that the group ofhigh investors that has the highest likelihood ofbeing competitively agile consists of firms <strong>with</strong>a mature digitized platform, whereas the lowperforming group of high investors consists offirms <strong>with</strong> immature digitized platforms.Together, these groups illustrate the benefits ofhaving a mature digitized platform <strong>and</strong> the risksof having an immature digitized platform.• Benefits: The group consisting of firmsthat are high investors in cloud-basedservices <strong>and</strong> that have a mature digitizedplatform is statistically twice as likely tobe highly agile than the group consistingof firms that are low investors in cloudbasedservices. Most firms in the group ofhigh investors are likely to be highly agile,whereas most firms in the group of lowinvestors are not likely to be highly agile.• Risks: The group of firms that are highinvestors in cloud-based services <strong>and</strong>that have an immature digitized platformis statistically no more likely to be highlyagile than the group consisting of firmsthat are low investors in cloud-basedservices. In short, for this group of highinvestors, the additional investments incloud-based services did not translate intogreater agility.Figure 7: The most agile firms distinguish themselves significantly by investing both in <strong>ICT</strong> <strong>and</strong> mature digitizedplatformsKey: 46% of those surveyed were low investorsin cloud-based services, while 30% were highinvestors in cloud-based services <strong>and</strong> theremaining 24%, not shown, did not invest incloud-based services. However, 12% <strong>and</strong> 18%making up the 30% that were high investorsin cloud-based services had an immature ora mature digitized platform, respectively. Ofthe 12% <strong>with</strong> an immature platform, 35% werehighly agile whereas of the 18% <strong>with</strong> a maturedigitized platform 74% were highly agile. Hence,it really pays for high investors in cloud to havea mature digitized platform.Withininvestorgroup,% of firmsthat werehigh agile74%MatureDigitizedPlatform36% 35%ImmatureDigitizedPlatform46% 12% 18%46% of the sample wereLow Investorsin Cloud30% of the samplewere High Investorsin CloudSize of each investor group (% of total sample);Non Investors in Cloud (24%) are not shown20 INSEAD eLab <strong>ICT</strong> Report