Newsline 2/2000 - KSPG AG

Newsline 2/2000 - KSPG AG

Newsline 2/2000 - KSPG AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The latest news from the Rheinmetall group 2/<strong>2000</strong><br />

<strong>Newsline</strong><br />

Das Profil<br />

<strong>Newsline</strong><br />

Stockholders’ newsletter of Rheinmetall <strong>AG</strong>: orders at an all-time high<br />

Reengineered and back on track<br />

Düsseldorf. Having slipped up in<br />

profit for 1999 due to the steep losses<br />

sustained by STN Atlas Elektronik and<br />

Jagenberg, the Rheinmetall group,<br />

with a reengineered portfolio and a towering<br />

order backlog, is well back on<br />

the success track in <strong>2000</strong>. This was the<br />

general message given in Rheinmetall’s<br />

most recent newsletter to the<br />

stockholders. In 1999, consolidated<br />

world sales of the group totaled a figure<br />

of € 4.515 billion, which was nine<br />

percent up on the previous year.<br />

Within the STN Atlas group, tight public-sector<br />

budgets meant that programs<br />

were delayed and already placed<br />

orders put on hold, the resulting<br />

sales shortfall impacting to a sustained<br />

degree on profit which also suffered<br />

from heavy unbudgeted extraordinary<br />

expenditure for restructuring,<br />

portfolio clean-up and project-related<br />

cost overruns for certain development<br />

contracts. These latter projects will be<br />

instrumental in generating new business<br />

over the years ahead. Fiscal 1999<br />

was largely governed by nonrecurring,<br />

below-the-line burdens while <strong>2000</strong><br />

will again show a profit as a result of<br />

the measures initiated back in 1999.<br />

The losses of the Jagenberg group<br />

were mainly due to market circum-<br />

Düsseldorf. Dr. Hans U. Brauner, 66,<br />

chairman of Rheinmetall <strong>AG</strong>’s supervisory<br />

board and from 1985 to 1999<br />

the group’s executive board chairman,<br />

has resigned as supervisory<br />

board chairman as of March 31, <strong>2000</strong>.<br />

For 20 years, Brauner, who joined the<br />

Rheinmetall executive board in 1980,<br />

has held senior positions within the<br />

Rheinmetall group. In December 1999<br />

Brauner had stepped down earlier<br />

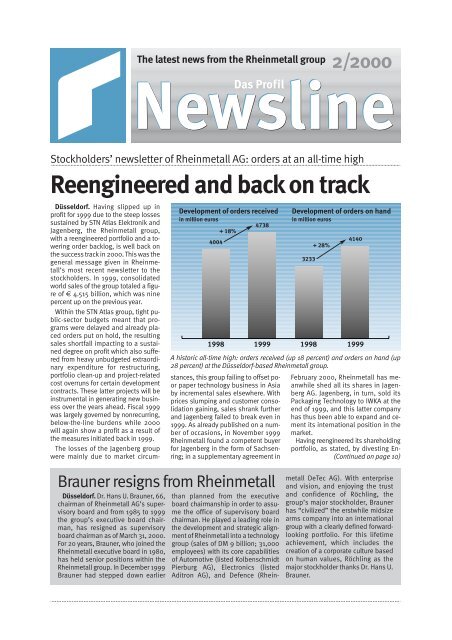

Development of orders received<br />

in million euros<br />

4738<br />

+ 18%<br />

4004<br />

1998 1999 1998 1999<br />

A historic all-time high: orders received (up 18 percent) and orders on hand (up<br />

28 percent) at the Düsseldorf-based Rheinmetall group.<br />

stances, this group failing to offset poor<br />

paper technology business in Asia<br />

by incremental sales elsewhere. With<br />

prices slumping and customer consolidation<br />

gaining, sales shrank further<br />

and Jagenberg failed to break even in<br />

1999. As already published on a number<br />

of occasions, in November 1999<br />

Rheinmetall found a competent buyer<br />

for Jagenberg in the form of Sachsenring;<br />

in a supplementary agreement in<br />

Brauner resigns from Rheinmetall<br />

than planned from the executive<br />

board chairmanship in order to assume<br />

the office of supervisory board<br />

chairman. He played a leading role in<br />

the development and strategic alignment<br />

of Rheinmetall into a technology<br />

group (sales of DM 9 billion; 31,000<br />

employees) with its core capabilities<br />

of Automotive (listed Kolbenschmidt<br />

Pierburg <strong>AG</strong>), Electronics (listed<br />

Aditron <strong>AG</strong>), and Defence (Rhein-<br />

Development of orders on hand<br />

in million euros<br />

3233<br />

+ 28%<br />

4140<br />

February <strong>2000</strong>, Rheinmetall has meanwhile<br />

shed all its shares in Jagenberg<br />

<strong>AG</strong>. Jagenberg, in turn, sold its<br />

Packaging Technology to IWKA at the<br />

end of 1999, and this latter company<br />

has thus been able to expand and cement<br />

its international position in the<br />

market.<br />

Having reengineered its shareholding<br />

portfolio, as stated, by divesting En-<br />

(Continued on page 10)<br />

metall DeTec <strong>AG</strong>). With enterprise<br />

and vision, and enjoying the trust<br />

and confidence of Röchling, the<br />

group’s major stockholder, Brauner<br />

has “civilized” the erstwhile midsize<br />

arms company into an international<br />

group with a clearly defined forwardlooking<br />

portfolio. For this lifetime<br />

achievement, which includes the<br />

creation of a corporate culture based<br />

on human values, Röchling as the<br />

major stockholder thanks Dr. Hans U.<br />

Brauner.

<strong>Newsline</strong><br />

First quoted on 27 March <strong>2000</strong><br />

Aditron <strong>AG</strong> goes public<br />

Düsseldorf/Frankfurt/Stuttgart. The<br />

stock of Düsseldorf-based Aditron <strong>AG</strong>,<br />

a company that subsumes Rheinmetall’s<br />

industrial electronics business,<br />

was for the first time publicly quoted<br />

on 27 March <strong>2000</strong>. Aditron has thus<br />

succeeded to and resumed the previous<br />

regulated market quotation of<br />

KIH Kommunikations Industrie Holding<br />

<strong>AG</strong>, Karlsruhe, at the Frankfurt/<br />

Main and Stuttgart stock exchanges.<br />

At the same time, the 3-month period<br />

commenced within which stockholders<br />

of KIH <strong>AG</strong>, meantime merged into<br />

Aditron <strong>AG</strong>, can exchange their KIH<br />

shares into Aditron <strong>AG</strong> stock.<br />

For this purpose, Aditron <strong>AG</strong> has raised<br />

its capital stock by € 3,502,080 to<br />

€ 40,857,600 by issuing a total<br />

1,368,000 new registered no-par shares.<br />

The exchange ratios are three registered<br />

no-par shares of Aditron <strong>AG</strong><br />

stock for one DM 50 share of KIH preferred<br />

stock at par, and seven for two<br />

DM 50 shares of KIH common stock at<br />

par. KIH <strong>AG</strong> common stockholders will<br />

additionally receive a cash payment of<br />

€ 0.69 per share of KIH common<br />

stock. After two no-dividend years, the<br />

previous KIH <strong>AG</strong> stockholders will<br />

again receive a cash dividend for their<br />

new Aditron <strong>AG</strong> stock for the entire fiscal<br />

1999.<br />

KIH <strong>AG</strong>’s merger into Aditron <strong>AG</strong> took<br />

retroactive economic effect as of 1 July<br />

1999, and became legally effective on<br />

24 March <strong>2000</strong>, upon entry of the merger<br />

in the Commercial Register of the<br />

Düsseldorf Local Court. Rheinmetall<br />

holds a 96.7 percent stake in Aditron<br />

<strong>AG</strong>’s capital stock, the previous KIH <strong>AG</strong><br />

Fritzsche chairman<br />

of EMG EuroMarine<br />

Hamburg/Düsseldorf. Dr. jur. Michael<br />

Fritzsche (50), since 1992 a Rheinmetall<br />

group executive, has been appointed<br />

as the new management board<br />

chairman of EMG EuroMarine Electronics<br />

GmbH, Hamburg, as of 1 March<br />

<strong>2000</strong>. Concurrently he is also a member<br />

of the Aditron <strong>AG</strong> executive board.<br />

At the end of February <strong>2000</strong>, Peter<br />

Wich (53), who had been in charge of<br />

stockholders accounting for the freefloating<br />

remaining 3.3 percent.<br />

Aditron’s core capabilities focus on<br />

the high-growth markets of automotive<br />

electronics and of communications<br />

and security. In certain sub-markets<br />

the company is a clear leader (especially<br />

the Heimann Systems x-ray scanning<br />

equipment for security checks),<br />

and thus Aditron is also well poised for<br />

both future organic growth and envisaged<br />

M&As and alliances.<br />

In 1999, sales of the Aditron group reached<br />

€ 686 million (up 4.5 percent on<br />

the previous year). The biggest growth<br />

generators were Heimann Systems, followed<br />

by Hirschmann. At € 666 million,<br />

order intake matched the year-earlier<br />

level. At the year-end, orders on hand<br />

totaled € 220 million. Pretax profit came<br />

to around € 16 million. At the end of<br />

1999, the Aditron group employed<br />

5,598 persons (down 6.6 percent).<br />

For the current fiscal year Aditron <strong>AG</strong><br />

expects sales in the region of € 1.1 billion.<br />

Its workforce will be just under<br />

8,000 in future. Growth is expected in<br />

both domestic and foreign business,<br />

particularly the latter.<br />

Retroactively as of 1 January <strong>2000</strong>,<br />

Aditron <strong>AG</strong> has taken over from Rheinmetall<br />

DeTec <strong>AG</strong> the latter’s stake in<br />

EMG EuroMarine Electronics GmbH,<br />

Hamburg. EMG was the result of the<br />

1999 merger of STN ATLAS Marine Electronics<br />

GmbH (operating in the industrial<br />

marine electronics sector) with<br />

the marine operations of the SAIT-Radio<br />

Holland group. Rheinmetall holds a<br />

50-percent stake in this joint venture in<br />

which it exercises industrial control.<br />

finance and controlling, stepped<br />

down from the management board<br />

of EMG in order to attend to intragroup<br />

projects at Rheinmetall, Düsseldorf.<br />

His successor at EMG is<br />

Jacques Debulpaep (51) who had<br />

joined the EMG management board<br />

when EMG EuroMarine Electronics<br />

was formed on 1 October 1999.<br />

The management board of EMG<br />

therefore consists of Dr. jur. Michael<br />

Fritzsche (chairman) and, as hitherto,<br />

Dipl.-Ing. Heinz Baier (59) and<br />

Dipl.-Kfm. Jacques Debulpaep.<br />

2<br />

Kaiser is the<br />

new chairman<br />

Neckartenzlingen. Dipl.-Wirtschafts-Ing.<br />

Walter R. Kaiser (53)<br />

has been appointed as the new management<br />

board chairman of Richard<br />

Hirschmann GmbH & Co. (Neckartenzlingen).<br />

He has also assumed<br />

responsibility for the automation<br />

and network systems unit of<br />

Hirschmann.<br />

Kaiser is taking over from Dipl.-<br />

Math. Klaus Eberhardt (51) who, as<br />

of 1 January <strong>2000</strong>, has been appointed<br />

as the new chairman of the<br />

executive board of Rheinmetall <strong>AG</strong>,<br />

a position he is combining with that<br />

of executive board chairman of<br />

Aditron <strong>AG</strong>.<br />

In the past, Kaiser has exercised<br />

various executive functions at IBM<br />

Deutschland GmbH (Stuttgart), followed<br />

by the position of general manager<br />

of Kaba<br />

Benzing GmbH<br />

(Villingen-<br />

Schwenningen),<br />

and most<br />

recently of Wieland<br />

Electric<br />

GmbH and Wieland<br />

Holding<br />

GmbH (Bam-<br />

berg). Besides<br />

his professional<br />

Walter R. Kaiser<br />

activities, Kaiser has for many years<br />

been lecturing on technical sales<br />

and sales management at the technical<br />

college in Esslingen.<br />

Further members of the Hirschmann<br />

management board are Dipl.-<br />

Ing. Eduard Schlauch (58) and<br />

Dipl.-Kfm. Karsten Odemann (39).<br />

<strong>Newsline</strong><br />

<strong>Newsline</strong> is a summary of the most<br />

important news articles published<br />

in “Das Profil”, the company newspaper<br />

of the Rheinmetall group<br />

Publisher: Rheinmetall <strong>AG</strong><br />

P.O. Box 104261, D-40033 Düsseldorf<br />

Responsible: Dr. Klaus Germann<br />

Editor-in-chief: Rolf D.Schneider<br />

Issue: April <strong>2000</strong>

<strong>Newsline</strong><br />

Second Rheinmetall management conference in Düsseldorf<br />

Growth abroad remains essential<br />

Düsseldorf. A review of the year 1999<br />

and an outlook towards the future:<br />

talks and discussions at the second<br />

Rheinmetall management conference<br />

on 20 January this year focused on<br />

operational and strategic perspectives<br />

for the Rheinmetall group in the year<br />

<strong>2000</strong> and the years to come as well as<br />

on the development of the group since<br />

1980 and the (preliminary) figures for<br />

1999. Speakers at the conference in<br />

Düsseldorf which was attended by<br />

nearly 300 top and middle level executives<br />

of the group from 15 countries included<br />

Michael Deaver, deputy chief of<br />

staff under President Ronald Reagan<br />

(1981 to 1989) and now vice chairman<br />

of Edelman Public Relations Worldwide,<br />

the chairman of the executive<br />

board of the Rheinmetall group Dipl.-<br />

Math. Klaus Eberhardt and Dr. Hans U.<br />

Brauner, the supervisory board chairman<br />

of Rheinmetall <strong>AG</strong> at that time.<br />

Speaking about the year 1999 and<br />

the plans for <strong>2000</strong>, the new chairman<br />

of the Rheinmetall group, Dipl.-Math.<br />

Klaus Eberhardt gave a detailed presentation<br />

of the group’s existing plans<br />

and perspectives for the current business<br />

year. The preliminary sales figures<br />

for 1999 showed a value of € 4.5 billion<br />

(corresponding to approximately nine<br />

billion marks). Addressing the order influx<br />

of around € 4.707 billion in 1999 –<br />

up 17.6 percent on the previous year<br />

and therefore the highest in the entire<br />

history of Rheinmetall – Eberhardt emphasized<br />

that “also in 1999, the group<br />

has progressed on the market with orders<br />

booked 17.6 percent higher than<br />

in the year earlier. Compared to 1998,<br />

we have therefore been able to boost<br />

the backlog of orders by 24.7 percent,<br />

an all-time high for Rheinmetall of well<br />

and truly four billion euros.”<br />

In this context, the 51-year old chairman<br />

of the Düsseldorf-based group<br />

appealed to the executives that they<br />

should do everything in their power to<br />

achieve the sales and earnings targets<br />

set for the year <strong>2000</strong>. “The plans for the<br />

year <strong>2000</strong> are realistic and encouraging.<br />

A backlog of orders of € four billion<br />

– others would be delighted to have<br />

such a sound basis. We have achieved<br />

growth and have become more global.<br />

These are qualitative claims which<br />

should also encourage the younger<br />

executives to commit themselves to<br />

Full house: some 300 representatives of top and middle management levels of<br />

the Düsseldorf-based Rheinmetall group attended the second Rheinmetall management<br />

conference in Düsseldorf on 20 January this year. Discussions and deliberations<br />

at the conference – which included a supporting program with the satirical<br />

review artistes Dr. Peter Förschler and Dieter Aisenbrey as well as members of the<br />

Bigband of the Essen Folkwang-Hochschule directed by the pianist Tae-Sung<br />

Chung – centered on the operational and strategic goals of the group for the year<br />

<strong>2000</strong> and the years to come.<br />

Gave a detailed presentation of planning<br />

for the year <strong>2000</strong>: Rheinmetall’s<br />

chairman Dipl.-Math. Klaus Eberhardt.<br />

Addressing the subject of “values in<br />

the Rheinmetall group: creating, imparting,<br />

sustaining and growing”, Dr.<br />

Hans U. Brauner, formerly supervisory<br />

board chairman, gave a review of developments<br />

in the group since 1980.<br />

3<br />

this group.” Eberhardt went on to say<br />

that it would be a remarkable achievement<br />

if the group managed to attain the<br />

budgeted targets in all areas, in every<br />

plant and in all companies belonging to<br />

the group. He challenged those present<br />

to act as entrepreneurs and achieve the<br />

targets they themselves had set.<br />

Referring to the medium-term growth<br />

planned for the group, Eberhardt stressed<br />

once more that Rheinmetall will<br />

continue to put its stakes on the further<br />

globalization of business in the future.<br />

“In our markets, we see that our chances<br />

outside Germany are growing. And<br />

we therefore intend (to continue) to<br />

pursue the strategy of growth abroad.<br />

We are increasingly developing from a<br />

national into an international corporation”.<br />

Addressing the executives<br />

assembled at Rheinmetall’s communication<br />

center in Düsseldorf – of which<br />

some 20 percent represented sites<br />

outside Germany – Rheinmetall’s boss<br />

promised that the ongoing globalization<br />

of the group would also be accounted<br />

for in regard to the development of<br />

executive resources.<br />

Eberhardt’s speech followed that of<br />

his long-standing predecessor Dr. Hans<br />

U. Brauner, the supervisory board chairman<br />

of the Rheinmetall group at that<br />

(Continued on page 4)

(Continued from page 3)<br />

time. Addressing the subject of “Values<br />

in the Rheinmetall group: creating, imparting,<br />

sustaining and growing”, Brauner<br />

held a very personal review of the<br />

last two decades of developments at<br />

Rheinmetall. He pointed out that this<br />

had been his “personal legacy”.<br />

Brauner stated that the quantitative<br />

value of the group as such and of its<br />

assets had developed very positively<br />

over the last twenty years. Broken down<br />

into the individual business sectors<br />

and management holdings, the group<br />

has achieved an overall rise in value<br />

since 1980 of some 2.3 billion German<br />

marks. Moreover, sales have grown<br />

from 700 million marks in 1979 to nearly<br />

nine billion in the year 1999. To quote<br />

Brauner: “We have achieved a clear<br />

positive development of our quantitative<br />

values. And we will not only maintain<br />

these in the coming decade but<br />

will increase them even further.”<br />

In the wake of the recent concentration<br />

on the core business areas Automotive,<br />

Electronics and Defence, Brauner<br />

remarked that the aim will be to<br />

make the development of Rheinmetall<br />

(even more) transparent and to give<br />

the rather reticent market price greater<br />

momentum. A point to note in this<br />

connection: according to a recent shareholder<br />

value study by the internationally<br />

renowned accountants Arthur<br />

Andersen of the top 500 shares in Europe,<br />

Rheinmetall is ranked 5th among<br />

the European conglomerates, 11th<br />

among the German companies included<br />

in the Euro-500 and holds 96th<br />

position among the Euro-500.<br />

In the opinion of Brauner, the qualitative<br />

management values of the<br />

group have likewise shown a marked<br />

improvement over the last twenty<br />

years. He remarked that “the technical<br />

competence has progressed enormously<br />

on all management levels. We<br />

have (today) a highly qualified and also<br />

highly motivated team of managers<br />

working as teams or as a team with a<br />

head.” Addressing the skills, knowhow<br />

and intelligence of the well over<br />

6000 employees with an academic<br />

background, Brauner emphasized the<br />

high technical competence and outstanding<br />

level of qualification throughout<br />

the group. “Training and qualifica-<br />

<strong>Newsline</strong><br />

Second Rheinmetall management conference in Düsseldorf<br />

Growth abroad remains essential<br />

tion activities are continuing and importance<br />

is attached to promoting junior<br />

members on the staff.” Brauner<br />

added that management values, rules<br />

of conduct and model patterns had<br />

been established, setting new standards<br />

inside and outside the group.<br />

As his (quasi) personal legacy to the<br />

executive board of the group’s holding,<br />

Brauner once more outlined the planned<br />

goals for the group. Rheinmetall<br />

intends to boost sales and earnings<br />

6000<br />

5000<br />

4000<br />

3000<br />

<strong>2000</strong><br />

1000<br />

0<br />

in million €<br />

4129<br />

2107<br />

4513 4465<br />

2544<br />

2022 1969<br />

1998 actual 1999 forecast <strong>2000</strong> planned 2001 planned 2002 planned<br />

Focus on internationalization: the share of foreign sales by<br />

the Rheinmetall group will continue to rise distinctly in future.<br />

even further – a fact which had already<br />

been presented to financial analysts<br />

and business journalists during informatory<br />

talks held in December last year<br />

(see last issue of <strong>Newsline</strong>) – and has<br />

its targets set on sales of some 20 billion<br />

German marks for the year 2010. Of<br />

this, Automotive is to generate ten billion<br />

marks with Electronics and Defence<br />

each contributing five billion marks.<br />

As an experienced politician with extensive<br />

experience in US and international<br />

politics, Michael Deaver – acting<br />

as the guest speaker at the conference<br />

– addressed his speech entitled “American<br />

politics looking to <strong>2000</strong>” to aspects<br />

of successful management as<br />

fundamentally viewed from his stand-<br />

More than forty years of experience in US<br />

and international politics: Michael Deaver.<br />

4<br />

2582<br />

1883<br />

4718<br />

2801<br />

1917<br />

point. Deaver – formerly deputy chief<br />

of staff under US President Ronald Reagan<br />

and now vice chairman of one of<br />

the world’s largest and most renowned<br />

public relations agencies – is of the<br />

opinion that to succeed in management<br />

one must know exactly who one<br />

is, yet know equally well one’s strengths<br />

and weaknesses. He stated that it is<br />

important to have and also announce<br />

simple messages, these management<br />

qualities being essential not only for<br />

politics but also for<br />

the economic and<br />

5082<br />

3032<br />

2050<br />

1998-2002: +44%<br />

1998-2002: +1%<br />

foreign<br />

domestic<br />

business community.<br />

Regarding the<br />

domestic developments<br />

in the<br />

world’s largest industrial<br />

nation, also<br />

with a view to<br />

the forthcoming<br />

presidential elections<br />

this fall, Deaver<br />

stated that he<br />

expects a change in government, pointing<br />

out that the USA are better off<br />

than ever before and voters in the US<br />

are very satisfied. There is no conflict<br />

and no war anywhere in the world in<br />

which the USA are involved. Indeed,<br />

the United States now have a generation<br />

of young voters who have never experienced<br />

a conflict, have never heard<br />

of economic recession and who have<br />

never suffered from the repercussions<br />

of such situations. Despite important<br />

social issues – for instance, concerning<br />

the health system, national insurance<br />

and the educational system –<br />

the determining subject (of the election)<br />

will be the character, the personality.<br />

Deaver therefore believes that<br />

the Republicans will move into the<br />

White House, that the Senate will remain<br />

in the hands of the Republicans<br />

and that the House of Representatives<br />

will go to the Democrats with a slim<br />

majority. In other words, the USA will<br />

probably have a divided government<br />

again. As to the prospects for foreign<br />

policy after the forthcoming 43rd presidential<br />

elections, Deaver expressed<br />

the hope that there would be a leadership<br />

for which the more than 40 years of<br />

close ties to Nato would continue to<br />

form the basis of US foreign policy in<br />

future, too (see pages 14 to 17).

<strong>Newsline</strong><br />

Technology from STN Atlas Marine Electronics on board the Aurora<br />

Safe passage assured with Nacos<br />

Papenburg/Hamburg. Tens of thousands<br />

of onlookers turned out on 19<br />

February this year to watch the Aurora<br />

luxury liner as it was cautiously navigated<br />

from its shipyard in Papenburg<br />

on the River Ems to Eemshaven on the<br />

Dutch coast. The event which was given<br />

huge media attention once again<br />

demonstrated that utmost precision<br />

was the name of the game.<br />

After all, the fact that the 76000 GRT<br />

ship with an overall length of 270 meters<br />

and a width of exactly 32.2 meters<br />

was actually able to sail along the Ems<br />

which is extremely narrow at various<br />

points is largely also attributable to<br />

the technology delivered by STN Atlas<br />

Marine Electronics GmbH. The Hamburg-based<br />

company that is a subsidiary<br />

of the recently established EMG<br />

EuroMarine Electronics GmbH (a joint<br />

venture of Rheinmetall Aditron <strong>AG</strong> and<br />

SAIT-RadioHolland S.A.) delivered the<br />

complete diesel-electric propulsion<br />

system for the latest cruise liner to be<br />

built in Papenburg: the propulsion system<br />

includes two synchronous engines<br />

each with a capacity of 20 MW,<br />

eight diesel generators with a total capacity<br />

of 72.5 MW and the mediumvoltage<br />

switching system.<br />

Experts from STN Atlas Marine Electronics<br />

GmbH were also responsible<br />

for the delivery of the integrated navigation<br />

system Nacos 65/3 installed on<br />

board the Aurora. Günter Krombach, vice<br />

president marketing, pointed out<br />

New partner for<br />

Mauser Waldeck<strong>AG</strong><br />

Düsseldorf/Amsterdam/Waldeck.<br />

Rheinmetall <strong>AG</strong>, Düsseldorf, intends<br />

to sell its majority financial holding<br />

(around 82 percent) in Mauser Waldeck<br />

<strong>AG</strong>, Waldeck, to Koninklijke<br />

Ahrend NV, Amsterdam, Netherlands,<br />

thus taking a further step toward the<br />

announced leaner portfolio while<br />

strengthening its worldwide interests<br />

in the core operations of Automotive,<br />

Electronics, and Defence.<br />

As of January 1, <strong>2000</strong>, Ahrend will<br />

take over Mauser Waldeck <strong>AG</strong> along<br />

Technology from STN Atlas Marine Electronics GmbH on board: the Hamburgbased<br />

company, a subsidiary of EMG EuroMarine Electronics GmbH, delivered the<br />

complete diesel-electric propulsion system as well as the integrated navigation<br />

system Nacos 65/3 for the new Aurora luxury liner.<br />

that it was thanks to the integrated navigation<br />

system which includes three<br />

Multipilots as well as a central display<br />

for all navigation and operating data<br />

(the conning display) that the cruise<br />

ship intended for P&O was actually able<br />

to navigate along the River Ems.<br />

Commenting on the function of the<br />

Multipilot, Krombach explained that<br />

this Nacos-component allows the captain<br />

to observe his own ship and the<br />

wider surroundings above and below<br />

water practically from a bird’s-eye view.<br />

with the operating companies Mauser<br />

Office GmbH and Systemmöbel Dessau<br />

GmbH, as well as the non-German<br />

Mauser sales companies. In<br />

1999, these companies together generated<br />

sales of around € 100 million<br />

with a workforce of 840.<br />

Still within the Rheinmetall group<br />

(as a financial holding) is Goldbach<br />

Innenausbau GmbH, a manufacturer<br />

of cupboard and partition systems<br />

whose 106 employees achieved sales<br />

of around € 15 million in 1999. Talks<br />

on the future of this company are also<br />

being held.<br />

Founded in 1896, Koninklijke Ahrend<br />

NV is a listed international company<br />

operating in the office furniture,<br />

5<br />

In other words, the navigator is always<br />

kept up to date about everything that is<br />

happening around him.<br />

The Aurora cruiseliner had been ordered<br />

by the world famous Peninsular<br />

and Oriental Steam Navigation Company,<br />

better known as P&O (London).<br />

The ship which offers space for nearly<br />

1900 passengers and has a cruise<br />

speed of 24 knots will set out on its<br />

maiden trip into the Mediterranean on<br />

1 May <strong>2000</strong> and will then be used for<br />

cruises throughout the world.<br />

office and computer supplies as well<br />

as reprography markets. Its 2,081 employees<br />

generate annual sales of around<br />

€ 446 million. The office furniture<br />

division, which in 1999 made up<br />

around 50 percent of the group’s<br />

aggregate sales, currently produces<br />

at two locations in the Netherlands<br />

from where it markets through its own<br />

branches at home and abroad a range<br />

of quality furniture distinctive for<br />

style and function.<br />

The acquisition of Mauser Waldeck<br />

<strong>AG</strong> will broaden Ahrend’s access to<br />

the German market. A company with<br />

a long-established tradition, the<br />

Dutch manufacturer will continue to<br />

use the Mauser trademark.

<strong>Newsline</strong><br />

Stockholders’ newsletter of Kolbenschmidt Pierburg<br />

Automotive group is<br />

outpacing the industry<br />

Düsseldorf. As an OEM-independent<br />

manufacturer of modules and systems<br />

“for every aspect of the engine”, the<br />

Kolbenschmidt Pierburg group, a member<br />

of Rheinmetall, outpaced industry<br />

growth in the second half of 1999. As<br />

pointed out by the management holding<br />

Kolbenschmidt Pierburg <strong>AG</strong> in its<br />

recent newsletter to the stockholders,<br />

during this period the group succeeded<br />

in surpassing the high sales level<br />

of the corresponding year-earlier period<br />

by a clear 9 percent, with earnings<br />

surging by as much as 27 percent. The<br />

substantial improvement in earnings<br />

during the second half of 1999 was particularly<br />

pleasing: at € 32 million, earnings<br />

before tax (EBT) in the latter half<br />

of the year for the first time topped the<br />

normally higher first six months. As a<br />

result, a 4.1-percent return on sales<br />

was achieved for the second half of<br />

1999 (up from 3.3 percent for the comparable<br />

year-earlier period). Group sales<br />

in 1999 reached € 1.527 billion (3.7<br />

percent up). The acquisition of the US<br />

piston producer Zollner Pistons and<br />

the divestment of PLU-Luftfahrttechnik<br />

resulted on balance in a sales increase<br />

of € 34 million. As a result, the Kolbenschmidt<br />

Pierburg<br />

group fully benefited<br />

in terms of organic<br />

growth from<br />

the higher production<br />

volumes of<br />

cars (up 1.5 percent)<br />

and commercial<br />

vehicles (up<br />

0.4 percent) in Western<br />

Europe, despite<br />

the necessary<br />

price conces-<br />

sions.<br />

Kolbenschmidt<br />

Pierburg boosted<br />

sales in 1999 both<br />

in Germany and outside. Due to the<br />

stronger market position for pistons in<br />

NAFTA countries as a consequence of<br />

the Zollner acquisition, growth abroad<br />

outpaced increases in Germany.<br />

In 1999, Pistons showed the steepest<br />

growth rate, partly due to the<br />

start-up of diesel piston production for<br />

Peugeot. Additionally, extra potentials<br />

available through Zollner were immediately<br />

exploited, Kolbenschmidt Pierburg<br />

becoming the largest piston producer<br />

in the United States and the second<br />

largest worldwide.<br />

The most comprehensive internal expansion<br />

was shown by Air Supply/<br />

Pumps in 1999 which, particularly<br />

through its innovative intake manifolds,<br />

electronic throttle bodies, valves<br />

and pumps, generated growth of<br />

more than € 20 million in the wake of<br />

major series production start-ups, e.g.<br />

throttle devices for General Motors.<br />

Plain Bearings also achieved aboveaverage<br />

growth rates while the declines<br />

in the smaller divisions Aluminum<br />

Technology (engine blocks), MotorEngineering<br />

and Motor Service (aftermarket<br />

business) were mainly due to temporary<br />

effects as well as the divestment<br />

of PLU-Luftfahrttechnik.<br />

Tangible asset additions in 1999 totaled<br />

€ 165 million, the high level of<br />

the first half of the year continuing unchanged<br />

into the second. Most of the<br />

expenditure by the Kolbenschmidt<br />

Pierburg group in 1999 was linked to<br />

Motorized throttle bodies EDR-E from Kolbenschmidt Pierburg<br />

combine all possibilities for managing the mass airflow<br />

on modern gasoline engines.<br />

customer projects and contracts. In<br />

readiness for the substantial organic<br />

growth scheduled over the years<br />

ahead, tangible asset expenditure in<br />

1999 was raised by 45 percent compared<br />

with the previous year.<br />

Major projects included expanding<br />

capacity for the magnesium intake<br />

6<br />

The world’s smallest diesel piston<br />

used in the Smart.<br />

manifolds at Nettetal, setting-up the<br />

production of motorized throttle devices<br />

in Berlin, and broadening manufacturing<br />

capacities for new product<br />

start-ups at the piston factories in Brazil,<br />

the United States, and France. Traditionally<br />

a big spender, the Aluminum<br />

Technology division (engine<br />

blocks) made preparations in the course<br />

of 1999 for the considerable sales<br />

increases targeted as from 2001, by<br />

extending its low-pressure casting capacities,<br />

etc. The investment program<br />

for engine block production will continue<br />

in <strong>2000</strong>/2001. A number of capital<br />

assets will also be leased.<br />

The high volume of capital expenditure<br />

surpassed depreciation by 42 percent.<br />

In <strong>2000</strong>, additions to tangible assets<br />

have been budgeted to shrink<br />

back to the level of depreciation. The<br />

acquisition of Zollner Pistons represented<br />

another significant financial investment<br />

in 1999.<br />

Despite the 3.7-percent sales climb,<br />

the group succeeded in limiting workforce<br />

growth to three percent. On an<br />

annualized average, the overall headcount<br />

in the group was 11,335 in 1999,<br />

and as of 31 December 1999, the Kolbenschmidt<br />

Pierburg group had a<br />

workforce of altogether 11,789 (up 786<br />

from 11,003). The Zollner acquisition<br />

accounted for 1,082 while 258 employees<br />

left the group in the wake of<br />

the divestment of PLU aviation business.<br />

As of 31 December 1999, the<br />

group employed 5,512 persons in Germany.<br />

Of the total 11,789 worldwide,<br />

the non-German workforce accounted<br />

for 47 percent. As a result of the acquisition<br />

of the pump activities of Magneti<br />

Marelli at the start of <strong>2000</strong>, the number<br />

of non-German employees rose<br />

further to 49 percent. Kolbenschmidt<br />

(Continued on page 7)

drupa: Jagenberg<br />

group at PrintCity<br />

Düsseldorf. At drupa <strong>2000</strong>, the Jagenberg<br />

group is presenting on<br />

stand E57, hall 6, as part of the joint<br />

PrintCity project its extensive range<br />

of die-cutting and folding-carton products.<br />

Alongside Jagenberg Papiertechnik<br />

GmbH, Woschnik & Partner<br />

Maschinenbau GmbH and Jagenberg<br />

Diana GmbH, the Jagenberg stand<br />

will also be hosting BMB Bachofen +<br />

Meier <strong>AG</strong> and Lemo Maschinenbau<br />

GmbH. Rounding off the range is a robotized<br />

automatic packaging and<br />

handling system built by A + F Automation<br />

+ Fördertechnik GmbH for boxed<br />

folding cartons.<br />

Taking up a large area of the joint<br />

stand are new products from the extensivedie-cutting<br />

and folding-cartonlineup<br />

of WPM<br />

GmbH and Jagenberg<br />

Diana<br />

print media fair<br />

GmbH. These<br />

are also part of<br />

a workflow entitled<br />

”The ma-<br />

(Continued from page 6)<br />

Pierburg intends to continue this policy<br />

of globalization in order to completely<br />

exploit customer potentials and<br />

achieve cost advantages through production<br />

sites outside of Germany.<br />

In the second half of 1999, the Kolbenschmidt<br />

Pierburg group achieved<br />

EBT of € 32 million, equivalent to a return<br />

on sales of 4.1 percent, a significant<br />

improvement over the figure for<br />

the second half of 1998 (3.3 percent).<br />

In all, fiscal 1999 closed with EBT of €<br />

60 million and a return on sales of 3.9<br />

percent. The improvement compared<br />

with the forecast published in the late<br />

summer of 1999, was due to sales surging<br />

toward the end of the year, as well<br />

as to exchange rate advantages. The<br />

EBT quoted already take into account<br />

the budgeted, exceptionally high capital<br />

outlays and the interest burden resulting<br />

from such capital expenditures,<br />

any further input, and the share<br />

<strong>Newsline</strong><br />

nufacture of a folding carton,” which<br />

is designed to integrate Jagenberg<br />

and its subsidiaries within the overall<br />

PrintCity architecture. The exhibits<br />

include two new Diana Pro 114 units<br />

with a variety of novel developed features<br />

such as an Eco 105-1 with a new<br />

LIN setting-up device to enable a linear,<br />

flattened blank throughout.<br />

Swiss Bachofen + Meier <strong>AG</strong> is demonstrating<br />

in action its newest curtain<br />

coating system besides informing<br />

visitors about its more traditional coating<br />

techniques. This Jagenberg subsidiary<br />

is also exposing its newly developed<br />

vacuum roll which only recently<br />

helped propel a paper coating line to<br />

a new world record speed of 3,259<br />

m/min. BMB will be briefing its customers<br />

on the advantages of both the<br />

new and the traditional coating techniques<br />

and advising potential buyers<br />

on which to opt for in view of their particular<br />

applications.<br />

Lemo Maschinenbau GmbH is the<br />

Jagenberg Group specialist for both<br />

flexo printing and bag welding machines.<br />

This company is presenting<br />

its video help line, a low-cost and effective<br />

new-media service tool for Jagenberg<br />

customers anywhere in the<br />

world.<br />

Stockholders’ newsletter of Kolbenschmidt Pierburg<br />

Automotive group is outpacing . . .<br />

acquisitions. This was, in fact, the only<br />

reason why EBT for all of 1999 fell just<br />

short of the previous year’s; in contrast,<br />

the 1999 earnings before depreciation,<br />

interest and taxes (EBDIT) were<br />

again raised from € 167 million to €<br />

184 million. Pistons and Plain Bearings,<br />

in particular, showed a significant<br />

improvement over the previous<br />

year.<br />

Increased earnings were generally<br />

due to successful rationalization efforts<br />

and, in certain cases, favorable<br />

exchange rates which in turn offset the<br />

burdens resulting from lower prices<br />

and higher personnel expenses. The<br />

group’s 1999 tax load ratio was clearly<br />

above the 1998 level as tax loss<br />

carryforwards had been fully utilized<br />

and high expenses disallowable<br />

against tax were incurred. However,<br />

since the new calculation methods<br />

were applied, the DVFA-based earnings<br />

per share are not affected by this<br />

7<br />

Sheet cutter<br />

for Scheufelen<br />

Oberlenningen/Neuss. The Scheufelen<br />

paper mill in Oberlenningen in<br />

the Swabian region of Germany has<br />

just ordered the ultra-modern highperformance<br />

Synchro sheet cutter<br />

model 400-2200 DD2 from Jagenberg<br />

Papiertechnik GmbH in Neuss.<br />

The machine has a working width<br />

of 2,200 mm and will process highquality<br />

art and illustration printing<br />

papers of basis weight 100-250<br />

gsm, and also specialty grades<br />

(such as board for playing cards) of<br />

up to 500 gsm basis weight. With<br />

its multi-motor AC direct drive, the<br />

Synchro achieves speeds of up to<br />

400 m/min.<br />

The reels will be unwound by a<br />

turret-type unwind, specially designed<br />

for non-stop operation, with<br />

length slitting performed by 5 pairs<br />

of Jagenberg Speedslit slitters. Following<br />

the cut-off and overlapping<br />

section, this machine is furbished<br />

with a Speedpiler pile changer with<br />

just one layboy for pile-changing<br />

without sheet loss at production<br />

speed.<br />

burden. Kolbenschmidt Pierburg <strong>AG</strong><br />

intends to maintain its dividend policy<br />

which is based on continuity.<br />

The automotive market in Western<br />

Europe and throughout the world is<br />

currently predicted to remain steady at<br />

the high level of 1999. A slight decline<br />

in certain countries cannot be ruled<br />

out which, however, is expected to be<br />

offset by rising production figures elsewhere.<br />

Against this setting, the year <strong>2000</strong><br />

began very favorably for the Kolbenschmidt<br />

Pierburg group. Sales in January<br />

and February <strong>2000</strong> clearly surpassed<br />

the year-earlier figures virtually<br />

throughout the divisions. The sales<br />

uptrend in the first half of <strong>2000</strong> is expected<br />

to continue, with additional<br />

growth being generated by the yearearlier<br />

takeovers. The group will exploit<br />

this sales upswing in order to<br />

achieve once again an above-average<br />

level of earnings.

<strong>Newsline</strong><br />

Rheinmetall’s financial executive Dr. Herbert Müller<br />

Giving the group more<br />

room to maneuver<br />

Düsseldorf. Asked about his personal<br />

opinion as to the further development<br />

of the Rheinmetall group, the answer<br />

given by Dr. rer. oec. Herbert Müller<br />

– the financial executive of the management<br />

holding since 1 January<br />

<strong>2000</strong> and in this capacity responsible<br />

for finance and controlling throughout<br />

the group – is as always prompt and<br />

precise: “I rate the likelihood that our<br />

group will attain sales in the order of<br />

20 billion German marks and a net profit<br />

of around 500 million marks by the<br />

end of the decade as extremely realistic.<br />

I can give my unconditional support<br />

to this long-term perspective.”<br />

Dr. Müller sees it as perfectly natural<br />

and also as a personal commitment<br />

that the stations towards this extremely<br />

ambitious target (which will involve<br />

an awful lot of hard work) will be supported<br />

and forged by him. The political<br />

economist points out that ultimately<br />

all business activities are reflected by<br />

the figures produced and that exactly<br />

these are his responsibility. Referring<br />

to the influence which can be exerted<br />

by the financial department, he sees<br />

this mainly as “giving the business<br />

more room to maneuver by optimizing<br />

the accounts, taxes and funding possibilities.<br />

After all this is my job.”<br />

One particularly successful example<br />

mentioned by Müller in this context is<br />

the DM 700 million syndicated loan<br />

granted by 21 national and international<br />

banks in December 1997. The conditions<br />

of this loan were excellent and<br />

Rheinmetall reaped a lot of praise<br />

from experts. According to Müller, the<br />

huge transaction caused quite an<br />

uproar in the German bank community<br />

at that time. In which context, the financial<br />

manager of Rheinmetall has<br />

no doubts whatsoever that the company’s<br />

excellent reputation and the<br />

high qualification of its management<br />

were essential for the loan.<br />

As to qualification: as the boss of a<br />

highly qualified and equally motivated<br />

team, Müller sees himself as the motor,<br />

as the driving force in order to secure<br />

the high performance level under<br />

the responsibility of the individual. Although<br />

it would be an understatement<br />

to say that his form of leadership is<br />

specifically “cooperative”. In the<br />

words of Müller: “Good colleagues<br />

need space and that is what I try to give<br />

them by delegating interesting jobs<br />

to them – jobs that obviously involve<br />

responsibility. Only thus can I keep<br />

good employees in my department in<br />

the long term.”<br />

When asked to give a concrete example,<br />

Rheinmetall’s new financial executive<br />

says without hesitation: “If, for<br />

instance, a due diligence* is necessary<br />

for a planned acquisition –<br />

perhaps abroad – I will not necessarily<br />

do the job myself but may just as well<br />

delegate it to somebody else”, fully<br />

aware of the fact that the superior will<br />

naturally also benefit from the (later)<br />

success of the work done by the individual.<br />

This is teamwork of the motivating<br />

type.<br />

Openness, fairness and partnership<br />

in his dealings with others rank top on<br />

Müller’s scale of values. He rates mutual<br />

esteem and friendly relations between<br />

colleagues “on all levels of the<br />

hierarchy” as the appropriate manner<br />

of working together, in fact as absolutely<br />

normal. “I always consider my opposite<br />

as a partner with whom a task<br />

or problem is to be solved. This is why<br />

partnership between colleagues is so<br />

very important to me.” Obviously, this<br />

does not mean that critical words cannot<br />

be spoken in case of need.<br />

Müller’s values for his business dealings<br />

are also determined by the principle<br />

of legality adopted throughout the<br />

Rheinmetall group – “the governing laws<br />

determine our freedom to maneuver”<br />

and the open, constructive dialog<br />

with the public. “Precedence is given<br />

to the correct, timely and reliable information<br />

on the situation of the group.”<br />

In terms of its owners, shareholders,<br />

investors, the financial community and<br />

the media, this motto has long been<br />

true for the Düsseldorf-based group.<br />

As a fully fledged financial expert<br />

Müller – who abhors exceedingly euphoric<br />

plans because they are often<br />

not realistic – knows all too well that<br />

the strong influence of the financial<br />

8<br />

Rheinmetall’s financial executive Dr.<br />

rer. oec. Herbert Müller considers the<br />

sales target of 20 billion German<br />

marks and a net profit of approx. 500<br />

million marks to be perfectly realistic<br />

by the end of this decade. Against this<br />

setting, the 46 year-old manager sees<br />

it as his job to give the core sectors<br />

Automotive, Electronics and Defence<br />

more room to maneuver by optimizing<br />

the accounts, taxes and funding possibilities.<br />

Müller mentions the syndicated<br />

loan of 700 million German marks<br />

negotiated with numerous national<br />

and international banks in 1997 as one<br />

successful example of such activities.<br />

community which already exists today<br />

(e.g. the small shareholders, major investors,<br />

analysts, banks and rating<br />

agencies) will continue to increase in<br />

future. “The pressure will grow.”<br />

Nonetheless, it is important that business<br />

dealings are not oriented exclusively<br />

towards relatively short-term actions<br />

and goals. “We must keep an eye<br />

on our longer term strategy which focuses<br />

on qualitative and quantitative<br />

growth in the three core sectors Automotive,<br />

Electronics and Defence. A significant<br />

boost in earnings will, however,<br />

only be achieved by those who<br />

actually concentrate on what they are<br />

good at.” A process which takes a lot<br />

of time and patience. And naturally also<br />

includes a critical assessment of<br />

the current figures at the end of the<br />

month or quarter.<br />

* Prior to the acquisition or sale of a company, the<br />

latter is subjected to a thorough investigation. This<br />

is done by the so-called due diligence process during<br />

which the repercussions, risks, potentials and<br />

deficits of a take-over are assessed. The objective of<br />

a due diligence is to determine the purchase price;<br />

moreover, it provides a basis for negotiations.

Dr. rer. oec. Herbert Müller:<br />

Always used<br />

his chances<br />

A s<br />

the executive responsible<br />

for finances and controlling<br />

on the executive board of<br />

Rheinmetall <strong>AG</strong> since 1 January this<br />

year, the career of Dr. rer. oec. Herbert<br />

Müller can be reduced to a<br />

simple yet very successful formula:<br />

the man born in Meerbusch has always<br />

systematically solved the<br />

tasks he had set himself and reached<br />

the professional targets he<br />

sought for himself. “I suppose it<br />

would be fair to say that I consistently<br />

used the opportunities offered<br />

by our educational system.” Determination<br />

as a trait and an instrument<br />

for his personal career.<br />

Some details on his education: after<br />

nine years at elementary school<br />

and two years at business school, a<br />

commercial apprenticeship and studies<br />

at a technical college, the 19<br />

year-old Müller attended advanced<br />

technical college in Düsseldorf, graduating<br />

in business economics after<br />

three years. He then went on to<br />

study at the University of Duisburg<br />

which he completed with his diploma<br />

in economics in 1978. Eight<br />

years later – and long since a member<br />

of the working community – he<br />

took his doctor’s degree in economics<br />

(Dr. rer.oec.). He passed his<br />

last exam qualifying him as a tax<br />

consultant in 1996, shortly after joining<br />

Rheinmetall <strong>AG</strong> as director of<br />

the central department of finances.<br />

The young graduate acquired his<br />

first professional experience with<br />

Contigas <strong>AG</strong> (Düsseldorf) in the late<br />

seventies. In the period between<br />

1980 and 1984, he worked as an assistant<br />

to the professor for accounting/controlling<br />

at the University of<br />

Duisburg. Further stations in his career:<br />

from 1984 to 1989 he worked<br />

for Deutsche Leasing <strong>AG</strong> in Frankfurt<br />

(as deputy head of the accounting<br />

department), the IWKA <strong>AG</strong> (in Karlsruhe)<br />

as financial director and for<br />

GEA <strong>AG</strong> in Bochum, a company operating<br />

in the field of power plant and<br />

packaging machine construction (financial<br />

director from 1993 to 1995).<br />

Müller has been working as an executive<br />

for the Rheinmetall holding<br />

since September 1995.<br />

<strong>Newsline</strong><br />

GOT OFF TO A PERFECT START during the first of a total of 17 races in the<br />

Formula 1 world championships: on 12 March this year at the Australian Grand<br />

Prix on the Albert Park course in Melbourne, Michael Schumacher came in first<br />

with his Ferrari, followed by Rubens Barrichello. The German racing driver and<br />

his Brazilian team mate – whose racing cars are fitted with oil and water pumps<br />

developed by Kolbenschmidt Pierburg in Italy – therefore presented an excellent<br />

start into the new Formula 1 racing season for the “Scuderia Ferrari”. Our picture<br />

shows Schumacher who also won the second race of the world championship in<br />

Sao Paolo (Brazil) on 26 March crossing the finishing line in Melbourne.<br />

Moody’s rating is first-class<br />

New York/Düsseldorf. Following the<br />

favorable assessment by the London<br />

branch of Standard & Poor’s in November<br />

1999 with BBB for long-term credit<br />

standing and senior unsecured debt<br />

and A-2 for short-term credit standing,<br />

Moody’s Investors Service, New York,<br />

has rated the stable growth outlook for<br />

Rheinmetall even higher.<br />

Moody’s Investors Service assigned<br />

a Baa1 issuer rating to Rheinmetall <strong>AG</strong><br />

for long-term debt and a Prime-2 to the<br />

company for short-term debt. The ratings<br />

are based on Rheinmetall’s diversified<br />

set of businesses with lea-<br />

Unanimous vote<br />

for Klaus Eberhardt<br />

Düsseldorf. Dipl.-Math. Klaus Eberhardt<br />

(52), appointed executive<br />

board chairman of Rheinmetall <strong>AG</strong> at<br />

the supervisory board meeting of 8<br />

December 1999, has had his term of<br />

office extended to the end of 2004.<br />

This decision was reached unanimously<br />

at the supervisory board<br />

meeting on 16 March <strong>2000</strong>.<br />

At the same time, Dipl. Phys. Werner<br />

Thürmel (74) and Professor em.<br />

Dr.-Ing. Hans Gerd Domen (72), both<br />

9<br />

ding market positions and a technological<br />

edge, a conservative financing<br />

policy and a stable shareholders base,<br />

supportive of long-term strategies. The<br />

ratings also reflect the challenge for<br />

Rheinmetall to raise margins in its core<br />

activities and the consolidation trend<br />

in many of Rheinmetall’s businesses.<br />

The rating also allows for the corporate<br />

structure of the group with less<br />

than 100% interests in the growth businesses,<br />

the potential for further ownership<br />

dilution to fund strategic investment,<br />

and the structural subordination<br />

of parent company debt.<br />

long-standing members of the supervisory<br />

board, retired from the board<br />

by reason of their age.<br />

They have been replaced by Dipl.<br />

rer. pol. Werner Engelhardt (54) and<br />

Dr. Bernd M. Hönle (51), appointed<br />

as members of the supervisory board<br />

by the local court of registration,<br />

Berlin-Charlottenburg. Engelhardt is<br />

management board chairman at<br />

Röchling Industrie Verwaltung GmbH<br />

which holds approx. 66 percent of<br />

the common stock of Rheinmetall<br />

<strong>AG</strong>. Dr. Hönle is also a member of the<br />

management board of Röchling Industrie<br />

Verwaltung GmbH.

(Continued from page 1)<br />

gineering and Office Systems (the latter<br />

being sold to Koninklijke Ahrend NV),<br />

Rheinmetall will in <strong>2000</strong> be able to successfully<br />

concentrate on its core businesses<br />

of Automotive (Kolbenschmidt<br />

Pierburg), Electronics (Aditron) and Defence<br />

(Rheinmetall DeTec). In each of<br />

these markets, Rheinmetall is among<br />

the leading international players.<br />

Rheinmetall’s group of consolidated<br />

companies was substantially widened<br />

in 1999 through the 12-month inclusion<br />

of the Belgian-Dutch SRH Marine-<br />

Holding (SRH Marine), the Danish EuroCom<br />

Industries (ECI), as well as the<br />

Dutch Eurometaal, and through the pro<br />

rata temporis consolidation of the<br />

Swiss Oerlikon Contraves and the American<br />

KUS Zollner Division. A contrary<br />

result was produced by the divestment<br />

of Jagenberg’s Packaging Technology<br />

division as of 31 December 1999, whose<br />

income statement data is still included<br />

in the figures below while its balance<br />

sheet data is not. In all other respects,<br />

the Jagenberg group is still fully<br />

included in the fiscal 1999 figures. Oerlikon<br />

Contraves and Eurometaal have<br />

been integrated into the Defence sector,<br />

Zollner into the Automotive sector.<br />

SRH Marine and ECI, both operating in<br />

the marine electronics market, as well<br />

as STN Atlas Marine Electronics, still a<br />

part of the Defence Sector in the previous<br />

year, are now all grouped under<br />

EuroMarine, which in turn is assigned<br />

to the Electronics sector.<br />

In 1999, the consolidated world sales<br />

of the Rheinmetall group totaled €<br />

4.515 billion (up 9 percent). Total 1999<br />

sales break down as follows: Automotive<br />

34 percent, Electronics 24 percent,<br />

and Defence 30 percent. Engineering<br />

(Jagenberg) accounted for ten percent<br />

of group sales and the financial holding<br />

Office Systems for two percent.<br />

Automotive managed to raise the<br />

high sales volume of fiscal 1998 by<br />

another 4 percent to € 1.525 billion,<br />

thanks to both the newcomers and organic<br />

growth. Electronics generated<br />

sales of € 1.103 billion, up by 68 percent.<br />

Discounting the first-time inclusion<br />

of EuroMarine, the gain was 5 percent.<br />

Sales by Defence were 15 percent<br />

higher at € 1.332 billion, due to the acquisitions.<br />

Sales by Engineering drop-<br />

<strong>Newsline</strong><br />

Stockholders’ newsletter of Rheinmetall <strong>AG</strong>: orders at an all-time high<br />

Reengineered and back on track<br />

ped € 64 million (minus 12 percent) in<br />

1999 to € 470 million. Whereas Packaging<br />

Technology sales rose marginally<br />

compared with the previous year, Paper<br />

Technology business nose-dived<br />

due to the worldwide weak investment<br />

propensity by the paper industry (down<br />

€ 74 million, minus 21 percent).<br />

The order situation at the Rheinmetall<br />

group is very good. During fiscal<br />

1999, orders worth € 4.738 billion were<br />

received, 18 percent above the high<br />

year-earlier figure. Orders on hand<br />

climbed 28 percent to € 4.140 billion.<br />

The remarkable growth in order intake<br />

and backlog (an all-time high for<br />

Rheinmetall) is due to both changes in<br />

the group of consolidated companies<br />

and a number of mega-contracts awarded<br />

to Defence (including the Leopard<br />

2 for Spain). Orders booked by Automotive<br />

added up to € 1.530 billion (up<br />

4 percent). Air Supply/Pumps (Pierburg)<br />

and Pistons were the prime growth<br />

generators. At a total € 1.101 billion<br />

in 1999, Electronics succeeded in<br />

acquiring 62 percent more orders, one<br />

of the reasons being the larger group<br />

of consolidated companies. Order influx<br />

by Defence in 1999 reached €<br />

1.549 billion (up by € 420 million, 37<br />

percent). As of 31 December 1999, Defence<br />

had an order backlog of € 3.219<br />

billion (up by € 869 million or 37 percent).<br />

At € 484 million, orders booked<br />

by Engineering were up by 6 percent.<br />

Whereas orders contracted by Packaging<br />

Technology climbed 23 percent,<br />

order intake by Paper Technology fell 5<br />

percent, due to the troubled market.<br />

Expenditure for intangible and tangible<br />

assets in fiscal 1999 came to €<br />

290 million, € 63 million above amortization/depreciation<br />

and € 74 million<br />

higher than the expenditure volume of<br />

1998, mainly due to increased spending<br />

by Automotive.<br />

The Rheinmetall group’s results for<br />

1999 showed a sharp dip. The operating<br />

result (preliminary figures) totaled<br />

€ 70 million (compared to € 174 million<br />

in 1998) and the pretax profit amounted<br />

to € 30 million (1998: € 147 million).<br />

The net loss for the year was € 7 million<br />

(1998: net profit of € 140 million).<br />

By selling Jagenberg and thoroughly<br />

restructuring STN Atlas Elektronik,<br />

Rheinmetall has taken the necessary<br />

10<br />

steps for a significant improvement in<br />

earnings in <strong>2000</strong>. Additionally, the selling<br />

of the Mauser Waldeck financial<br />

holding, which broke even in 1999,<br />

has allowed the group to shed a<br />

hitherto poor earner. In the current<br />

fiscal year <strong>2000</strong>, Rheinmetall will reachieve<br />

the good operating profit position<br />

of earlier years. Moreover, the disposal<br />

of Jagenberg is expected to yield<br />

an additional gain for fiscal <strong>2000</strong>.<br />

At € 60 million, Automotive generated<br />

a pretax profit matching the high<br />

level of the previous year. As then, Air<br />

Supply/Pumps (Pierburg), Pistons and<br />

Plain Bearings were the most successful<br />

divisions. As a result, it proved possible<br />

to offset the weaker result of the<br />

first half of the year in the course of the<br />

second. In fact, this dynamic performance<br />

during the latter half of 1999<br />

will continue into the first half of <strong>2000</strong>.<br />

At € 20 million, the pretax profit of<br />

Electronics matched that of the previous<br />

year. The annual result also takes<br />

into account expenditure in<br />

connection with the closedown or liquidation<br />

of companies outside of<br />

Germany belonging to the former KIH<br />

group. Due to the exceptional poor<br />

performance by STN Atlas Elektronik,<br />

Defence shows a pretax loss of € 9<br />

million for 1999. The figures for STN Atlas<br />

Elektronik include considerable<br />

amounts related to the nonrecurring<br />

expenditure for tapping new markets<br />

and restructuring parts of the business,<br />

which represent important investments<br />

in the future.<br />

On 31 December 1999, the Rheinmetall<br />

group employed 32,859 persons<br />

(up 9 percent). The rise is mainly due<br />

to the newly consolidated companies,<br />

like-for-like the workforce was down<br />

by around 600 at the end of 1999.<br />

The outlook: the year <strong>2000</strong> is a period<br />

in which the Rheinmetall group is<br />

back on the success track, with present<br />

performance signaling growth<br />

and earnings as a result of the actions<br />

initiated. Orders on hand are at an alltime<br />

high. Rheinmetall is becoming increasingly<br />

global, with non-German<br />

business now accounting for more<br />

than 60 percent. The target for <strong>2000</strong>:<br />

just under € 5 billion sales, a pretax<br />

profit of € 100 million, 30,000 employees.

<strong>Newsline</strong><br />

‘Milestones’ distinction for Rheinmetall <strong>AG</strong><br />

Growth leads to new<br />

position on market<br />

Düsseldorf. 18 companies operating<br />

on international and domestic markets,<br />

including Rheinmetall <strong>AG</strong> (Düsseldorf),<br />

won the ‘Milestones’ prize<br />

awarded for the very first time a few<br />

weeks ago. The Ministry of Trade and<br />

Small and Medium-sized Businesses,<br />

Technology and Transport of North Rhine-Westphalia,<br />

the Boston Consulting<br />

Group and the Handelsblatt publishing<br />

group which sponsored this competition<br />

for the first time intend to<br />

award this distinction for trend-setting<br />

business achievements associated<br />

with the German state of North Rhine-<br />

Westphalia at regular intervals in the<br />

future. The Düsseldorf-based Rheinmetall<br />

group received its distinction in<br />

the Business Migration category for its<br />

successful business expansion policy<br />

in the automotive and defence technology<br />

sectors in the recent past.<br />

Speaking on the occasion of the first<br />

‘Milestones’ award on 29 January<br />

<strong>2000</strong>, Wolfgang<br />

Clement, Minister<br />

President of the<br />

state of North Rhine-Westphalia,<br />

pointed out that<br />

this German state<br />

intends to pursue a<br />

new industrial policy<br />

in the future:<br />

“Instead of subsidizing<br />

businesses,<br />

we hope to create a<br />

framework which<br />

will promote the initiative<br />

of the industry”.<br />

Clement remarked<br />

that this<br />

new business<br />

award will contri-<br />

Marinette, WI<br />

bute towards this process in future,<br />

and that “the outstanding entrepreneurial<br />

achievements distinguished<br />

with this prize should encourage younger<br />

businesses in particular.”<br />

Dr. Volkhard Hofmann, chief executive<br />

of The Boston Consulting Group<br />

GmbH & Partner, Dr. Heinz-Werner<br />

Nienstedt, spokesman of the management<br />

board of the Düsseldorf-based<br />

publishing group Handelsblatt GmbH<br />

and Peer Steinbrück, formerly Minister<br />

for Economic Affairs and now Minister<br />

of Finance in North Rhine-Westphalia<br />

all commented on the distinction much<br />

to the same effect. Minister of Finance<br />

Steinbrück, for example, emphasized<br />

that this business prize which has been<br />

awarded for the first time fits well into<br />

the economic policy (of North Rhine-<br />

Westphalia) with its strong focus on<br />

small to medium-sized businesses since<br />

the distinction is bestowed on future-oriented<br />

business achievements<br />

with a model character. “Unfortunately,<br />

this potential frequently lies dormant<br />

in obscurity. It is (therefore) especially<br />

important that the broader public<br />

should find out about these trend-setting<br />

strategies – this being beneficial<br />

not only for the businesses as such but<br />

also for others who can learn from the<br />

achievements.”<br />

The high-carat jury distinguished 18<br />

companies in six different categories.<br />

Leamington/Canada<br />

Auburn Hills, MI<br />

Fort Wayne, IN<br />

Greensburg, IN<br />

Greenville, SC<br />

Nova Odessa<br />

Brazil<br />

Thionville<br />

France<br />

Abadiano<br />

Spain<br />

One important reason for winning the ‘Milestones’ award has been that the Kolbenschmidt<br />

Pierburg group has increased its customer-focus and customer-satisfaction<br />

through the significant expansion of its production and sales sites worldwide.<br />

Other winners besides Rheinmetall <strong>AG</strong><br />

included businesses like LSG Lufthansa<br />

Service, Preussag, Schering, Steag<br />

Microparts, Schwarz Pharma, Pneumant<br />

Reifen and Garant Schuh.<br />

Rheinmetall <strong>AG</strong> was awarded the distinction<br />

in the Business Migration category<br />

on grounds of its successful<br />

growth strategy, especially during the<br />

last three years, having consistently<br />

used and expanded its core capabili-<br />

11<br />

Germany (10 sites)<br />

Usti/Czech Republic<br />

Lanciano/Italy<br />

ties in the Automotive and Defence<br />

sectors. The migration processes (acquisition<br />

of Kolbenschmidt <strong>AG</strong> and<br />

STN Atlas Elektronik GmbH) assessed<br />

by the jury have led to the following<br />

developments:<br />

★ In the Automotive sector, the<br />

group has developed into an internationally<br />

renowned systems supplier<br />

with a range of products for “every<br />

aspect of the engine”. In this context,<br />

customer-focus and customer-satisfaction<br />

have been increased consistently<br />

through the significant expansion<br />

of production and sales sites<br />

throughout the world. Today, the<br />

Automotive sector is one of the top 15<br />

in Europe and in the top league of international<br />

OEM-independent automotive<br />

suppliers.<br />

★ In the Defence sector, the group has<br />

rounded off its systems capabilities in<br />

the army technology sector with the<br />

acquisition in late 1996 of STN Atlas<br />

Elektronik GmbH,<br />

as the manufacturer<br />

of electronic defence<br />

systems.<br />

One direct effect in<br />

this context has<br />

Shanghai<br />

China<br />

been the sustained<br />

networking of<br />

hardware capabilities<br />

in the weapons,<br />

ammunition<br />

and vehicle sector<br />

with electronic<br />

competence in the<br />

field of command<br />

and communication<br />

systems (combination<br />

of mechanical<br />

and electronic<br />

systems).<br />

Overall, the Rheinmetall group has<br />

adopted a new strategic position as a<br />

result of the two migration processes<br />

in the defence and automotive industry<br />

distinguished by the ‘Milestones’<br />

award. Moreover, the earning power<br />

and goodwill of the group (as the basis<br />

for further growth) have increased significantly,<br />

factors which have ultimately<br />

also helped to secure existing and<br />

create new jobs.

<strong>Newsline</strong><br />

CeBIT <strong>2000</strong>: Aditron’s premiere at the trade fair<br />

New products<br />

highlight capabilities<br />

Hanover. For seven days, from 24<br />

February to 1 March, the exhibition<br />

grounds in Hanover were once more a<br />

mecca for the high-tech industry. As in<br />

earlier years, the CeBIT <strong>2000</strong> which is<br />

the world’s most important trade fair<br />

for information and telecommunication<br />

technology, served as the perfect<br />

technical forum for this branch of the<br />

industry. Over 750,000 visitors, more<br />

than 7,800 exhibitors who were well<br />

and truly satisfied with the CeBIT, some<br />

415,000 square meters of exhibition<br />

area, and innumerable technical<br />

and technological innovations – reason<br />

enough for the organizers of the<br />

event to delight in record figures. Joining<br />

the world of bits and bytes: the<br />

newly formed Aditron <strong>AG</strong> represented<br />

by its subsidiaries Hirschmann, Preh<br />

and CKS displaying their exhibits with<br />

numerous novelties to the interested<br />

public in halls 11, 17 and 23.<br />

At this year’s CeBIT, Richard Hirschmann<br />

& Co. presented innovative products<br />

and trends<br />

from the fields of<br />

communication<br />

and data technology.<br />

At the spacious,<br />

two-level stand of<br />

Aditron <strong>AG</strong> in hall<br />

17, which the Hirschmann<br />

divisions<br />