Annual Report 2009-10 - United Breweries Limited

Annual Report 2009-10 - United Breweries Limited

Annual Report 2009-10 - United Breweries Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

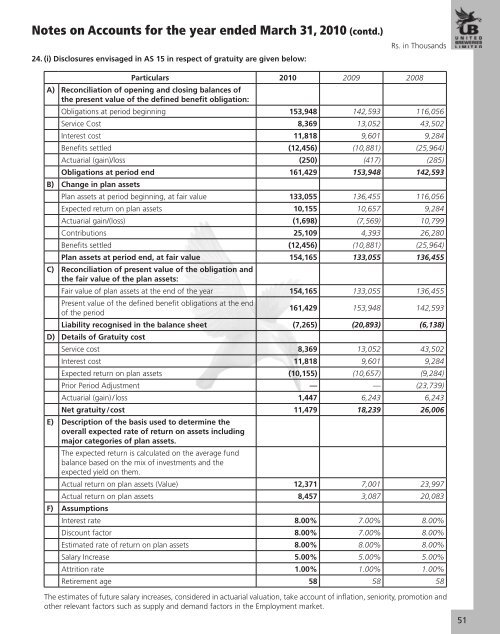

Notes on Accounts for the year ended March 31, 20<strong>10</strong> (contd.)24. (i) Disclosures envisaged in AS 15 in respect of gratuity are given below:Rs. in ThousandsParticulars 20<strong>10</strong> <strong>2009</strong> 2008A) Reconciliation of opening and closing balances ofthe present value of the defined benefit obligation:Obligations at period beginning 153,948 142,593 116,056Service Cost 8,369 13,052 43,502Interest cost 11,818 9,601 9,284Benefits settled (12,456) (<strong>10</strong>,881) (25,964)Actuarial (gain)/loss (250) (417) (285)Obligations at period end 161,429 153,948 142,593B) Change in plan assetsPlan assets at period beginning, at fair value 133,055 136,455 116,056Expected return on plan assets <strong>10</strong>,155 <strong>10</strong>,657 9,284Actuarial gain/(loss) (1,698) (7,569) <strong>10</strong>,799Contributions 25,<strong>10</strong>9 4,393 26,280Benefits settled (12,456) (<strong>10</strong>,881) (25,964)Plan assets at period end, at fair value 154,165 133,055 136,455C) Reconciliation of present value of the obligation andthe fair value of the plan assets:Fair value of plan assets at the end of the year 154,165 133,055 136,455Present value of the defined benefit obligations at the endof the period161,429 153,948 142,593Liability recognised in the balance sheet (7,265) (20,893) (6,138)D) Details of Gratuity costService cost 8,369 13,052 43,502Interest cost 11,818 9,601 9,284Expected return on plan assets (<strong>10</strong>,155) (<strong>10</strong>,657) (9,284)Prior Period Adjustment — — (23,739)Actuarial (gain) /loss 1,447 6,243 6,243Net gratuity/cost 11,479 18,239 26,006E) Description of the basis used to determine theoverall expected rate of return on assets includingmajor categories of plan assets.The expected return is calculated on the average fundbalance based on the mix of investments and theexpected yield on them.Actual return on plan assets (Value) 12,371 7,001 23,997Actual return on plan assets 8,457 3,087 20,083F) AssumptionsInterest rate 8.00% 7.00% 8.00%Discount factor 8.00% 7.00% 8.00%Estimated rate of return on plan assets 8.00% 8.00% 8.00%Salary Increase 5.00% 5.00% 5.00%Attrition rate 1.00% 1.00% 1.00%Retirement age 58 58 58The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority, promotion andother relevant factors such as supply and demand factors in the Employment market.51