1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

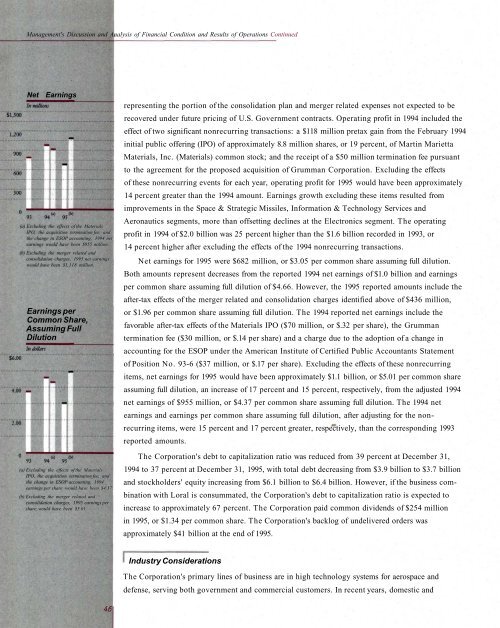

Management's Discussion and Analysis of Financial Condition and Results of Operations ContinuedNet Earnings(a) Excluding the effects of the MaterialsIPO, the acquisition termination fee, andthe change in ESOP accounting, 1994 netearnings would have been $955 million.(b) Excluding the merger related andconsolidation charges, <strong>1995</strong> net earningswould have been $I,118 million.Earnings perCommon Share,Assuming FullDilution(a) Excluding the effects of the MaterialsIPO, the acquisition termination fee, andthe change in ESOP accounting, 1994earnings per share would have been $4.37.(b) Excluding the merger related andconsolidation charges, <strong>1995</strong> earnings pershare would have been $5.01.representing the portion of the consolidation plan and merger related expenses not expected to berecovered under future pricing of U.S. Government contracts. Operating profit in 1994 included theeffect of two significant nonrecurring transactions: a $118 million pretax gain from the February 1994initial public offering (IPO) of approximately 8.8 million shares, or 19 percent, of <strong>Martin</strong> MariettaMaterials, Inc. (Materials) common stock; and the receipt of a $50 million termination fee pursuantto the agreement for the proposed acquisition of Grumman Corporation. Excluding the effectsof these nonrecurring events for each year, operating profit for <strong>1995</strong> would have been approximately14 percent greater than the 1994 amount. Earnings growth excluding these items resulted fromimprovements in the Space & Strategic Missiles, Information & Technology Services andAeronautics segments, more than offsetting declines at the Electronics segment. The operatingprofit in 1994 of $2.0 billion was 25 percent higher than the $1.6 billion recorded in 1993, or14 percent higher after excluding the effects of the 1994 nonrecurring transactions.Net earnings for <strong>1995</strong> were $682 million, or $3.05 per common share assuming full dilution.Both amounts represent decreases from the reported 1994 net earnings of $1.0 billion and earningsper common share assuming full dilution of $4.66. However, the <strong>1995</strong> reported amounts include theafter-tax effects of the merger related and consolidation charges identified above of $436 million,or $1.96 per common share assuming full dilution. The 1994 reported net earnings include thefavorable after-tax effects of the Materials IPO ($70 million, or $.32 per share), the Grummantermination fee ($30 million, or $.14 per share) and a charge due to the adoption of a change inaccounting for the ESOP under the American Institute of Certified Public Accountants Statementof Position No. 93-6 ($37 million, or $.17 per share). Excluding the effects of these nonrecurringitems, net earnings for <strong>1995</strong> would have been approximately $1.1 billion, or $5.01 per common shareassuming full dilution, an increase of 17 percent and 15 percent, respectively, from the adjusted 1994net earnings of $955 million, or $4.37 per common share assuming full dilution. The 1994 netearnings and earnings per common share assuming full dilution, after adjusting for the nonrecurringitems, were 15 percent and 17 percent greater, respectively, than the corresponding 1993reported amounts.The Corporation's debt to capitalization ratio was reduced from 39 percent at December 31,1994 to 37 percent at December 31, <strong>1995</strong>, with total debt decreasing from $3.9 billion to $3.7 billionand stockholders' equity increasing from $6.1 billion to $6.4 billion. However, if the business combinationwith Loral is consummated, the Corporation's debt to capitalization ratio is expected toincrease to approximately 67 percent. The Corporation paid common dividends of $254 millionin <strong>1995</strong>, or $1.34 per common share. The Corporation's backlog of undelivered orders wasapproximately $41 billion at the end of <strong>1995</strong>.Industry ConsiderationsThe Corporation's primary lines of business are in high technology systems for aerospace anddefense, serving both government and commercial customers. In recent years, domestic and