1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

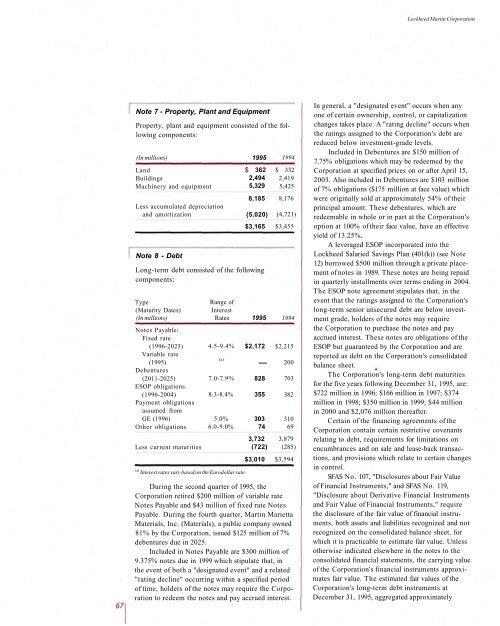

<strong>Lockheed</strong> <strong>Martin</strong> CorporationNote 7 - Property, Plant and EquipmentProperty, plant and equipment consisted of the followingcomponents:(In millions)LandBuildingsMachinery and equipmentLess accumulated depreciationand amortizationNote 8 - Debt<strong>1995</strong>$ 3622,4945,3298,185(5,020)$3,165Long-term debt consisted of the followingcomponents:Type(Maturity Dates)(In millions)Notes Payable:Fixed rate(1996-2023)Variable rate(<strong>1995</strong>)Debentures(2011-2025)ESOP obligations(1996-2004)Payment obligationsassumed fromGE (1996)Other obligationsLess current maturitiesRange ofInterestRates4.5-9.4%(a)7.0-7.9%8.3-8.4%5.0%6.0-9.0%(a) Interest rates vary based on the Eurodollar rate.<strong>1995</strong>$2,172—828355303743,732(722)$3,0101994$ 3322,4195,4258,176(4,721)$3,4551994$2,215200703382310693,879(285)$3,594During the second quarter of <strong>1995</strong>, theCorporation retired $200 million of variable rateNotes Payable and $43 million of fixed rate NotesPayable. During the fourth quarter, <strong>Martin</strong> MariettaMaterials, Inc. (Materials), a public company owned81% by the Corporation, issued $125 million of 7%debentures due in 2025.Included in Notes Payable are $300 million of9.375% notes due in 1999 which stipulate that, inthe event of both a "designated event" and a related"rating decline" occurring within a specified periodof time, holders of the notes may require the Corporationto redeem the notes and pay accrued interest.In general, a "designated event" occurs when anyone of certain ownership, control, or capitalizationchanges takes place. A "rating decline" occurs whenthe ratings assigned to the Corporation's debt arereduced below investment-grade levels.Included in Debentures are $150 million of7.75% obligations which may be redeemed by theCorporation at specified prices on or after April 15,2003. Also included in Debentures are $103 millionof 7% obligations ($175 million at face value) whichwere originally sold at approximately 54% of theirprincipal amount. These debentures, which areredeemable in whole or in part at the Corporation'soption at 100% of their face value, have an effectiveyield of 13.25%.A leveraged ESOP incorporated into the<strong>Lockheed</strong> Salaried Savings Plan (401(k)) (see Note12) borrowed $500 million through a private placementof notes in 1989. These notes are being repaidin quarterly installments over terms ending in 2004.The ESOP note agreement stipulates that, in theevent that the ratings assigned to the Corporation'slong-term senior unsecured debt are below investmentgrade, holders of the notes may requirethe Corporation to purchase the notes and payaccrued interest. These notes are obligations of theESOP but guaranteed by the Corporation and arereported as debt on the Corporation's consolidatedbalance sheet.The Corporation's long-term debt maturitiesfor the five years following December 31, <strong>1995</strong>, are:$722 million in 1996; $166 million in 1997; $374million in 1998; $350 million in 1999; $44 millionin 2000 and $2,076 million thereafter.Certain of the financing agreements of theCorporation contain certain restrictive covenantsrelating to debt, requirements for limitations onencumbrances and on sale and lease-back transactions,and provisions which relate to certain changesin control.SFAS No. 107, "Disclosures about Fair Valueof Financial Instruments," and SFAS No. 119,"Disclosure about Derivative Financial Instrumentsand Fair Value of Financial Instruments," requirethe disclosure of the fair value of financial instruments,both assets and liabilities recognized and notrecognized on the consolidated balance sheet, forwhich it is practicable to estimate fair value. Unlessotherwise indicated elsewhere in the notes to theconsolidated financial statements, the carrying valueof the Corporation's financial instruments approximatesfair value. The estimated fair values of theCorporation's long-term debt instruments atDecember 31, <strong>1995</strong>, aggregated approximately