1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

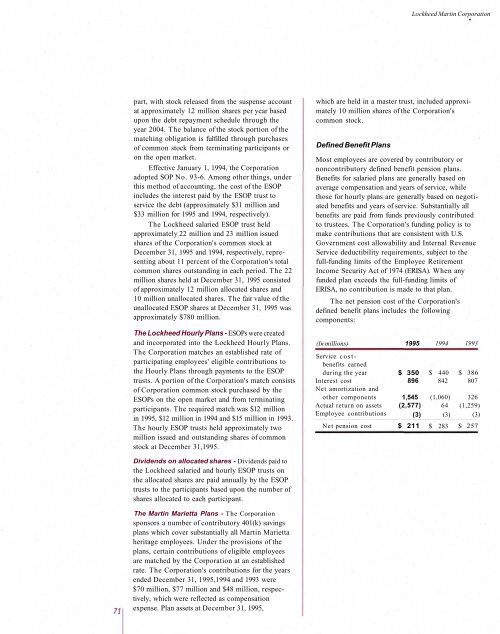

<strong>Lockheed</strong> <strong>Martin</strong> Corporationpart, with stock released from the suspense accountat approximately 1.2 million shares per year basedupon the debt repayment schedule through theyear 2004. The balance of the stock portion of thematching obligation is fulfilled through purchasesof common stock from terminating participants oron the open market.Effective January 1, 1994, the Corporationadopted SOP No. 93-6. Among other things, underthis method of accounting, the cost of the ESOPincludes the interest paid by the ESOP trust toservice the debt (approximately $31 million and$33 million for <strong>1995</strong> and 1994, respectively).The <strong>Lockheed</strong> salaried ESOP trust heldapproximately 22 million and 23 million issuedshares of the Corporation's common stock atDecember 31, <strong>1995</strong> and 1994, respectively, representingabout 11 percent of the Corporation's totalcommon shares outstanding in each period. The 22million shares held at December 31, <strong>1995</strong> consistedof approximately 12 million allocated shares and10 million unallocated shares. The fair value of theunallocated ESOP shares at December 31, <strong>1995</strong> wasapproximately $780 million.The <strong>Lockheed</strong> Hourly Plans - ESOPs were createdand incorporated into the <strong>Lockheed</strong> Hourly Plans.The Corporation matches an established rate ofparticipating employees' eligible contributions tothe Hourly Plans through payments to the ESOPtrusts. A portion of the Corporation's match consistsof Corporation common stock purchased by theESOPs on the open market and from terminatingparticipants. The required match was $12 millionin <strong>1995</strong>, $12 million in 1994 and $15 million in 1993.The hourly ESOP trusts held approximately twomillion issued and outstanding shares of commonstock at December 31,<strong>1995</strong>.which are held in a master trust, included approximately10 million shares of the Corporation'scommon stock.Defined Benefit PlansMost employees are covered by contributory ornoncontributory defined benefit pension plans.Benefits for salaried plans are generally based onaverage compensation and years of service, whilethose for hourly plans are generally based on negotiatedbenefits and years of service. Substantially allbenefits are paid from funds previously contributedto trustees. The Corporation's funding policy is tomake contributions that are consistent with U.S.Government cost allowability and Internal RevenueService deductibility requirements, subject to thefull-funding limits of the Employee RetirementIncome Security Act of 1974 (ERISA). When anyfunded plan exceeds the full-funding limits ofERISA, no contribution is made to that plan.The net pension cost of the Corporation'sdefined benefit plans includes the followingcomponents:(In millions)Service costbenefitsearnedduring the yearInterest costNet amortization andother componentsActual return on assetsEmployee contributionsNet pension cost<strong>1995</strong>$ 3508961,545(2,577)(3)$ 2111994$ 440842(1,060)64(3)$ 2831993$ 386807326(1,259)(3)$ 257Dividends on allocated shares - Dividends paid tothe <strong>Lockheed</strong> salaried and hourly ESOP trusts onthe allocated shares are paid annually by the ESOPtrusts to the participants based upon the number ofshares allocated to each participant.The <strong>Martin</strong> Marietta Plans - The Corporationsponsors a number of contributory 401(k) savingsplans which cover substantially all <strong>Martin</strong> Mariettaheritage employees. Under the provisions of theplans, certain contributions of eligible employeesare matched by the Corporation at an establishedrate. The Corporation's contributions for the yearsended December 31, <strong>1995</strong>,1994 and 1993 were$70 million, $77 million and $48 million, respectively,which were reflected as compensationexpense. Plan assets at December 31, <strong>1995</strong>,