1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

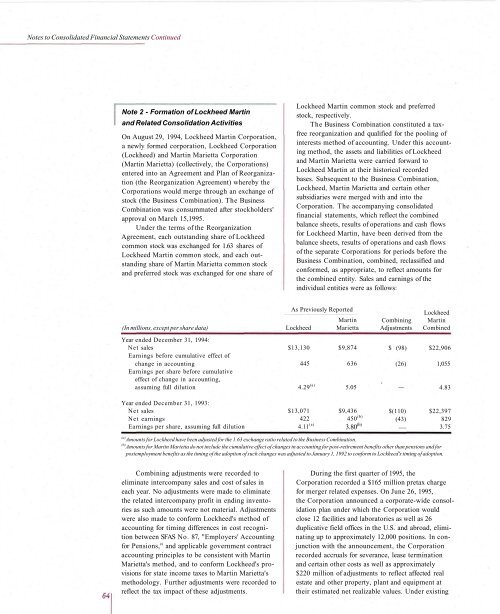

Notes to Consolidated Financial Statements ContinuedNote 2 - Formation of <strong>Lockheed</strong> <strong>Martin</strong>and Related Consolidation ActivitiesOn August 29, 1994, <strong>Lockheed</strong> <strong>Martin</strong> Corporation,a newly formed corporation, <strong>Lockheed</strong> Corporation(<strong>Lockheed</strong>) and <strong>Martin</strong> Marietta Corporation(<strong>Martin</strong> Marietta) (collectively, the Corporations)entered into an Agreement and Plan of Reorganization(the Reorganization Agreement) whereby theCorporations would merge through an exchange ofstock (the Business Combination). The BusinessCombination was consummated after stockholders'approval on March 15,<strong>1995</strong>.Under the terms of the ReorganizationAgreement, each outstanding share of <strong>Lockheed</strong>common stock was exchanged for 1.63 shares of<strong>Lockheed</strong> <strong>Martin</strong> common stock, and each outstandingshare of <strong>Martin</strong> Marietta common stockand preferred stock was exchanged for one share of<strong>Lockheed</strong> <strong>Martin</strong> common stock and preferredstock, respectively.The Business Combination constituted a taxfreereorganization and qualified for the pooling ofinterests method of accounting. Under this accountingmethod, the assets and liabilities of <strong>Lockheed</strong>and <strong>Martin</strong> Marietta were carried forward to<strong>Lockheed</strong> <strong>Martin</strong> at their historical recordedbases. Subsequent to the Business Combination,<strong>Lockheed</strong>, <strong>Martin</strong> Marietta and certain othersubsidiaries were merged with and into theCorporation. The accompanying consolidatedfinancial statements, which reflect the combinedbalance sheets, results of operations and cash flowsfor <strong>Lockheed</strong> <strong>Martin</strong>, have been derived from thebalance sheets, results of operations and cash flowsof the separate Corporations for periods before theBusiness Combination, combined, reclassified andconformed, as appropriate, to reflect amounts forthe combined entity. Sales and earnings of theindividual entities were as follows:(In millions, except per share data)Year ended December 31, 1994:Net salesEarnings before cumulative effect ofchange in accountingEarnings per share before cumulativeeffect of change in accounting,assuming full dilutionYear ended December 31, 1993:Net salesNet earningsEarnings per share, assuming full dilutionAs Previously <strong>Report</strong>ed<strong>Lockheed</strong>$13,1304454.29 (a)$13,0714224.11 (a) <strong>Martin</strong>Marietta$9,8746365.05$9,436450 (b)3.80 (b) CombiningAdjustments$ (98)(26).$(110)(43)—<strong>Lockheed</strong><strong>Martin</strong>Combined$22,906(a) Amounts for <strong>Lockheed</strong> have been adjusted for the 1.63 exchange ratio related to the Business Combination.(b) Amounts for <strong>Martin</strong> Marietta do not include the cumulative effect of changes in accounting for post-retirement benefits other than pensions and forpostemployment benefits as the timing of the adoption of such changes was adjusted to January 1, 1992 to conform to <strong>Lockheed</strong>'s timing of adoption.1,0554.83$22,3978293.75Combining adjustments were recorded toeliminate intercompany sales and cost of sales ineach year. No adjustments were made to eliminatethe related intercompany profit in ending inventoriesas such amounts were not material. Adjustmentswere also made to conform <strong>Lockheed</strong>'s method ofaccounting for timing differences in cost recognitionbetween SFAS No. 87, "Employers' Accountingfor Pensions," and applicable government contractaccounting principles to be consistent with <strong>Martin</strong>Marietta's method, and to conform <strong>Lockheed</strong>'s provisionsfor state income taxes to <strong>Martin</strong> Marietta'smethodology. Further adjustments were recorded toreflect the tax impact of these adjustments.During the first quarter of <strong>1995</strong>, theCorporation recorded a $165 million pretax chargefor merger related expenses. On June 26, <strong>1995</strong>,the Corporation announced a corporate-wide consolidationplan under which the Corporation wouldclose 12 facilities and laboratories as well as 26duplicative field offices in the U.S. and abroad, eliminatingup to approximately 12,000 positions. In conjunctionwith the announcement, the Corporationrecorded accruals for severance, lease terminationand certain other costs as well as approximately$220 million of adjustments to reflect affected realestate and other property, plant and equipment attheir estimated net realizable values. Under existing