1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

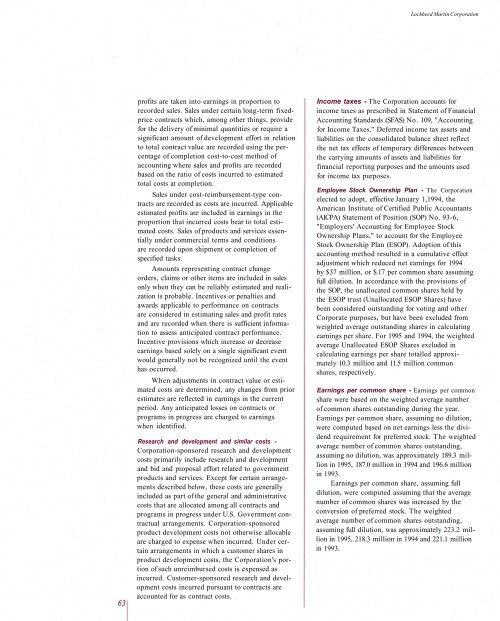

<strong>Lockheed</strong> <strong>Martin</strong> Corporationprofits are taken into earnings in proportion torecorded sales. Sales under certain long-term fixedpricecontracts which, among other things, providefor the delivery of minimal quantities or require asignificant amount of development effort in relationto total contract value are recorded using the percentageof completion cost-to-cost method ofaccounting where sales and profits are recordedbased on the ratio of costs incurred to estimatedtotal costs at completion.Sales under cost-reimbursement-type contractsare recorded as costs are incurred. Applicableestimated profits are included in earnings in theproportion that incurred costs bear to total estimatedcosts. Sales of products and services essentiallyunder commercial terms and conditionsare recorded upon shipment or completion ofspecified tasks.Amounts representing contract changeorders, claims or other items are included in salesonly when they can be reliably estimated and realizationis probable. Incentives or penalties andawards applicable to performance on contractsare considered in estimating sales and profit ratesand are recorded when there is sufficient informationto assess anticipated contract performance.Incentive provisions which increase or decreaseearnings based solely on a single significant eventwould generally not be recognized until the eventhas occurred.When adjustments in contract value or estimatedcosts are determined, any changes from priorestimates are reflected in earnings in the currentperiod. Any anticipated losses on contracts orprograms in progress are charged to earningswhen identified.Research and development and similar costs -Corporation-sponsored research and developmentcosts primarily include research and developmentand bid and proposal effort related to governmentproducts and services. Except for certain arrangementsdescribed below, these costs are generallyincluded as part of the general and administrativecosts that are allocated among all contracts andprograms in progress under U.S. Government contractualarrangements. Corporation-sponsoredproduct development costs not otherwise allocableare charged to expense when incurred. Under certainarrangements in which a customer shares inproduct development costs, the Corporation's portionof such unreimbursed costs is expensed asincurred. Customer-sponsored research and developmentcosts incurred pursuant to contracts areaccounted for as contract costs.Income taxes - The Corporation accounts forincome taxes as prescribed in Statement of FinancialAccounting Standards (SFAS) No. 109, "Accountingfor Income Taxes." Deferred income tax assets andliabilities on the consolidated balance sheet reflectthe net tax effects of temporary differences betweenthe carrying amounts of assets and liabilities forfinancial reporting purposes and the amounts usedfor income tax purposes.Employee Stock Ownership Plan - The Corporationelected to adopt, effective January 1,1994, theAmerican Institute of Certified Public Accountants(AICPA) Statement of Position (SOP) No. 93-6,"Employers' Accounting for Employee StockOwnership Plans," to account for the EmployeeStock Ownership Plan (ESOP). Adoption of thisaccounting method resulted in a cumulative effectadjustment which reduced net earnings for 1994by $37 million, or $.17 per common share assumingfull dilution. In accordance with the provisions ofthe SOP, the unallocated common shares held bythe ESOP trust (Unallocated ESOP Shares) havebeen considered outstanding for voting and otherCorporate purposes, but have been excluded fromweighted average outstanding shares in calculatingearnings per share. For <strong>1995</strong> and 1994, the weightedaverage Unallocated ESOP Shares excluded incalculating earnings per share totalled approximately10.3 million and 11.5 million commonshares, respectively.Earnings per common share - Earnings per commonshare were based on the weighted average numberof common shares outstanding during the year.Earnings per common share, assuming no dilution,were computed based on net earnings less the dividendrequirement for preferred stock. The weightedaverage number of common shares outstanding,assuming no dilution, was approximately 189.3 millionin <strong>1995</strong>, 187.0 million in 1994 and 196.6 millionin 1993.Earnings per common share, assuming fulldilution, were computed assuming that the averagenumber of common shares was increased by theconversion of preferred stock. The weightedaverage number of common shares outstanding,assuming full dilution, was approximately 223.2 millionin <strong>1995</strong>, 218.3 million in 1994 and 221.1 millionin 1993.