1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

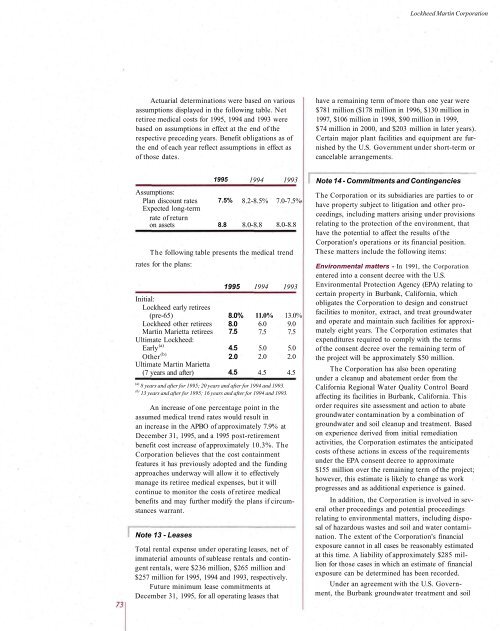

<strong>Lockheed</strong> <strong>Martin</strong> CorporationActuarial determinations were based on variousassumptions displayed in the following table. Netretiree medical costs for <strong>1995</strong>, 1994 and 1993 werebased on assumptions in effect at the end of therespective preceding years. Benefit obligations as ofthe end of each year reflect assumptions in effect asof those dates.have a remaining term of more than one year were$781 million ($178 million in 1996, $130 million in1997, $106 million in 1998, $90 million in 1999,$74 million in 2000, and $203 million in later years).Certain major plant facilities and equipment are furnishedby the U.S. Government under short-term orcancelable arrangements.Assumptions:Plan discount ratesExpected long-termrate of returnon assetsThe following table presents the medical trendrates for the plans:Initial:<strong>Lockheed</strong> early retirees(pre-65)<strong>Lockheed</strong> other retirees<strong>Martin</strong> Marietta retireesUltimate <strong>Lockheed</strong>:Early (a)Other (b)Ultimate <strong>Martin</strong> Marietta(7 years and after)(a) 8 years and after for <strong>1995</strong>; 20 years and after for 1994 and 1993.(b) 13 years and after for <strong>1995</strong>; 16 years and after for 1994 and 1993.An increase of one percentage point in theassumed medical trend rates would result inan increase in the APBO of approximately 7.9% atDecember 31, <strong>1995</strong>, and a <strong>1995</strong> post-retirementbenefit cost increase of approximately 10.3%. TheCorporation believes that the cost containmentfeatures it has previously adopted and the fundingapproaches underway will allow it to effectivelymanage its retiree medical expenses, but it willcontinue to monitor the costs of retiree medicalbenefits and may further modify the plans if circumstanceswarrant.Note 13 - Leases<strong>1995</strong>7.5%8.8<strong>1995</strong>8.0%8.07.54.52.04.519948.2-8.5%8.0-8.8199411.0%6.07.55.02.04.519937.0-7.5%8.0-8.81993Total rental expense under operating leases, net ofimmaterial amounts of sublease rentals and contingentrentals, were $236 million, $265 million and$257 million for <strong>1995</strong>, 1994 and 1993, respectively.Future minimum lease commitments atDecember 31, <strong>1995</strong>, for all operating leases that13.0%9.07.55.02.04.5Note 14 - Commitments and ContingenciesThe Corporation or its subsidiaries are parties to orhave property subject to litigation and other proceedings,including matters arising under provisionsrelating to the protection of the environment, thathave the potential to affect the results of theCorporation's operations or its financial position.These matters include the following items:Environmental matters - In 1991, the Corporationentered into a consent decree with the U.S.Environmental Protection Agency (EPA) relating tocertain property in Burbank, California, whichobligates the Corporation to design and constructfacilities to monitor, extract, and treat groundwaterand operate and maintain such facilities for approximatelyeight years. The Corporation estimates thatexpenditures required to comply with the termsof the consent decree over the remaining term ofthe project will be approximately $50 million.The Corporation has also been operatingunder a cleanup and abatement order from theCalifornia Regional Water Quality Control Boardaffecting its facilities in Burbank, California. Thisorder requires site assessment and action to abategroundwater contamination by a combination ofgroundwater and soil cleanup and treatment. Basedon experience derived from initial remediationactivities, the Corporation estimates the anticipatedcosts of these actions in excess of the requirementsunder the EPA consent decree to approximate$155 million over the remaining term of the project;however, this estimate is likely to change as workprogresses and as additional experience is gained.In addition, the Corporation is involved in severalother proceedings and potential proceedingsrelating to environmental matters, including disposalof hazardous wastes and soil and water contamination.The extent of the Corporation's financialexposure cannot in all cases be reasonably estimatedat this time. A liability of approximately $285 millionfor those cases in which an estimate of financialexposure can be determined has been recorded.Under an agreement with the U.S. Government,the Burbank groundwater treatment and soil