1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

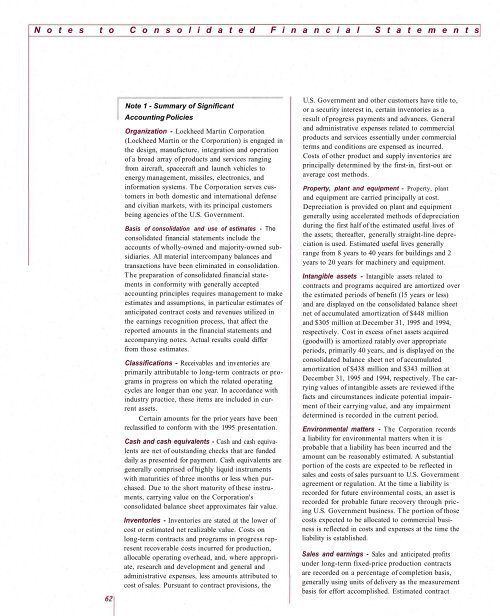

N o t e s t o C o n s o l i d a t e d F i n a n c i a l S t a t e m e n t s62Note 1 - Summary of SignificantAccounting PoliciesOrganization - <strong>Lockheed</strong> <strong>Martin</strong> Corporation(<strong>Lockheed</strong> <strong>Martin</strong> or the Corporation) is engaged inthe design, manufacture, integration and operationof a broad array of products and services rangingfrom aircraft, spacecraft and launch vehicles toenergy management, missiles, electronics, andinformation systems. The Corporation serves customersin both domestic and international defenseand civilian markets, with its principal customersbeing agencies of the U.S. Government.Basis of consolidation and use of estimates - Theconsolidated financial statements include theaccounts of wholly-owned and majority-owned subsidiaries.All material intercompany balances andtransactions have been eliminated in consolidation.The preparation of consolidated financial statementsin conformity with generally acceptedaccounting principles requires management to makeestimates and assumptions, in particular estimates ofanticipated contract costs and revenues utilized inthe earnings recognition process, that affect thereported amounts in the financial statements andaccompanying notes. Actual results could differfrom those estimates.Classifications - Receivables and inventories areprimarily attributable to long-term contracts or programsin progress on which the related operatingcycles are longer than one year. In accordance withindustry practice, these items are included in currentassets.Certain amounts for the prior years have beenreclassified to conform with the <strong>1995</strong> presentation.Cash and cash equivalents - Cash and cash equivalentsare net of outstanding checks that are fundeddaily as presented for payment. Cash equivalents aregenerally comprised of highly liquid instrumentswith maturities of three months or less when purchased.Due to the short maturity of these instruments,carrying value on the Corporation'sconsolidated balance sheet approximates fair value.Inventories - Inventories are stated at the lower ofcost or estimated net realizable value. Costs onlong-term contracts and programs in progress representrecoverable costs incurred for production,allocable operating overhead, and, where appropriate,research and development and general andadministrative expenses, less amounts attributed tocost of sales. Pursuant to contract provisions, theU.S. Government and other customers have title to,or a security interest in, certain inventories as aresult of progress payments and advances. Generaland administrative expenses related to commercialproducts and services essentially under commercialterms and conditions are expensed as incurred.Costs of other product and supply inventories areprincipally determined by the first-in, first-out oraverage cost methods.Property, plant and equipment - Property, plantand equipment are carried principally at cost.Depreciation is provided on plant and equipmentgenerally using accelerated methods of depreciationduring the first half of the estimated useful lives ofthe assets; thereafter, generally straight-line depreciationis used. Estimated useful lives generallyrange from 8 years to 40 years for buildings and 2years to 20 years for machinery and equipment.Intangible assets - Intangible assets related tocontracts and programs acquired are amortized overthe estimated periods of benefit (15 years or less)and are displayed on the consolidated balance sheetnet of accumulated amortization of $448 millionand $305 million at December 31, <strong>1995</strong> and 1994,respectively. Cost in excess of net assets acquired(goodwill) is amortized ratably over appropriateperiods, primarily 40 years, and is displayed on theconsolidated balance sheet net of accumulatedamortization of $438 million and $343 million atDecember 31, <strong>1995</strong> and 1994, respectively. The carryingvalues of intangible assets are reviewed if thefacts and circumstances indicate potential impairmentof their carrying value, and any impairmentdetermined is recorded in the current period.Environmental matters - The Corporation recordsa liability for environmental matters when it isprobable that a liability has been incurred and theamount can be reasonably estimated. A substantialportion of the costs are expected to be reflected insales and costs of sales pursuant to U.S. Governmentagreement or regulation. At the time a liability isrecorded for future environmental costs, an asset isrecorded for probable future recovery through pricingU.S. Government business. The portion of thosecosts expected to be allocated to commercial businessis reflected in costs and expenses at the time theliability is established.Sales and earnings - Sales and anticipated profitsunder long-term fixed-price production contractsare recorded on a percentage of completion basis,generally using units of delivery as the measurementbasis for effort accomplished. Estimated contract