1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

1995 Annual Report - Lockheed Martin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

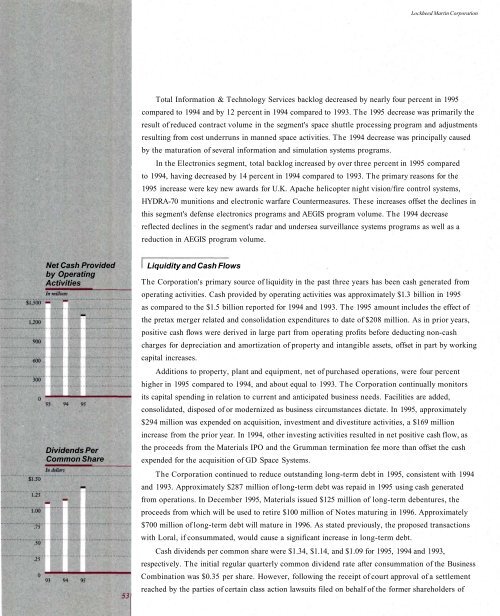

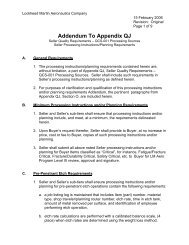

<strong>Lockheed</strong> <strong>Martin</strong> CorporationTotal Information & Technology Services backlog decreased by nearly four percent in <strong>1995</strong>compared to 1994 and by 12 percent in 1994 compared to 1993. The <strong>1995</strong> decrease was primarily theresult of reduced contract volume in the segment's space shuttle processing program and adjustmentsresulting from cost underruns in manned space activities. The 1994 decrease was principally causedby the maturation of several information and simulation systems programs.In the Electronics segment, total backlog increased by over three percent in <strong>1995</strong> comparedto 1994, having decreased by 14 percent in 1994 compared to 1993. The primary reasons for the<strong>1995</strong> increase were key new awards for U.K. Apache helicopter night vision/fire control systems,HYDRA-70 munitions and electronic warfare Countermeasures. These increases offset the declines inthis segment's defense electronics programs and AEGIS program volume. The 1994 decreasereflected declines in the segment's radar and undersea surveillance systems programs as well as areduction in AEGIS program volume.Net Cash Providedby OperatingActivitiesDividends PerCommon ShareLiquidity and Cash FlowsThe Corporation's primary source of liquidity in the past three years has been cash generated fromoperating activities. Cash provided by operating activities was approximately $1.3 billion in <strong>1995</strong>as compared to the $1.5 billion reported for 1994 and 1993. The <strong>1995</strong> amount includes the effect ofthe pretax merger related and consolidation expenditures to date of $208 million. As in prior years,positive cash flows were derived in large part from operating profits before deducting non-cashcharges for depreciation and amortization of property and intangible assets, offset in part by workingcapital increases.Additions to property, plant and equipment, net of purchased operations, were four percenthigher in <strong>1995</strong> compared to 1994, and about equal to 1993. The Corporation continually monitorsits capital spending in relation to current and anticipated business needs. Facilities are added,consolidated, disposed of or modernized as business circumstances dictate. In <strong>1995</strong>, approximately$294 million was expended on acquisition, investment and divestiture activities, a $169 millionincrease from the prior year. In 1994, other investing activities resulted in net positive cash flow, asthe proceeds from the Materials IPO and the Grumman termination fee more than offset the cashexpended for the acquisition of GD Space Systems.The Corporation continued to reduce outstanding long-term debt in <strong>1995</strong>, consistent with 1994and 1993. Approximately $287 million of long-term debt was repaid in <strong>1995</strong> using cash generatedfrom operations. In December <strong>1995</strong>, Materials issued $125 million of long-term debentures, theproceeds from which will be used to retire $100 million of Notes maturing in 1996. Approximately$700 million of long-term debt will mature in 1996. As stated previously, the proposed transactionswith Loral, if consummated, would cause a significant increase in long-term debt.Cash dividends per common share were $1.34, $1.14, and $1.09 for <strong>1995</strong>, 1994 and 1993,respectively. The initial regular quarterly common dividend rate after consummation of the BusinessCombination was $0.35 per share. However, following the receipt of court approval of a settlementreached by the parties of certain class action lawsuits filed on behalf of the former shareholders of