Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

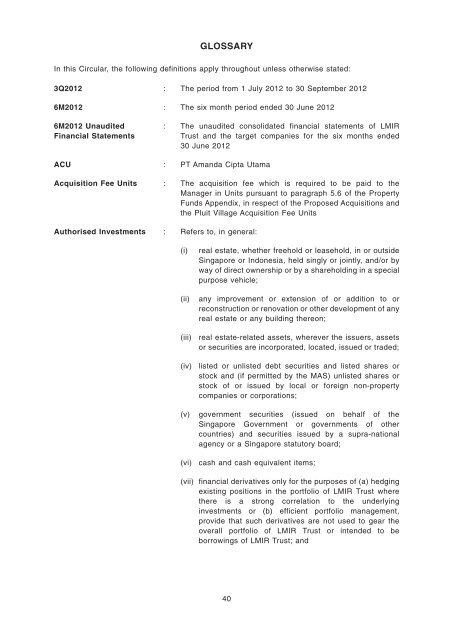

GLOSSARYIn this <strong>Circular</strong>, the following definitions apply throughout unless otherwise stated:3Q2012 : The period from 1 July 2012 to 30 September 20126M2012 : The six month period ended 30 June 20126M2012 UnauditedFinancial Statements: The unaudited consolidated financial statements of LMIR<strong>Trust</strong> and the target companies for the six months ended30 June 2012ACU : PT Amanda Cipta UtamaAcquisition Fee Units : The acquisition fee which is required to be paid to theManager in Units pursuant to paragraph 5.6 of the PropertyFunds Appendix, in respect of the Proposed Acquisitions andthe Pluit Village Acquisition Fee UnitsAuthorised Investments : Refers to, in general:(i)(ii)(iii)(iv)real estate, whether freehold or leasehold, in or outsideSingapore or <strong>Indonesia</strong>, held singly or jointly, and/or byway of direct ownership or by a shareholding in a specialpurpose vehicle;any improvement or extension of or addition to orreconstruction or renovation or other development of anyreal estate or any building thereon;real estate-related assets, wherever the issuers, assetsor securities are incorporated, located, issued or traded;listed or unlisted debt securities and listed shares orstock and (if permitted by the MAS) unlisted shares orstock of or issued by local or foreign non-propertycompanies or corporations;(v) government securities (issued on behalf of theSingapore Government or governments of othercountries) and securities issued by a supra-nationalagency or a Singapore statutory board;(vi)cash and cash equivalent items;(vii) financial derivatives only for the purposes of (a) hedgingexisting positions in the portfolio of LMIR <strong>Trust</strong> wherethere is a strong correlation to the underlyinginvestments or (b) efficient portfolio management,provide that such derivatives are not used to gear theoverall portfolio of LMIR <strong>Trust</strong> or intended to beborrowings of LMIR <strong>Trust</strong>; and40