Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

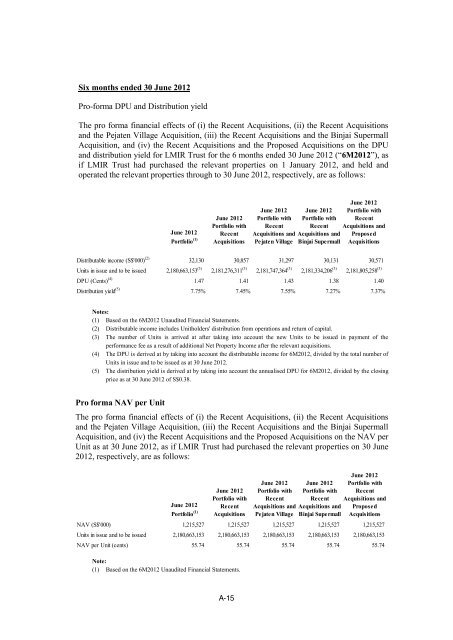

Six months ended 30 June 2012Pro-forma DPU and Distribution yieldThe pro forma financial effects of (i) the Recent Acquisitions, (ii) the Recent Acquisitionsand the Pejaten Village Acquisition, (iii) the Recent Acquisitions and the Binjai SupermallAcquisition, and (iv) the Recent Acquisitions and the Proposed Acquisitions on the DPUand distribution yield for LMIR <strong>Trust</strong> for the 6 months ended 30 June 2012 (“6M2012”), asif LMIR <strong>Trust</strong> had purchased the relevant properties on 1 January 2012, and held andoperated the relevant properties through to 30 June 2012, respectively, are as follows:June 2012Portfolio withJune 2012 RecentPortfolio (1) AcquisitionsJune 2012Portfolio withRecentAcquisitions andPejaten VillageJune 2012Portfolio withRecentAcquisitions andBinjai SupermallJune 2012Portfolio withRecentAcquisitions andProposedAcquisitionsDistributable income (S$'000) (2) 32,130 30,857 31,297 30,131 30,571Units in issue and to be issued 2,180,663,153 (3) 2,181,276,311 (3) 2,181,747,364 (3) 2,181,334,206 (3) 2,181,805,258 (3)DPU (Cents) (4) 1.47 1.41 1.43 1.38 1.40Distribution yield (5) 7.75% 7.45% 7.55% 7.27% 7.37%Notes:(1) Based on the 6M2012 Unaudited Financial Statements.(2) Distributable income includes Unitholders' distribution from operations and return of capital.(3) The number of Units is arrived at after taking into account the new Units to be issued in payment of theperformance fee as a result of additional Net Property Income after the relevant acquisitions.(4) The DPU is derived at by taking into account the distributable income for 6M2012, divided by the total number ofUnits in issue and to be issued as at 30 June 2012.(5) The distribution yield is derived at by taking into account the annualised DPU for 6M2012, divided by the closingprice as at 30 June 2012 of S$0.38.Pro forma NAV per UnitThe pro forma financial effects of (i) the Recent Acquisitions, (ii) the Recent Acquisitionsand the Pejaten Village Acquisition, (iii) the Recent Acquisitions and the Binjai SupermallAcquisition, and (iv) the Recent Acquisitions and the Proposed Acquisitions on the NAV perUnit as at 30 June 2012, as if LMIR <strong>Trust</strong> had purchased the relevant properties on 30 June2012, respectively, are as follows:June 2012Portfolio (1) June 2012Portfolio withRecentAcquisitionsJune 2012Portfolio withRecentAcquisitions andPejaten VillageJune 2012Portfolio withRecentAcquisitions andBinjai SupermallJune 2012Portfolio withRecentAcquisitions andProposedAcquisitionsNAV (S$'000) 1,215,527 1,215,527 1,215,527 1,215,527 1,215,527Units in issue and to be issued 2,180,663,153 2,180,663,153 2,180,663,153 2,180,663,153 2,180,663,153NAV per Unit (cents) 55.74 55.74 55.74 55.74 55.74Note:(1) Based on the 6M2012 Unaudited Financial Statements.A-15