Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

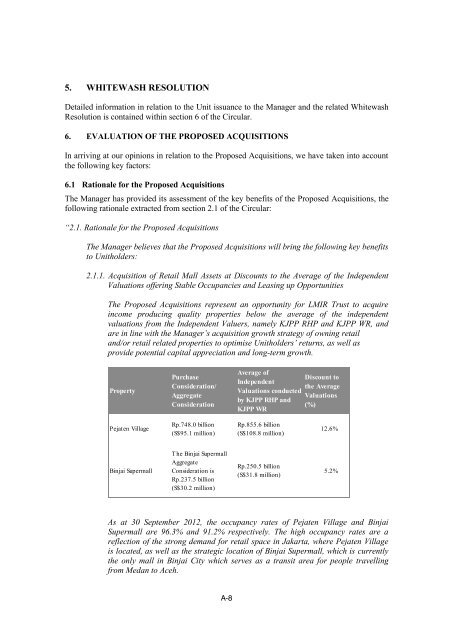

5. WHITEWASH RESOLUTIONDetailed information in relation to the Unit issuance to the Manager and the related WhitewashResolution is contained within section 6 of the <strong>Circular</strong>.6. EVALUATION OF THE PROPOSED ACQUISITIONSIn arriving at our opinions in relation to the Proposed Acquisitions, we have taken into accountthe following key factors:6.1 Rationale for the Proposed AcquisitionsThe Manager has provided its assessment of the key benefits of the Proposed Acquisitions, thefollowing rationale extracted from section 2.1 of the <strong>Circular</strong>:“2.1. Rationale for the Proposed AcquisitionsThe Manager believes that the Proposed Acquisitions will bring the following key benefitsto Unitholders:2.1.1. Acquisition of <strong>Retail</strong> Mall Assets at Discounts to the Average of the IndependentValuations offering Stable Occupancies and Leasing up OpportunitiesThe Proposed Acquisitions represent an opportunity for LMIR <strong>Trust</strong> to acquireincome producing quality properties below the average of the independentvaluations from the Independent Valuers, namely KJPP RHP and KJPP WR, andare in line with the Manager’s acquisition growth strategy of owning retailand/or retail related properties to optimise Unitholders’ returns, as well asprovide potential capital appreciation and long-term growth.PropertyPurchaseConsideration/AggregateConsiderationAverage ofIndependentValuations conductedby KJPP RHP andKJPP WRDiscount tothe AverageValuations(%)Pejaten VillageRp.748.0 billion(S$95.1 million)Rp.855.6 billion(S$108.8 million)12.6%Binjai SupermallThe Binjai SupermallAggregateConsideration isRp.237.5 billion(S$30.2 million)Rp.250.5 billion(S$31.8 million)5.2%As at 30 September 2012, the occupancy rates of Pejaten Village and BinjaiSupermall are 96.3% and 91.2% respectively. The high occupancy rates are areflection of the strong demand for retail space in Jakarta, where Pejaten Villageis located, as well as the strategic location of Binjai Supermall, which is currentlythe only mall in Binjai City which serves as a transit area for people travellingfrom Medan to Aceh.A-8