Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

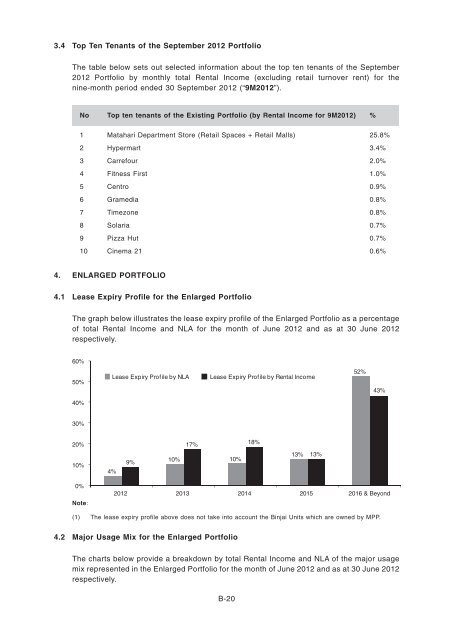

3.4 Top Ten Tenants of the September 2012 PortfolioThe table below sets out selected information about the top ten tenants of the September2012 Portfolio by monthly total Rental Income (excluding retail turnover rent) for thenine-month period ended 30 September 2012 (“9M2012”).No Top ten tenants of the Existing Portfolio (by Rental Income for 9M2012) %1 Matahari Department Store (<strong>Retail</strong> Spaces + <strong>Retail</strong> <strong>Malls</strong>) 25.8%2 Hypermart 3.4%3 Carrefour 2.0%4 Fitness First 1.0%5 Centro 0.9%6 Gramedia 0.8%7 Timezone 0.8%8 Solaria 0.7%9 Pizza Hut 0.7%10 Cinema 21 0.6%4. ENLARGED PORTFOLIO4.1 Lease Expiry Profile for the Enlarged PortfolioThe graph below illustrates the lease expiry profile of the Enlarged Portfolio as a percentageof total Rental Income and NLA for the month of June 2012 and as at 30 June 2012respectively.60%50%Lease Expiry Profile by NLALease Expiry Profile by Rental Income52%43%40%30%20%10%4%9%17%10% 10%18%13%13%0%Note:2012 2013 2014 2015 2016 & Beyond(1) The lease expiry profile above does not take into account the Binjai Units which are owned by MPP.4.2 Major Usage Mix for the Enlarged PortfolioThe charts below provide a breakdown by total Rental Income and NLA of the major usagemix represented in the Enlarged Portfolio for the month of June 2012 and as at 30 June 2012respectively.B-20