Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

Circular - Lippo Malls Indonesia Retail Trust - Investor Relations

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

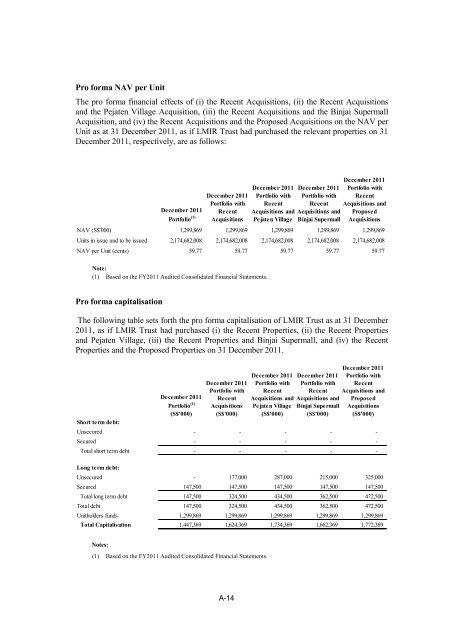

Pro forma NAV per UnitThe pro forma financial effects of (i) the Recent Acquisitions, (ii) the Recent Acquisitionsand the Pejaten Village Acquisition, (iii) the Recent Acquisitions and the Binjai SupermallAcquisition, and (iv) the Recent Acquisitions and the Proposed Acquisitions on the NAV perUnit as at 31 December 2011, as if LMIR <strong>Trust</strong> had purchased the relevant properties on 31December 2011, respectively, are as follows:December 2011December 2011 December 2011 Portfolio withPortfolio (1) Acquisitions Pejaten Village Binjai Supermall AcquisitionsDecember 2011Portfolio withPortfolio withRecentPortfolio withRecentRecentAcquisitions andDecember 2011 Recent Acquisitions and Acquisitions and ProposedNAV (S$'000) 1,299,869 1,299,869 1,299,869 1,299,869 1,299,869Units in issue and to be issued 2,174,682,008 2,174,682,008 2,174,682,008 2,174,682,008 2,174,682,008NAV per Unit (cents) 59.77 59.77 59.77 59.77 59.77Note:(1) Based on the FY2011 Audited Consolidated Financial Statements.Pro forma capitalisationThe following table sets forth the pro forma capitalisation of LMIR <strong>Trust</strong> as at 31 December2011, as if LMIR <strong>Trust</strong> had purchased (i) the Recent Properties, (ii) the Recent Propertiesand Pejaten Village, (iii) the Recent Properties and Binjai Supermall, and (iv) the RecentProperties and the Proposed Properties on 31 December 2011.December 2011December 2011 December 2011 Portfolio withPortfolio (1) Acquisitions Pejaten Village Binjai Supermall AcquisitionsDecember 2011Portfolio withPortfolio withRecentPortfolio withRecentRecentAcquisitions andDecember 2011 Recent Acquisitions and Acquisitions and Proposed(S$'000) (S$'000) (S$'000) (S$'000) (S$'000)Short term debt:Unsecured - - - - -Secured - - - - -Total short term debt - - - - -Long term debt:Unsecured - 177,000 287,000 215,000 325,000Secured 147,500 147,500 147,500 147,500 147,500Total long term debt 147,500 324,500 434,500 362,500 472,500Total debt 147,500 324,500 434,500 362,500 472,500Unitholders funds 1,299,869 1,299,869 1,299,869 1,299,869 1,299,869Total Capitalisation 1,447,369 1,624,369 1,734,369 1,662,369 1,772,369Notes:(1) Based on the FY2011 Audited Consolidated Financial Statements.A-14