Full-year - Chime Communications PLC

Full-year - Chime Communications PLC

Full-year - Chime Communications PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

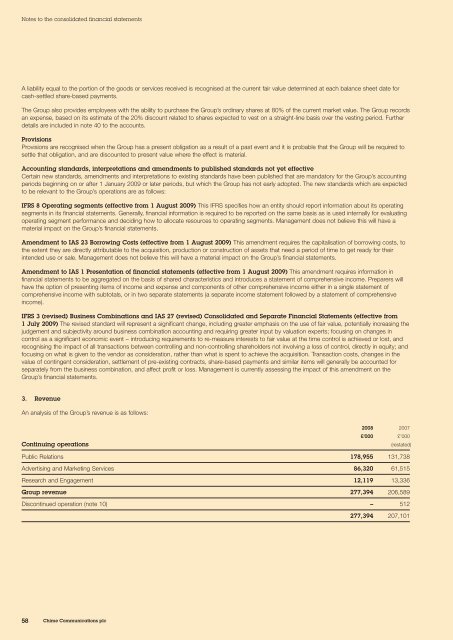

Notes to the consolidated financial statementsA liability equal to the portion of the goods or services received is recognised at the current fair value determined at each balance sheet date forcash-settled share-based payments.The Group also provides employees with the ability to purchase the Group’s ordinary shares at 80% of the current market value. The Group recordsan expense, based on its estimate of the 20% discount related to shares expected to vest on a straight-line basis over the vesting period. Furtherdetails are included in note 40 to the accounts.ProvisionsProvisions are recognised when the Group has a present obligation as a result of a past event and it is probable that the Group will be required tosettle that obligation, and are discounted to present value where the effect is material.Accounting standards, interpretations and amendments to published standards not yet effectiveCertain new standards, amendments and interpretations to existing standards have been published that are mandatory for the Group’s accountingperiods beginning on or after 1 January 2009 or later periods, but which the Group has not early adopted. The new standards which are expectedto be relevant to the Group’s operations are as follows:IFRS 8 Operating segments (effective from 1 August 2009) This IFRS specifies how an entity should report information about its operatingsegments in its financial statements. Generally, financial information is required to be reported on the same basis as is used internally for evaluatingoperating segment performance and deciding how to allocate resources to operating segments. Management does not believe this will have amaterial impact on the Group’s financial statements.Amendment to IAS 23 Borrowing Costs (effective from 1 August 2009) This amendment requires the capitalisation of borrowing costs, tothe extent they are directly attributable to the acquisition, production or construction of assets that need a period of time to get ready for theirintended use or sale. Management does not believe this will have a material impact on the Group’s financial statements.Amendment to IAS 1 Presentation of financial statements (effective from 1 August 2009) This amendment requires information infinancial statements to be aggregated on the basis of shared characteristics and introduces a statement of comprehensive income. Preparers willhave the option of presenting items of income and expense and components of other comprehensive income either in a single statement ofcomprehensive income with subtotals, or in two separate statements (a separate income statement followed by a statement of comprehensiveincome).IFRS 3 (revised) Business Combinations and IAS 27 (revised) Consolidated and Separate Financial Statements (effective from1 July 2009) The revised standard will represent a significant change, including greater emphasis on the use of fair value, potentially increasing thejudgement and subjectivity around business combination accounting and requiring greater input by valuation experts; focusing on changes incontrol as a significant economic event – introducing requirements to re-measure interests to fair value at the time control is achieved or lost, andrecognising the impact of all transactions between controlling and non-controlling shareholders not involving a loss of control, directly in equity; andfocusing on what is given to the vendor as consideration, rather than what is spent to achieve the acquisition. Transaction costs, changes in thevalue of contingent consideration, settlement of pre-existing contracts, share-based payments and similar items will generally be accounted forseparately from the business combination, and affect profit or loss. Management is currently assessing the impact of this amendment on theGroup’s financial statements.3. RevenueAn analysis of the Group’s revenue is as follows:Continuing operations2008 2007£’000 £’000(restated)Public Relations 178,955 131,738Advertising and Marketing Services 86,320 61,515Research and Engagement 12,119 13,336Group revenue 277,394 206,589Discontinued operation (note 10) – 512277,394 207,10158<strong>Chime</strong> <strong>Communications</strong> plc