w 109 long-run economic aspects of the european union's eastern ...

w 109 long-run economic aspects of the european union's eastern ...

w 109 long-run economic aspects of the european union's eastern ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

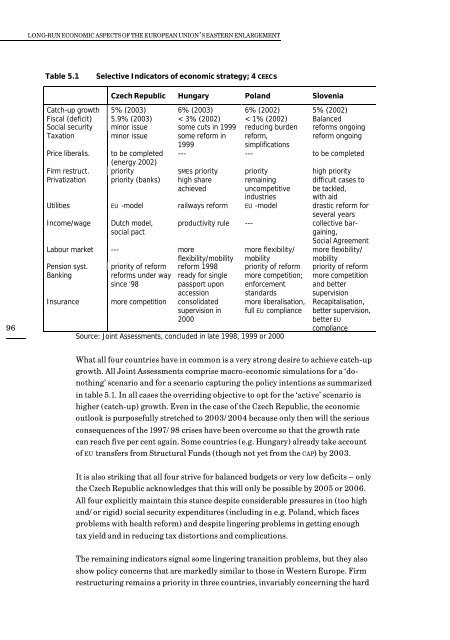

LONG-RUN ECONOMIC ASPECTS OF THE EUROPEAN UNION’S EASTERN ENLARGEMENTTable 5.1Selective Indicators <strong>of</strong> <strong>economic</strong> strategy; 4 CEECsCzech Republic Hungary Poland Slovenia96Catch-up growth 5% (2003) 6% (2003) 6% (2002) 5% (2002)Fiscal (deficit) 5.9% (2003) < 3% (2002) < 1% (2002) BalancedSocial security minor issue some cuts in 1999 reducing burden reforms ongoingTaxation minor issue some reform in reform, reform ongoing1999simplificationsPrice liberalis. to be completed(energy 2002)--- --- to be completedFirm restruct. priority SMEs priority priority high priorityPrivatization priority (banks) high share remainingachieved uncompetitivedifficult cases tobe tackled,industries with aidUtilities EU -model railways reform EU -model drastic reform forseveral yearsIncome/wageDutch model,social pactproductivity rule --- collective bargaining,Social AgreementLabour market --- moreflexibility/mobilitymore flexibility/mobilitymore flexibility/mobilityPension syst. priority <strong>of</strong> reform reform 1998 priority <strong>of</strong> reform priority <strong>of</strong> reformBanking reforms under waysince ‘98ready for singlepassport uponmore competition;enforcementmore competitionand betteraccessionInsurance more competition consolidatedsupervision in2000standardsmore liberalisation,full EU complianceSource: Joint Assessments, concluded in late 1998, 1999 or 2000supervisionRecapitalisation,better supervision,better EUcomplianceWhat all four countries have in common is a very strong desire to achieve catch-upgrowth. All Joint Assessments comprise macro-<strong>economic</strong> simulations for a ‘donothing’scenario and for a scenario capturing <strong>the</strong> policy intentions as summarizedin table 5.1. In all cases <strong>the</strong> overriding objective to opt for <strong>the</strong> ‘active’ scenario ishigher (catch-up) growth. Even in <strong>the</strong> case <strong>of</strong> <strong>the</strong> Czech Republic, <strong>the</strong> <strong>economic</strong>outlook is purposefully stretched to 2003/2004 because only <strong>the</strong>n will <strong>the</strong> seriousconsequences <strong>of</strong> <strong>the</strong> 1997/98 crises have been overcome so that <strong>the</strong> growth ratecan reach five per cent again. Some countries (e.g. Hungary) already take account<strong>of</strong> EU transfers from Structural Funds (though not yet from <strong>the</strong> CAP) by 2003.It is also striking that all four strive for balanced budgets or very low deficits – only<strong>the</strong> Czech Republic acknowledges that this will only be possible by 2005 or 2006.All four explicitly maintain this stance despite considerable pressures in (too highand/or rigid) social security expenditures (including in e.g. Poland, which facesproblems with health reform) and despite lingering problems in getting enoughtax yield and in reducing tax distortions and complications.The remaining indicators signal some lingering transition problems, but <strong>the</strong>y alsoshow policy concerns that are markedly similar to those in Western Europe. Firmrestructuring remains a priority in three countries, invariably concerning <strong>the</strong> hard