Annual Report Accounts 2012 - Tribal

Annual Report Accounts 2012 - Tribal

Annual Report Accounts 2012 - Tribal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

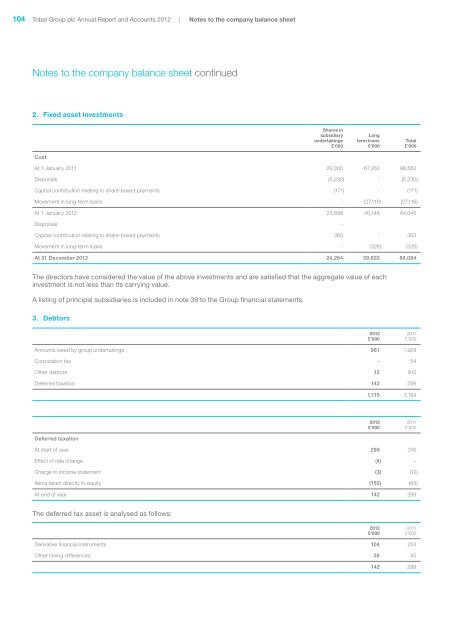

104<strong>Tribal</strong> Group plc <strong>Annual</strong> <strong>Report</strong> and <strong>Accounts</strong> <strong>2012</strong> | Notes to the company balance sheetNotes to the company balance sheet continued2. Fixed asset investmentsShares insubsidiaryundertakings£’000Longterm loans£’000Total£’000CostAt 1 January 2011 29,300 67,262 96,562Disposals (5,230) - (5,230)Capital contribution relating to share-based payments (171) - (171)Movement in long-term loans - (27,116) (27,116)At 1 January <strong>2012</strong> 23,899 40,146 64,045Disposals -Capital contribution relating to share-based payments 365 - 365Movement in long-term loans - (326) (326)At 31 December <strong>2012</strong> 24,264 39,820 64,084The directors have considered the value of the above investments and are satisfied that the aggregate value of eachinvestment is not less than its carrying value.A listing of principal subsidiaries is included in note 39 to the Group financial statements.3. Debtors<strong>2012</strong>£’0002011£’000Amounts owed by group undertakings 961 1,929Corporation tax - 54Other debtors 12 912Deferred taxation 142 2991,115 3,194<strong>2012</strong>£’0002011£’000Deferred taxationAt start of year 299 376Effect of rate change (4) -Charge to income statement (3) (12)Items taken directly to equity (150) (65)At end of year 142 299The deferred tax asset is analysed as follows:<strong>2012</strong>£’0002011£’000Derivative financial instruments 104 254Other timing differences 38 45142 299