Annual Report Accounts 2012 - Tribal

Annual Report Accounts 2012 - Tribal

Annual Report Accounts 2012 - Tribal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

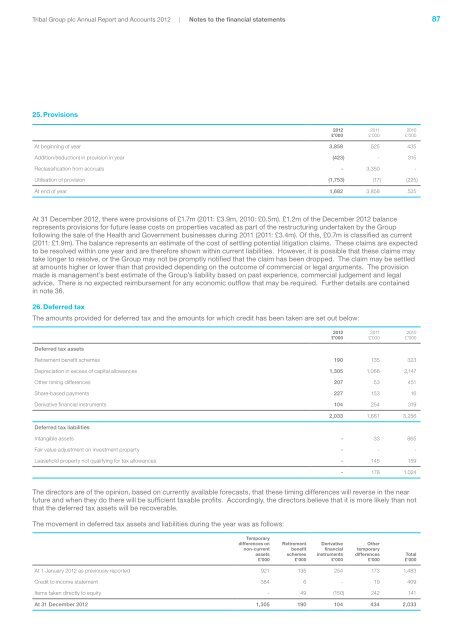

<strong>Tribal</strong> Group plc <strong>Annual</strong> <strong>Report</strong> and <strong>Accounts</strong> <strong>2012</strong> | Notes to the financial statements8725. Provisions<strong>2012</strong>£’0002011£’0002010£’000At beginning of year 3,858 525 435Addition/(reduction) in provision in year (423) - 315Reclassification from accruals - 3,350 -Utilisation of provision (1,753) (17) (225)At end of year 1,682 3,858 525At 31 December <strong>2012</strong>, there were provisions of £1.7m (2011: £3.9m, 2010: £0.5m). £1.2m of the December <strong>2012</strong> balancerepresents provisions for future lease costs on properties vacated as part of the restructuring undertaken by the Groupfollowing the sale of the Health and Government businesses during 2011 (2011: £3.4m). Of this, £0.7m is classified as current(2011: £1.9m). The balance represents an estimate of the cost of settling potential litigation claims. These claims are expectedto be resolved within one year and are therefore shown within current liabilities. However, it is possible that these claims maytake longer to resolve, or the Group may not be promptly notified that the claim has been dropped. The claim may be settledat amounts higher or lower than that provided depending on the outcome of commercial or legal arguments. The provisionmade is management’s best estimate of the Group’s liability based on past experience, commercial judgement and legaladvice. There is no expected reimbursement for any economic outflow that may be required. Further details are containedin note 36.26. Deferred taxThe amounts provided for deferred tax and the amounts for which credit has been taken are set out below:<strong>2012</strong>£’0002011£’0002010£’000Deferred tax assetsRetirement benefit schemes 190 135 323Depreciation in excess of capital allowances 1,305 1,066 2,147Other timing differences 207 53 451Share-based payments 227 153 16Derivative financial instruments 104 254 3192,033 1,661 3,256Deferred tax liabilitiesIntangible assets - 33 865Fair value adjustment on investment property - - -Leasehold property not qualifying for tax allowances - 145 159- 178 1,024The directors are of the opinion, based on currently available forecasts, that these timing differences will reverse in the nearfuture and when they do there will be sufficient taxable profits. Accordingly, the directors believe that it is more likely than notthat the deferred tax assets will be recoverable.The movement in deferred tax assets and liabilities during the year was as follows:Temporarydifferences onnon-currentassets£’000Retirementbenefitschemes£’000Derivativefinancialinstruments£’000Othertemporarydifferences£’000Total£’000At 1 January <strong>2012</strong> as previously reported 921 135 254 173 1,483Credit to income statement 384 6 - 19 409Items taken directly to equity - 49 (150) 242 141At 31 December <strong>2012</strong> 1,305 190 104 434 2,033