Annual Report Accounts 2012 - Tribal

Annual Report Accounts 2012 - Tribal

Annual Report Accounts 2012 - Tribal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

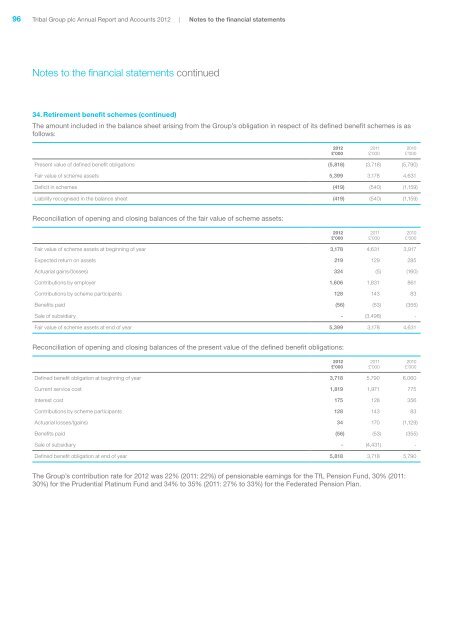

96<strong>Tribal</strong> Group plc <strong>Annual</strong> <strong>Report</strong> and <strong>Accounts</strong> <strong>2012</strong> | Notes to the financial statementsNotes to the financial statements continued34. Retirement benefit schemes (continued)The amount included in the balance sheet arising from the Group’s obligation in respect of its defined benefit schemes is asfollows:<strong>2012</strong>£’0002011£’0002010£’000Present value of defined benefit obligations (5,818) (3,718) (5,790)Fair value of scheme assets 5,399 3,178 4,631Deficit in schemes (419) (540) (1,159)Liability recognised in the balance sheet (419) (540) (1,159)Reconciliation of opening and closing balances of the fair value of scheme assets:<strong>2012</strong>£’0002011£’0002010£’000Fair value of scheme assets at beginning of year 3,178 4,631 3,917Expected return on assets 219 129 285Actuarial gains/(losses) 324 (5) (160)Contributions by employer 1,606 1,831 861Contributions by scheme participants 128 143 83Benefits paid (56) (53) (355)Sale of subsidiary - (3,498) -Fair value of scheme assets at end of year 5,399 3,178 4,631Reconciliation of opening and closing balances of the present value of the defined benefit obligations:<strong>2012</strong>£’0002011£’0002010£’000Defined benefit obligation at beginning of year 3,718 5,790 6,060Current service cost 1,819 1,971 775Interest cost 175 128 356Contributions by scheme participants 128 143 83Actuarial losses/(gains) 34 170 (1,129)Benefits paid (56) (53) (355)Sale of subsidiary - (4,431) -Defined benefit obligation at end of year 5,818 3,718 5,790The Group’s contribution rate for <strong>2012</strong> was 22% (2011: 22%) of pensionable earnings for the TfL Pension Fund, 30% (2011:30%) for the Prudential Platinum Fund and 34% to 35% (2011: 27% to 33%) for the Federated Pension Plan.