Annual Report Accounts 2012 - Tribal

Annual Report Accounts 2012 - Tribal

Annual Report Accounts 2012 - Tribal

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

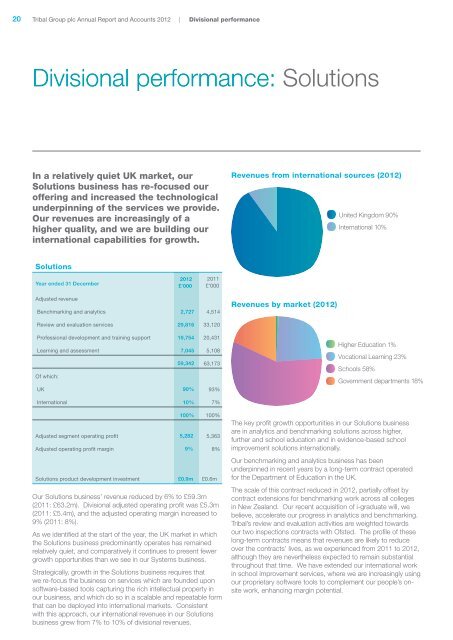

20<strong>Tribal</strong> Group plc <strong>Annual</strong> <strong>Report</strong> and <strong>Accounts</strong> <strong>2012</strong> | Divisional performanceDivisional performance: SolutionsIn a relatively quiet UK market, ourSolutions business has re-focused ouroffering and increased the technologicalunderpinning of the services we provide.Our revenues are increasingly of ahigher quality, and we are building ourinternational capabilities for growth.Revenues from international sources (<strong>2012</strong>)United Kingdom 90%International 10%SolutionsYear ended 31 December<strong>2012</strong>£’0002011£’000Adjusted revenueBenchmarking and analytics 2,727 4,514Revenues by market (<strong>2012</strong>)Review and evaluation services 29,816 33,120Professional development and training support 19,754 20,431Learning and assessment 7,045 5,10859,342 63,173Of which:UK 90% 93%Higher Education 1%Vocational Learning 23%Schools 58%Government departments 18%International 10% 7%100% 100%Adjusted segment operating profit 5,282 5,363Adjusted operating profit margin 9% 8%Solutions product development investment £0.9m £0.6mOur Solutions business’ revenue reduced by 6% to £59.3m(2011: £63.2m). Divisional adjusted operating profit was £5.3m(2011: £5.4m), and the adjusted operating margin increased to9% (2011: 8%).As we identified at the start of the year, the UK market in whichthe Solutions business predominantly operates has remainedrelatively quiet, and comparatively it continues to present fewergrowth opportunities than we see in our Systems business.Strategically, growth in the Solutions business requires thatwe re-focus the business on services which are founded uponsoftware-based tools capturing the rich intellectual property inour business, and which do so in a scalable and repeatable formthat can be deployed into international markets. Consistentwith this approach, our international revenues in our Solutionsbusiness grew from 7% to 10% of divisional revenues.The key profit growth opportunities in our Solutions businessare in analytics and benchmarking solutions across higher,further and school education and in evidence-based schoolimprovement solutions internationally.Our benchmarking and analytics business has beenunderpinned in recent years by a long-term contract operatedfor the Department of Education in the UK.The scale of this contract reduced in <strong>2012</strong>, partially offset bycontract extensions for benchmarking work across all collegesin New Zealand. Our recent acquisition of i-graduate will, webelieve, accelerate our progress in analytics and benchmarking.<strong>Tribal</strong>’s review and evaluation activities are weighted towardsour two inspections contracts with Ofsted. The profile of theselong-term contracts means that revenues are likely to reduceover the contracts’ lives, as we experienced from 2011 to <strong>2012</strong>,although they are nevertheless expected to remain substantialthroughout that time. We have extended our international workin school improvement services, where we are increasingly usingour proprietary software tools to complement our people’s onsitework, enhancing margin potential.