- Page 1 and 2:

CHAPTER THREEAFFECTED ENVIRONMENT3.

- Page 3 and 4:

The CDCA Plan assigns a “multiple

- Page 5 and 6:

Desert Tortoise Research Natural Ar

- Page 7 and 8:

closure to target shooting. Hunting

- Page 9 and 10:

percentage of public land ownership

- Page 11 and 12:

As of March 2004, BLM had acquired

- Page 13 and 14:

Ripley Joshua Tree Woodland: The st

- Page 15 and 16:

through “resource use” designat

- Page 17 and 18:

Significant Ecological Areas: There

- Page 19 and 20:

Wildlife and Wildflower Sanctuaries

- Page 21 and 22:

Mojave River Forks Regional Park: A

- Page 23 and 24:

oriented commercial uses are expect

- Page 25 and 26:

HCP would include mitigation measur

- Page 27 and 28:

3.1.3.12 City of RidgecrestThe City

- Page 29 and 30:

It is a goal of the town’s genera

- Page 31 and 32:

• Inyo California Towhee (April 1

- Page 33 and 34:

(i) The taking will be incidental;(

- Page 35 and 36:

handled, and number accidentally ki

- Page 37 and 38:

3.1.5 California Endangered Species

- Page 39 and 40:

Obtaining an Incidental Take Permit

- Page 41 and 42:

Monitoring: Monitoring is often the

- Page 43 and 44:

is so restrictive that project dela

- Page 45 and 46:

excess moisture. A minus 4 is consi

- Page 47 and 48:

Air BasinsN190I n y o C o395Ridgecr

- Page 49 and 50:

Federal PM10 Planning AreasN190Owen

- Page 51 and 52:

POLLUTANTOzone (O 3 )RespirablePart

- Page 53 and 54:

AIRBASINAIR QUALITYDISTRICTPOLLUTAN

- Page 55 and 56:

subtraction of transported ozone in

- Page 57 and 58:

The general soil information and ma

- Page 59 and 60:

The Marine Corps Ground Combat Cent

- Page 61 and 62:

The most permeable basin-fill depos

- Page 63 and 64:

Surface water was and is the major

- Page 65 and 66:

A relatively small number of introd

- Page 67 and 68:

freshwater or alkali wetlands, or o

- Page 69 and 70:

3.3.2 Desert Tortoise3.3.2.1 Regula

- Page 71 and 72:

progress toward meeting the overall

- Page 73 and 74:

“higher density” and “lower d

- Page 75 and 76:

several seasons (Esque 1994 in Aver

- Page 77 and 78:

Assistant District Manager Molly Br

- Page 79 and 80:

• Since 1975, federal land manage

- Page 81 and 82:

“52 mi 2 of higher density tortoi

- Page 83 and 84:

1984 Tortoise Range and Density Map

- Page 85 and 86:

Higher Density Tortoise Sign Count

- Page 87 and 88:

When data for the three lowest sign

- Page 89 and 90:

Occurrence of Tortoises Relative to

- Page 91 and 92:

Regional Declines in the Four DWMAs

- Page 93 and 94:

Tortoise Distribution within the Re

- Page 95 and 96:

Boarman (pers. comm., Nov 2002) has

- Page 97 and 98:

tortoises are either extirpated (La

- Page 99 and 100:

sites surveyed by LaRue between 199

- Page 101 and 102:

aseline data are lacking. Grasses p

- Page 103 and 104:

Canine Predators: This includes coy

- Page 105 and 106:

The spatial distribution of 12 of 1

- Page 107 and 108:

Predation Versus Scavenging of Juve

- Page 109 and 110:

Table 3-20Prevalence of Tortoises i

- Page 111 and 112:

(Jacobson et al. 1991, Brown et al.

- Page 113 and 114:

3.3.2.5.3 Older and Newer Die-off R

- Page 115 and 116:

Table 3-21Characteristics of Older

- Page 117 and 118:

Table 3-22Characteristics of Older

- Page 119 and 120:

of the Johnson Valley Open Area, an

- Page 121 and 122:

Distribution of Recreational and Re

- Page 123 and 124:

Tortoises and Burrows Crushed: Vehi

- Page 125 and 126:

TypeYearsSignCount98-99-01Distance2

- Page 127 and 128:

OHV Impacts to Soils: OHV use has r

- Page 129 and 130:

Rodman DWMA. There were no higher d

- Page 131 and 132:

of Dove Springs that has experience

- Page 133 and 134:

Both inside and adjacent to open ar

- Page 135 and 136:

3.3.2.6.6 Organized Competitive OHV

- Page 137 and 138:

3.3.2.7 Current Effectiveness of Ex

- Page 139 and 140:

Overall, one sees that 68% of the 3

- Page 141 and 142:

off regions discussed herein. Black

- Page 143 and 144:

ManixACECMojave fishhookcactusRainb

- Page 145 and 146:

Range of Mohave Ground SquirrelN190

- Page 147 and 148: 3.3.3.2.2 Seasonal ActivityThe MGS

- Page 149 and 150: 1996). As herbaceous annuals appear

- Page 151 and 152: 1998 Mohave Ground Squirrel Transec

- Page 153 and 154: Finally, the 84% success rate was a

- Page 155 and 156: LaRue characterized substrates at t

- Page 157 and 158: There were no MGS occurrences in 28

- Page 159 and 160: certain shrubs (e.g. winterfat) tha

- Page 161 and 162: NAWS China Lake 1993). As discussed

- Page 163 and 164: Cumulatively, one finds there to be

- Page 165 and 166: Citing Bury and Luckenbach (1977),

- Page 167 and 168: the MGS is restricted to about 7,00

- Page 169 and 170: Habitat Management Plans (HMPs) wer

- Page 171 and 172: Basic to the biology of bighorn she

- Page 173 and 174: 3.3.6 Birds3.3.6.1 Bendire’s Thra

- Page 175 and 176: 3.3.6.5 Golden EagleLife History: T

- Page 177 and 178: The towhee recovery plan establishe

- Page 179 and 180: Regulatory Status: Federal Endanger

- Page 181 and 182: 3.3.6.15 Western Yellow-billed Cuck

- Page 183 and 184: Other major threats are flood contr

- Page 185 and 186: Population Status in the Planning A

- Page 187 and 188: on the inaccessible mountain slopes

- Page 189 and 190: 3.3.8.8 Kern BuckwheatLife History:

- Page 191 and 192: Threats Affecting the Mojave Monkey

- Page 193 and 194: 3.3.8.16 Red Rock PoppyLife History

- Page 195 and 196: populations show intergradation wit

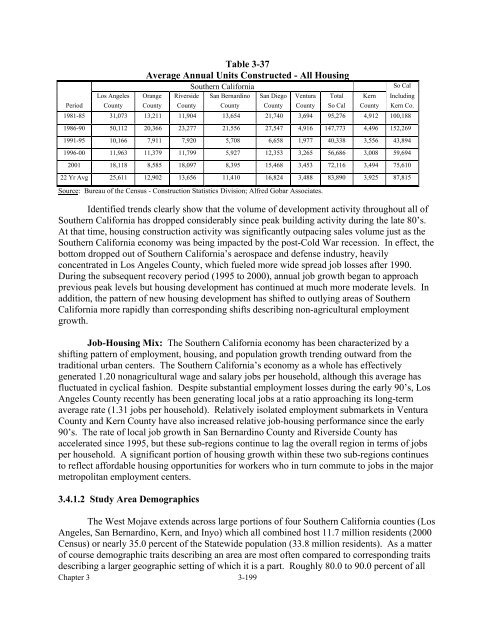

- Page 197: 3.4.1.1 Regional EnvironmentIn tota

- Page 201 and 202: 2002 SOUTHERN CALIFORNIAEMPLOYMENT

- Page 203 and 204: TABLE 3-382000 CENSUS DEMOGRAPHIC C

- Page 205 and 206: to undergo a dramatic reversal to t

- Page 207 and 208: 3.4.1.5 Study Area Property Valuati

- Page 209 and 210: The supply of private property in t

- Page 211 and 212: ALLOTMENT NAME TYPE OF LIVESTOCK FO

- Page 213 and 214: Grazing AllotmentsNOlanchaDarwinTun

- Page 215 and 216: ALLOTMENT NAMEALLOTMENTACRESP. L. 1

- Page 217 and 218: 3.4.3 Mineral Potential and Develop

- Page 219 and 220: Mineral Potential, Active and Inact

- Page 221 and 222: Mineral Potential, Active and Inact

- Page 223 and 224: development based on the results of

- Page 225 and 226: MANAGEMENT AREATable 3-46Potential

- Page 227 and 228: A third item, yttrium (on the USBM

- Page 229 and 230: the California Department of Conser

- Page 231 and 232: Table 3-49 shows the number of mini

- Page 233 and 234: produces about 75,000 tons per year

- Page 235 and 236: Table 3-50Most Important Deposits B

- Page 237 and 238: 3.4.3.5 Coolgardie MesaThe Coolgard

- Page 239 and 240: Areas designated as regionally sign

- Page 241 and 242: Recreationists engage in activities

- Page 243 and 244: OPENAREADoveSpringsElMirageJawboneC

- Page 245 and 246: cycle engine motorcycles in OHV rid

- Page 247 and 248: One popular activity is dual sport

- Page 249 and 250:

Compliance With Regulations: Compli

- Page 251 and 252:

REGIONORCITYRidgecrestSanBernardino

- Page 253 and 254:

REGIONORCITYVictorville /AppleValle

- Page 255 and 256:

Rail: The West Mojave planning area

- Page 257 and 258:

Arterials: Arterials are routes wit

- Page 259 and 260:

Ridgecrest-Inyokern Sanitary Landfi

- Page 261 and 262:

approximately 3 miles south of the

- Page 263 and 264:

Trona-Agrus Transfer Station (SWIS

- Page 265 and 266:

The BLM is an agency of the U.S. De

- Page 267 and 268:

Route designations apply only to ro

- Page 269 and 270:

Utility Maintenance: Many powerline

- Page 271 and 272:

ACECNAME ANDNUMBERHarper Dry Lake(3

- Page 273 and 274:

SUBREGIONAmboyBighornCoyoteEastSier

- Page 275 and 276:

• All pipelines with diameters gr

- Page 277 and 278:

3.6.2 Energy Generation PlantsEnerg

- Page 279 and 280:

3.7 CULTURAL RESOURCES3.7.1 Archaeo

- Page 281 and 282:

seasonal movement from place to pla

- Page 283 and 284:

RIDGECREST FIELD OFFICEPROPERTY NAM

- Page 285 and 286:

ACECRose SpringFossil FallsLast Cha

- Page 287 and 288:

have been dated by radiocarbon and

- Page 289 and 290:

MYACENOZOICEPOCHTable 3-65Paleontol

- Page 291 and 292:

In the southern area, fossils of la

- Page 293 and 294:

At Twenty-Nine Palms, there is an u