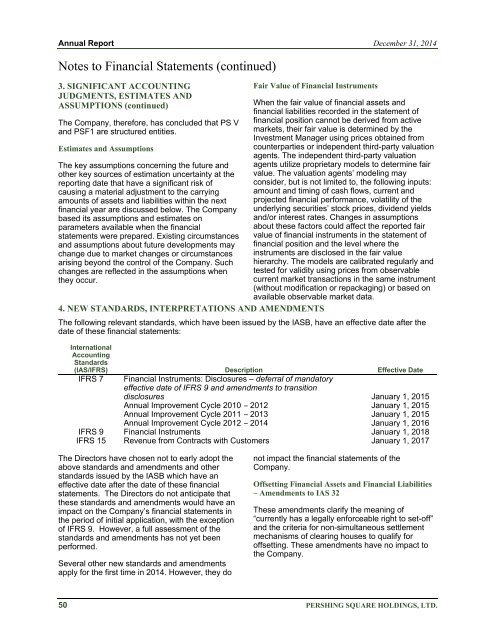

<strong>Annual</strong> <strong>Report</strong> December 31, 2014Notes to Financial Statements (continued)3. SIGNIFICANT ACCOUNTINGJUDGMENTS, ESTIMATES ANDASSUMPTIONS (continued)The Company, therefore, has concluded that PS Vand PSF1 are structured entities.Estimates and AssumptionsThe key assumptions concerning the future andother key sources of estimation uncertainty at thereporting date that have a significant risk ofcausing a material adjustment to the carryingamounts of assets and liabilities within the nextfinancial year are discussed below. The Companybased its assumptions and estimates onparameters available when the financialstatements were prepared. Existing circumstancesand assumptions about future developments maychange due to market changes or circumstancesarising beyond the control of the Company. Suchchanges are reflected in the assumptions whenthey occur.Fair Value of Financial Instruments4. NEW STANDARDS, INTERPRETATIONS AND AMENDMENTSWhen the fair value of financial assets andfinancial liabilities recorded in the statement offinancial position cannot be derived from activemarkets, their fair value is determined by theInvestment Manager using prices obtained fromcounterparties or independent third-party valuationagents. The independent third-party valuationagents utilize proprietary models to determine fairvalue. The valuation agents’ modeling mayconsider, but is not limited to, the following inputs:amount and timing of cash flows, current andprojected financial performance, volatility of theunderlying securities’ stock prices, dividend yieldsand/or interest rates. Changes in assumptionsabout these factors could affect the reported fairvalue of financial instruments in the statement offinancial position and the level where theinstruments are disclosed in the fair valuehierarchy. The models are calibrated regularly andtested for validity using prices from observablecurrent market transactions in the same instrument(without modification or repackaging) or based onavailable observable market data.The following relevant standards, which have been issued by the IASB, have an effective date after thedate of these financial statements:InternationalAccountingStandards(IAS/IFRS) Description Effective DateIFRS 7Financial Instruments: Disclosures – deferral of mandatoryeffective date of IFRS 9 and amendments to transitiondisclosures January 1, 2015<strong>Annual</strong> Improvement Cycle 2010 – 2012 January 1, 2015<strong>Annual</strong> Improvement Cycle 2011 – 2013 January 1, 2015<strong>Annual</strong> Improvement Cycle 2012 – 2014 January 1, 2016IFRS 9 Financial Instruments January 1, 2018IFRS 15 Revenue from Contracts with Customers January 1, 2017The Directors have chosen not to early adopt theabove standards and amendments and otherstandards issued by the IASB which have aneffective date after the date of these financialstatements. The Directors do not anticipate thatthese standards and amendments would have animpact on the Company’s financial statements inthe period of initial application, with the exceptionof IFRS 9. However, a full assessment of thestandards and amendments has not yet beenperformed.Several other new standards and amendmentsapply for the first time in 2014. However, they donot impact the financial statements of theCompany.Offsetting Financial Assets and Financial Liabilities– Amendments to IAS 32These amendments clarify the meaning of“currently has a legally enforceable right to set-off”and the criteria for non-simultaneous settlementmechanisms of clearing houses to qualify foroffsetting. These amendments have no impact tothe Company.50 PERSHING SQUARE HOLDINGS, LTD.

<strong>Annual</strong> <strong>Report</strong> December 31, 2014Notes to Financial Statements (continued)4. NEW STANDARDS, INTERPRETATIONSAND AMENDMENTS (continued)Novation of Derivatives and Continuation of HedgeAccounting – Amendments to IAS 39These amendments provide relief fromdiscontinuing hedge accounting when novation ofa derivative designated as a hedging instrumentmeets certain criteria. These amendments do notapply to the Company and have no impact on thefinancial statements.Recoverable Amount Disclosures for Non-FinancialAssets – Amendments to IAS 36These amendments remove the unintendedconsequences of IFRS 13 Fair ValueMeasurement on the disclosures required underIAS 36 Impairment of Assets. In addition, theseamendments require disclosure of the recoverableamounts for the assets or cash-generating units(“CGUs”) for which an impairment loss has beenrecognized or reversed during the period. Theseamendments do not apply to the Company andhave no impact on the financial statements.IFRIC 21 LeviesIFRIC 21 is effective for annual periods beginningon or after January 1, 2014 and is appliedretrospectively. It is applicable to all levies imposedby governments under legislation, other thanoutflows that are within the scope of otherstandards (e.g., IAS 12 Income Taxes) and fines orother penalties for breaches of legislation. IFRIC21 does not apply to the Company and has noimpact on the financial statements.5. SEGMENT INFORMATIONIn accordance with IFRS 8: Operating Segments, itis mandatory for the Company to present anddisclose segmental information based on theinternal reports that are regularly reviewed by theBoard in order to assess each segment’sperformance.Management information for the Company as awhole is provided internally to the Directors fordecision-making purposes. The Directors’decisions are based on a single integratedinvestment strategy and the Company’sperformance is evaluated on an overall basis. TheCompany has a portfolio of long and shortinvestments that the Board and InvestmentManager believe exhibit significant valuationdiscrepancies between current trading prices andintrinsic business value, often with a catalyst forvalue recognition. Therefore, the Directors are ofthe opinion that the Company is engaged in asingle economic segment of business for alldecision-making purposes. The financial results ofthis segment are equivalent to the results of theCompany as a whole.6. FINANCIAL ASSETS AND FINANCIALLIABILITIES AT FAIR VALUE THROUGHPROFIT AND LOSSFinancial assets at fair value through profit or loss2014 2013Financial assets atfair value throughprofit or lossInvestment in equitysecurities $ 5,791,187,783 $ 1,911,130,931Derivative financialinstruments 289,114,933 345,359,760Financial assets atfair value throughprofit or loss $ 6,080,302,716 $ 2,256,490,691Financial liabilities at fair value through profit or loss2014 2013Financial liabilities atfair value throughprofit or lossSecurities sold, not yetpurchased $ 391,285,125 $ 271,859,619Derivative financialinstruments 27,139,624 91,744,432Financial liabilities atfair value throughprofit or loss $ 418,424,749 $ 363,604,051PERSHING SQUARE HOLDINGS, LTD. 51

- Page 1 and 2: 2014 Annual Report

- Page 3 and 4: Annual Report Year Ended December 3

- Page 5 and 6: Annual Report Year Ended December 3

- Page 7 and 8: Annual Report Year Ended December 3

- Page 9 and 10: Annual Report Year Ended December 3

- Page 11 and 12: Annual Report Year Ended December 3

- Page 13 and 14: Annual Report Year Ended December 3

- Page 15 and 16: Annual Report Year Ended December 3

- Page 17 and 18: Annual Report Year Ended December 3

- Page 19 and 20: Annual Report Year Ended December 3

- Page 21 and 22: Annual Report Year Ended December 3

- Page 23 and 24: Annual Report Year Ended December 3

- Page 25 and 26: Annual Report Year Ended December 3

- Page 27 and 28: Annual Report Year Ended December 3

- Page 29 and 30: Annual Report Year Ended December 3

- Page 31 and 32: Annual Report Year Ended December 3

- Page 33 and 34: Annual Report Year Ended December 3

- Page 35 and 36: Annual Report Year Ended December 3

- Page 37 and 38: Annual Report Year Ended December 3

- Page 39 and 40: Annual Report Year Ended December 3

- Page 41 and 42: Annual Report December 31, 2014Stat

- Page 43 and 44: Annual Report Years Ended December

- Page 45 and 46: Annual Report Years Ended December

- Page 47 and 48: Annual Report December 31, 2014Note

- Page 49 and 50: Annual Report December 31, 2014Note

- Page 51: Annual Report December 31, 2014Note

- Page 55 and 56: Annual Report December 31, 2014Note

- Page 57 and 58: Annual Report December 31, 2014Note

- Page 59 and 60: Annual Report December 31, 2014Note

- Page 61 and 62: Annual Report December 31, 2014Note

- Page 63 and 64: Annual Report December 31, 2014Note

- Page 65 and 66: Annual Report December 31, 2014Note

- Page 67 and 68: Annual Report December 31, 2014Note

- Page 69 and 70: Annual Report December 31, 2014Note

- Page 71 and 72: Annual Report December 31, 2014Note

- Page 73 and 74: Annual Report December 31, 2014U.S.

- Page 75 and 76: Annual Report Year Ended December 3

- Page 77 and 78: Annual Report Year Ended December 3