PSH-Annual-Report

PSH-Annual-Report

PSH-Annual-Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

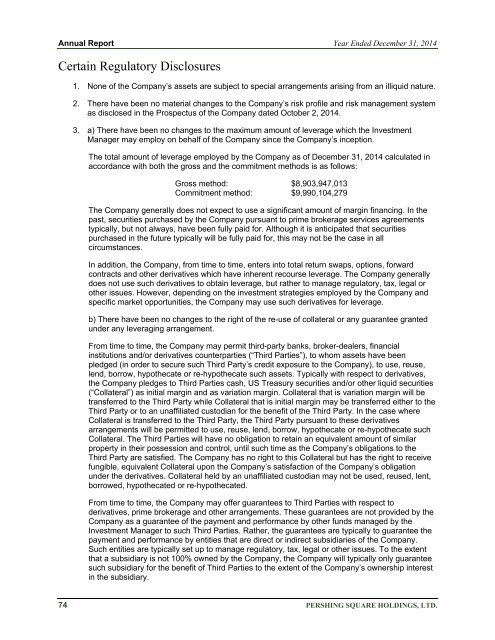

<strong>Annual</strong> <strong>Report</strong> Year Ended December 31, 2014Certain Regulatory Disclosures1. None of the Company’s assets are subject to special arrangements arising from an illiquid nature.2. There have been no material changes to the Company’s risk profile and risk management systemas disclosed in the Prospectus of the Company dated October 2, 2014.3. a) There have been no changes to the maximum amount of leverage which the InvestmentManager may employ on behalf of the Company since the Company’s inception.The total amount of leverage employed by the Company as of December 31, 2014 calculated inaccordance with both the gross and the commitment methods is as follows:Gross method: $8,903,947,013Commitment method: $9,990,104,279The Company generally does not expect to use a significant amount of margin financing. In thepast, securities purchased by the Company pursuant to prime brokerage services agreementstypically, but not always, have been fully paid for. Although it is anticipated that securitiespurchased in the future typically will be fully paid for, this may not be the case in allcircumstances.In addition, the Company, from time to time, enters into total return swaps, options, forwardcontracts and other derivatives which have inherent recourse leverage. The Company generallydoes not use such derivatives to obtain leverage, but rather to manage regulatory, tax, legal orother issues. However, depending on the investment strategies employed by the Company andspecific market opportunities, the Company may use such derivatives for leverage.b) There have been no changes to the right of the re-use of collateral or any guarantee grantedunder any leveraging arrangement.From time to time, the Company may permit third-party banks, broker-dealers, financialinstitutions and/or derivatives counterparties (“Third Parties”), to whom assets have beenpledged (in order to secure such Third Party’s credit exposure to the Company), to use, reuse,lend, borrow, hypothecate or re-hypothecate such assets. Typically with respect to derivatives,the Company pledges to Third Parties cash, US Treasury securities and/or other liquid securities(“Collateral”) as initial margin and as variation margin. Collateral that is variation margin will betransferred to the Third Party while Collateral that is initial margin may be transferred either to theThird Party or to an unaffiliated custodian for the benefit of the Third Party. In the case whereCollateral is transferred to the Third Party, the Third Party pursuant to these derivativesarrangements will be permitted to use, reuse, lend, borrow, hypothecate or re-hypothecate suchCollateral. The Third Parties will have no obligation to retain an equivalent amount of similarproperty in their possession and control, until such time as the Company’s obligations to theThird Party are satisfied. The Company has no right to this Collateral but has the right to receivefungible, equivalent Collateral upon the Company’s satisfaction of the Company’s obligationunder the derivatives. Collateral held by an unaffiliated custodian may not be used, reused, lent,borrowed, hypothecated or re-hypothecated.From time to time, the Company may offer guarantees to Third Parties with respect toderivatives, prime brokerage and other arrangements. These guarantees are not provided by theCompany as a guarantee of the payment and performance by other funds managed by theInvestment Manager to such Third Parties. Rather, the guarantees are typically to guarantee thepayment and performance by entities that are direct or indirect subsidiaries of the Company.Such entities are typically set up to manage regulatory, tax, legal or other issues. To the extentthat a subsidiary is not 100% owned by the Company, the Company will typically only guaranteesuch subsidiary for the benefit of Third Parties to the extent of the Company’s ownership interestin the subsidiary.74 PERSHING SQUARE HOLDINGS, LTD.